Analysys Mason, a research firm, has crafted three potential scenarios to delve into the ramifications of generative artificial intelligence (GenAI) on the telecommunications sector.

The Three Scenarios Unveiled

The Three Scenarios Unveiled

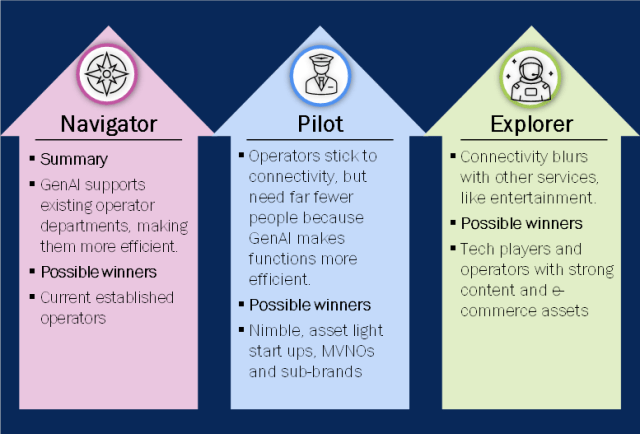

Navigator Scenario

Positioned as the least disruptive, this scenario offers a promising outlook for established telecom operators. GenAI serves as a supportive tool, enhancing productivity and streamlining existing operations. While this scenario retains similarities with the present landscape, it foresees cost reductions due to increased efficiency. However, with limited differentiation and intense market competition, the scenario hints at potential revenue squeezes, Analysys Mason said in its report on GenAI.

Pilot Scenario

Marked by revolutionary GenAI advancements, this scenario presents a more radical transformation. GenAI-powered solutions infiltrate various operational facets, challenging traditional players. Regulatory restrictions on service bundling limit avenues for differentiation, leading to heightened price competition. Legacy operators may find themselves disadvantaged against nimble newcomers and asset-light startups.

Explorer Scenario

Characterized by highly advanced GenAI integration, this scenario envisions extensive automation across telecom operations. While some operators may seize opportunities to become comprehensive service providers or ‘super-apps,’ global technology firms could potentially overshadow traditional operators by seamlessly integrating telecom services into their offerings. The scenario hints at a potentially positive impact on industry size due to enhanced differentiation and reduced churn.

Implications and Responses

Regardless of the scenario, telecom operators face a complex landscape shaped by GenAI. While some are already dabbling in GenAI applications, broader strategic responses are essential to navigate the evolving terrain effectively. This may involve experimenting with innovative customer support models, considering potential acquisition impacts, or exploring diverse operational paradigms.

Global spending on AI software will surge from $124 billion in 2022 to $297 billion in 2027 — at a 19.1 percent compound annual growth rate in the next six years. Generative AI (GenAI) software spending is expected to skyrocket from 8 percent in 2023 to 35 percent by 2027, Gartner forecasts.

Conclusion

The GenAI revolution holds the promise of transformative change within the telecom industry. As operators brace for impact, strategic foresight and adaptive responses will be critical in shaping their trajectories amid the shifting dynamics of the GenAI-powered future.