Samsung Electronics reported a strong rebound in the third quarter of 2025, posting revenue of KRW 86.1 trillion, up 15.4 percent from the previous quarter, with operating profit climbing to KRW 12.2 trillion. The performance was fueled by record semiconductor sales and strength in its premium smartphone lineup.

Strong Semiconductor Performance

Samsung’s Device Solutions (DS) Division reported KRW 33.1 trillion in revenue and KRW 7.0 trillion in operating profit. Memory chip sales surged 19 percent quarter-on-quarter, led by demand for HBM3E and server SSDs. Samsung achieved record-high memory revenue as HBM3E entered mass production, with shipments to all major customers. HBM4 samples are already being supplied to key clients.

Samsung expects continued growth in Q4 2025, driven by AI server demand. The company plans to expand sales of high-value memory, including DDR5, GDDR7 and high-density SSDs. In 2026, Samsung aims to begin mass production of HBM4, while broadening its product portfolio with LPDDR5x and QLC SSDs tailored for AI applications.

The Foundry Business reported improved earnings on the back of reduced costs and strong demand for advanced nodes. Samsung plans to ramp up mass production of 2nm Gate-All-Around (GAA) chips and begin operations at its new fab in Taylor, Texas, in 2026.

Display Business Sees Profit Growth

Samsung Display (SDC) delivered KRW 8.1 trillion in revenue and KRW 1.2 trillion in operating profit. Small and medium display sales grew due to strong demand for flagship smartphones and gaming monitors. In Q4 2025, SDC expects further growth from the launch of its new QD-OLED monitor lineup.

For 2026, SDC plans to strengthen its position in the premium display market by expanding OLED production through its new 8.6G IT line and focusing on technologies optimized for AI devices and foldables.

Smartphone Sales Drive DX Division

The Device eXperience (DX) Division reported an 11 percent rise in revenue quarter-on-quarter, led by the Mobile eXperience (MX) and Networks Businesses, which together posted KRW 34.1 trillion in revenue and KRW 3.6 trillion in operating profit.

Samsung’s Galaxy Z Fold7 launch and strong sales of Galaxy S25, tablets and wearables contributed to higher profits. In Q4 2025, the company plans to accelerate growth through seasonal promotions of AI-enabled smartphones and ecosystem devices.

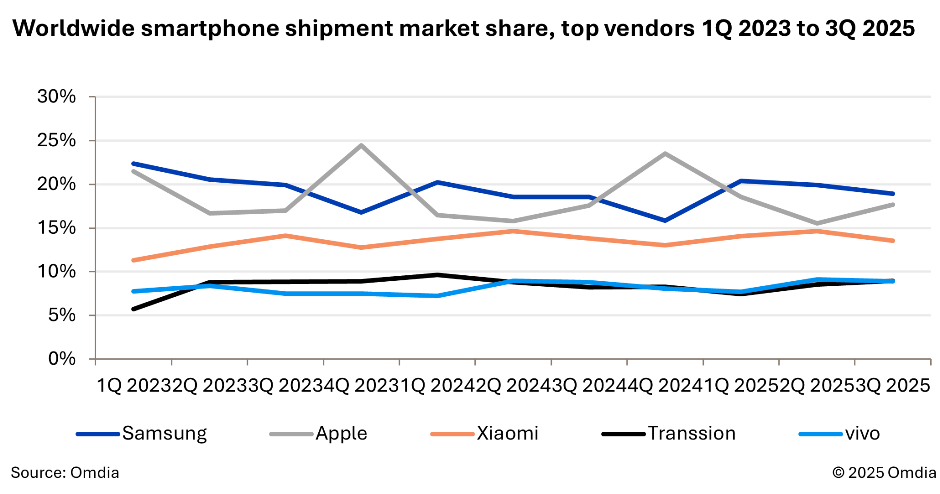

The latest Omdia report indicated that Samsung has shipped 60.6 million smartphones during the third-quarter of 2025 achieving 19 percent market share. Growth was driven by Samsung’s Galaxy Z Fold7 / Flip7 models alongside Galaxy A07 and A17 in the mid-to-low-end segment. Strong sales of the Galaxy A series in Asia-Pacific and the Middle East contributed to overall shipments, Jusy Hong, Senior Research Manager at Omdia, said.

In 2026, Samsung intends to expand its AI smartphone portfolio and introduce form factor innovations to enhance competitiveness across all price segments.

Consumer Electronics Faces Margin Pressure

The Visual Display and Digital Appliances Businesses recorded KRW 13.9 trillion in revenue but posted a small operating loss of KRW 0.1 trillion. Despite solid sales of Neo QLED, OLED and large-screen TVs, profitability was affected by intense competition.

Samsung expects a rebound in Q4 2025, supported by strong seasonal demand and premium product focus. In 2026, the company aims to strengthen its leadership in premium TVs through innovations such as Micro RGB technology and AI-enhanced functionality.

Strategic Outlook

Samsung expects the AI-driven semiconductor boom to continue supporting demand across both the DS and DX Divisions. The company’s strategy focuses on:

Expanding production of high-value memory products for AI servers

Accelerating 2nm foundry production and fab expansion in the United States

Launching AI-integrated smartphones and foldables

Strengthening leadership in OLED and premium TV markets

As the AI industry reshapes global technology demand, Samsung is positioning itself to leverage opportunities across chips, devices and displays to sustain growth in 2026 and beyond.

Baburajan Kizhakedath