The global smartphone market shipped 320.1 million units in the third quarter of 2025, marking a 3 percent year-on-year increase, according to new research from Omdia. This growth signals a recovery from the sluggish performance seen in the first half of the year, which was affected by supply chain restructuring, cautious retail sentiment, and uncertainty surrounding changes in U.S. tariff policy.

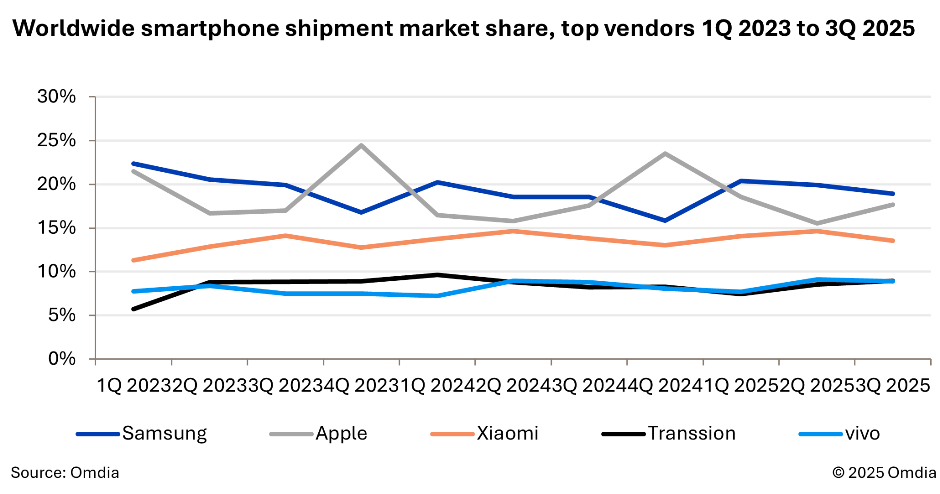

After several quarters of inventory correction, smartphone vendors accelerated new product launches and capitalized on seasonal demand during the back-to-school and festive periods. Samsung, Apple, Transsion, and Lenovo each shipped over two million additional units compared to the previous year, driving the market’s rebound, Omdia report said.

Samsung Leads Global Market with 60.6 Million Shipments

Samsung maintained its leadership position with 60.6 million units shipped, up 6 percent year over year. Growth was fueled by strong sales of its premium Galaxy Z Fold7 and Flip7 models, along with the Galaxy A07 and A17 devices in the mid-to-low-end segment. The Galaxy A series saw particularly strong demand in Asia-Pacific and the Middle East.

Apple followed with 56.5 million units, up 4 percent year over year, as it prepared for the festive fourth quarter. The base iPhone 17 performed above expectations due to improved storage capacity without a price increase, while the iPhone 17 Pro and Pro Max maintained strong global momentum. Omdia noted that growing demand in emerging markets such as India is expected to further support Apple’s full-year shipment growth.

Xiaomi achieved mild annual growth of 1 percent with 43.4 million units shipped. While the end of subsidy programs led to weaker sales in China, the company offset this decline through growth in Asia-Pacific and other international markets.

Transsion climbed to fourth place with a 12 percent increase in shipments, following inventory normalization earlier in the year. vivo, ranked fifth, strengthened its presence in India and other emerging regions while overtaking Huawei in market share within China.

Regional Growth Driven by Asia-Pacific and Africa

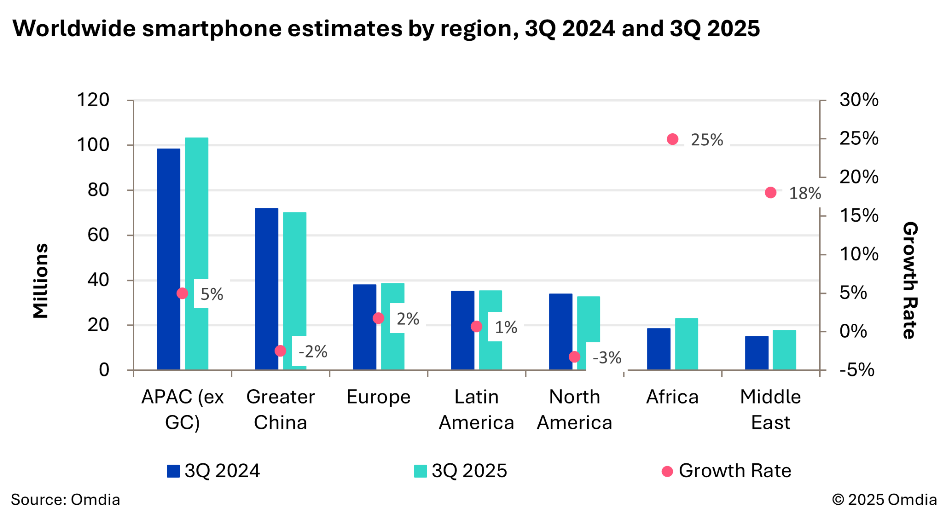

Asia-Pacific and Africa were the standout performers in Q3 2025. Africa’s smartphone shipments surged 25 percent year over year, led by Transsion’s recovery and expansion efforts. Asia-Pacific shipments increased 5 percent year over year, marking the region’s highest quarterly volume since the end of 2021.

In contrast, North America and Greater China recorded shipment declines. The North American market softened after an early pull-in caused by tariff uncertainty, while China experienced its second consecutive quarter of contraction following the end of government subsidy programs.

Market Outlook: Polarized Growth and Rising Costs

According to Omdia, the smartphone market’s growth pattern remains polarized. Expansion is strongest at the ultra-low-end (below $100) and high-end (above $700) segments, while the mid-range category continues to struggle. However, recent component shortages and rising costs may limit short-term growth and lead to price hikes for new models.

“Vendors may adopt different strategies to tackle this common challenge – securing channel funding early, prioritizing high-margin models, keeping mid- and low-end devices on a defensive stance, and leveraging scaling to strengthen supply chain bargaining power. Regardless, maintaining profitability remains their shared top priority,” said Jusy Hong, Senior Research Manager at Omdia.

Fasna Shabeer