A surge in satellite performance coupled with reduced costs is opening up a wealth of opportunities for telecom operators (telcos) to incorporate satellite services into their offerings, as highlighted by Analysys Mason’s Satellite Strategies for Telcos program.

Growth Projections

Growth Projections

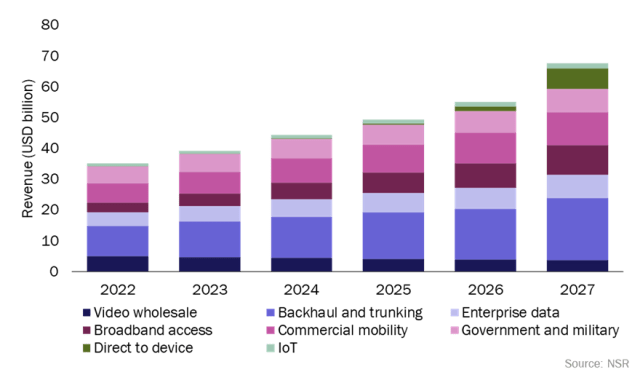

Analysys Mason’s report on satellite strategy said satellite-related revenue for telcos is anticipated to soar by USD 32.5 billion from 2022 to 2027. This promising business underscores the immense potential for telcos to tap into this burgeoning market.

Embracing Satellites for Growth

Telcos are urged to view satellites as a novel avenue for differentiation and expansion amidst dwindling traditional revenue streams. Recent technological advancements, including low-Earth orbit (LEO) constellations and software-defined satellites, have significantly enhanced the bandwidth and performance of satellite services. Moreover, improvements in the economics of satellite communications have made satellite backhaul a cost-effective solution, particularly for connecting rural mobile base stations.

Integration Benefits Integrating satellite services offers manifold benefits for telcos, including:

Mobile Broadband: Extending network coverage to remote areas via satellite backhaul.

Rural Connectivity: Deploying satellite terminals to serve previously underserved households.

Direct-to-Device Connectivity: Offering direct satellite connectivity to handheld devices, complementing terrestrial technologies.

Access to New Enterprise Segments: Addressing niche markets such as in-flight connectivity and the government and military sectors.

Enhanced Services: Leveraging satellites to offer private connectivity, ensure data ownership, and bolster network resilience.

Strategic Considerations

Telcos must evaluate their competencies and market synergies to devise effective satellite strategies. Options include:

Organic Growth: Expanding existing capabilities, exemplified by Orange’s broadband offer expansion.

M&A Activity: Pursuing strategic acquisitions to enter new segments and enhance services, as seen in the Dish-EchoStar deal.

‘Satellite-as-a-Service’ Adoption: Partnering with providers like Africa Mobile Networks to deploy and manage rural mobile coverage.

Branch Spin-offs: Opting for growth-focused spin-offs, illustrated by Telenor Satellite’s acquisition by Space Norway.

Leveraging 5G Standards

The integration of satellite services is poised to accelerate with the adoption of 5G standards. Many satellite operators already offer solutions compliant with Metro Ethernet Forum (MEF) standards and compatible with SD-WAN, paving the way for seamless integration into telcos’ networks. Standardization efforts in 5G non-terrestrial networks will further facilitate satellite adoption, enabling telcos to swiftly deploy and monetize satellite services.

Another report said global satellite data services market size was valued at USD 6.58 billion in 2021 and is poised to grow from USD 7.86 billion in 2022 to USD 27.36 billion by 2030, at a CAGR of 19.50 percent during the forecast period (2023-2030).