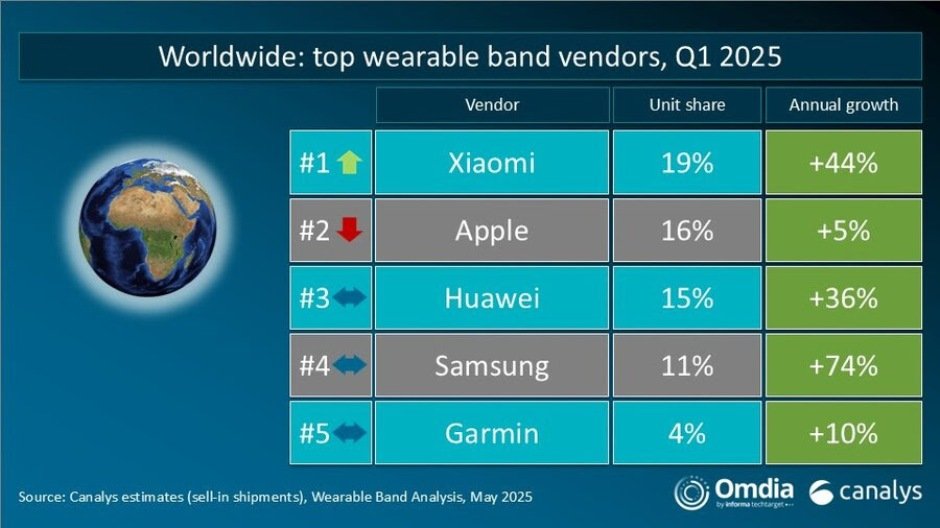

The global wearable band market has shown impressive recovery and growth, expanding 13 percent year-on-year in Q1 2025 to 46.6 million units, according to the latest Canalys report (now under Omdia).

Xiaomi (19 percent share), Apple (16 percent), Huawei (15 percent), Samsung (11 percent), and Garmin (4 percent) are the leading brands in the global wearable band market in Q1-2025.

The growth in the wearable band market, spurred by recovering consumer demand and a low base in the prior year, marks a significant rebound, especially in the basic wearables segment. The analysis reveals a shift in the industry — from hardware innovation to ecosystem integration.

Xiaomi’s Return to the Top: A Broader Play

Xiaomi’s return to the top spot, with 44 percent shipment growth to 8.7 million units, underscores the value of product breadth and ecosystem strategy. Its success with the Redmi Band 5 and a new in-house smartphone chip points to a long-term commitment to vertical integration. More than just adding features, Xiaomi’s push under its “Human × Car × Home” strategy shows how wearables are increasingly becoming just one node in a broader, interconnected tech ecosystem.

In emerging markets, Xiaomi’s competitive pricing and diversified offerings have created a compelling value proposition. Its growth also highlights how effective regional strategies — especially in price-sensitive markets — can drive scale, even in a mature category.

Apple and Huawei: Ecosystem Maturity Pays Off

Apple, despite only 5 percent growth, remains a formidable force in the market, shipping 7.6 million units. As the Apple Watch marks its tenth anniversary, Apple’s ecosystem — centered on health and wellness — remains its moat. The company’s conservative Q1 may be a prelude to a larger play in the latter half of 2025 with anticipated major portfolio updates.

Huawei, meanwhile, continues its global resurgence, shipping 7.1 million units (up 36 percent) and expanding its Huawei Health app ecosystem. Its consistent performance shows that, even in the face of geopolitical headwinds, strong product design and ecosystem expansion outside China can maintain global competitiveness.

Samsung and Garmin: Dual Strategies and Niche Loyalty

Samsung’s 74 percent growth is one of the standout metrics in the report. Its two-pronged strategy — targeting emerging markets with affordable basic bands and protecting its premium smartwatches in developed markets — is working. The company’s ability to adapt its positioning based on regional market dynamics is a blueprint for others.

Garmin, though more niche, saw a healthy 10 percent growth and is leaning into its strength: a loyal fitness-centric user base. The launch of Garmin Connect+ hints at a strategic pivot toward service monetization — a necessary move as hardware margins decline.

Ecosystem Depth: The New Market Differentiator

The report makes it clear that the wearables market is no longer just about hardware. As hardware margins compress, service layers, platform integration, and recurring revenue streams become the new frontiers. Companies like Oura and Whoop, which have a lighter hardware footprint but deeper subscription models, exemplify this shift.

Xiaomi’s HyperOS and Huawei’s closed-loop health ecosystem point to an industry-wide realization: hardware is the gateway, but the ecosystem keeps users locked in. This is especially critical as consumer decision-making is still dominated by basic factors like price, battery life, and health tracking. Once market education and hardware adoption mature, value will increasingly come from software and services.

Outlook: Sustained Growth Hinges on Services and Integration

Looking ahead, competition will intensify around who can build the most sticky, service-rich ecosystem. Core use cases — health tracking, fitness coaching, and wellness management — will evolve, but differentiation will rely more on seamless device integration and the ability to offer personalized, subscription-based experiences.

The wearable band market is moving past the “hardware race” phase and entering an era where ecosystems — not just gadgets — are the true product. For vendors, future growth will depend not only on what they build, but how well they integrate it into the broader digital life of their users.