Africa’s smartphone market opened 2025 with cautious optimism, defying global trends with an 8th consecutive quarter of growth.

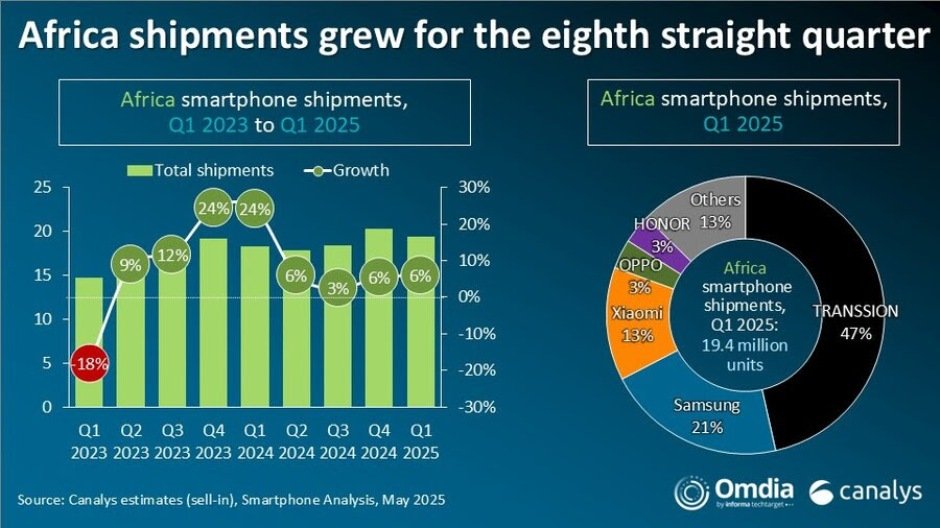

Shipments in Africa’s smartphone market rose 6 percent year-on-year in Q1 2025, reaching 19.4 million units, according to Canalys (now part of Omdia). This resilience stands in contrast to a global slowdown in entry-level smartphone demand, underscoring Africa’s unique market dynamics — where offline retail strength, supportive policies, and vendor focus on broad coverage are playing a key role in sustaining momentum.

Regional Drivers and Challenges

North Africa saw standout performance, particularly in Egypt — the region’s top market — with shipments surging 34 percent year-on-year. Egypt’s growth story was powered by IMEI whitelisting policies targeting grey-market imports, greater macroeconomic stability, and efforts to localize manufacturing. Algeria, too, posted 16 percent growth, aided by government initiatives, improved telecom infrastructure, and digital payment adoption such as “DZ Mob Pay.”

In Sub-Saharan Africa, South Africa led with 14 percent growth, driven by strategic policy reforms — most notably the removal of the 9 percent luxury tax on lower-priced smartphones (below ZAR2,500) and efforts to sunset 2G/3G networks in favor of 4G/5G expansion. Conversely, Nigeria — the region’s largest market — contracted 7 percent, reflecting economic pressures that continue to suppress discretionary spending. Despite this, Nigeria’s large, digitally-inclined youth population remains a long-term growth lever. Kenya showed marginal 1 percent growth, yet positive signs such as expanding financing options (via OnPhone Mobile and LOOP) hint at an evolving market landscape.

Shifting Market Composition: The Rise of Mid-Tier and 4G

The dominance of 4G devices (85 percent of shipments) and the growing share of the mid-tier segment (US$100–199) at 42 percent indicate a price-sensitive market still in transition. High-end devices remain out of reach for most consumers, and while financing partnerships expand access, they raise concerns about consumer debt sustainability — a risk that could hamper future demand.

Structural Constraints Temper Outlook

While Africa’s digital aspirations are clear, persistent macroeconomic headwinds — including sluggish infrastructure development, rising sovereign debt, and global trade disruptions (notably from US-China tariff tensions)—cast a shadow over the growth trajectory. Manish Pravinkumar, Principal Analyst at Canalys, forecasts a 3 percent market growth for 2025 reflecting constraints.

Crucially, Africa’s youthful, urban population — driven by digital connectivity needs — remains the key growth engine. But limited disposable income and economic pressures will continue to cap aspirations, particularly as vendors and operators navigate the high capital requirements of 4G and nascent 5G network rollouts.

Top vendors

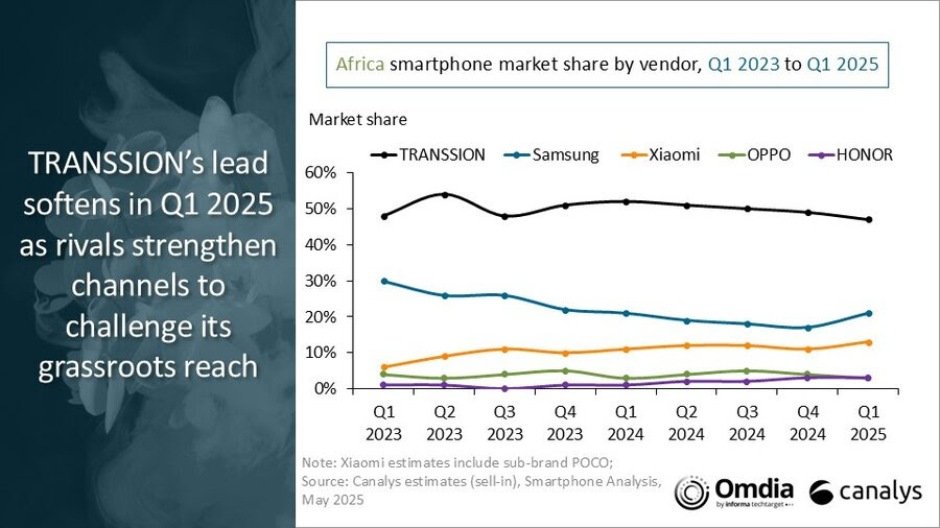

In Q1 2025, Africa’s smartphone market saw notable shifts among key players. TRANSSION remained the dominant vendor with a 47 percent market share, though its shipments declined 5 percent year-over-year to 9.0 million units from 9.5 million in Q1 2024, as competitors replicated its successful three-tier channel model.

Samsung maintained a stable 21 percent market share, growing slightly from 3.8 million units in Q1 2024 to 4.0 million in Q1 2025, with strong performance in South Africa and Egypt. Its A-series models, such as the A06 and A16, accounted for 60 percent of its total shipments, underscoring its mass-market focus. Xiaomi posted 32 percent growth, increasing shipments from 1.9 million in Q1 2024 to 2.6 million in Q1 2025, driven by strong demand in Egypt and Nigeria, especially for its Redmi 14C and A-series models.

OPPO saw a 17 percent increase in shipments, reaching 0.7 million units in Q1 2025, supported by local assembly efforts and a focus on the A-series and Reno lines.

HONOR recorded the fastest growth among major players, surging 283 percent year-over-year from 0.2 million to 0.7 million units, bolstered by premium Magic series devices and 5G bundles with MTN and Vodacom that enhanced brand visibility and demand across key markets. The “Others” category grew from 2.3 million to 2.4 million units, holding a 13 percent market share.

Baburajan Kizhakedath