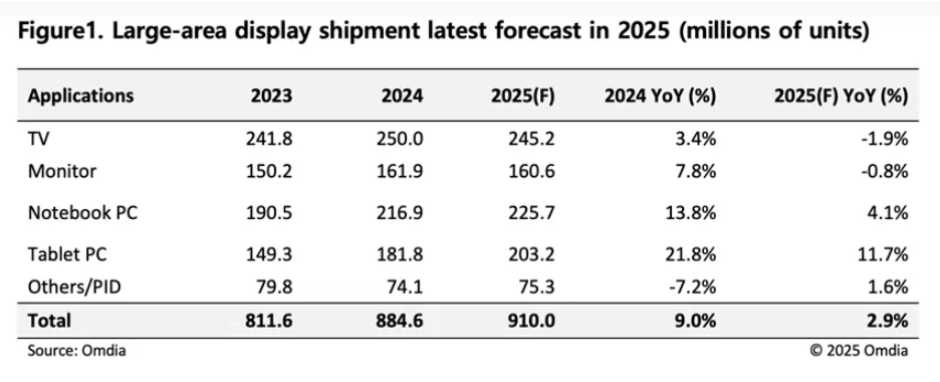

The large-area display market is projected to grow modestly in 2025, with unit shipments rising 2.9 percent year-over-year despite economic uncertainties and U.S. tariff concerns.

Large-area LCD shipments are expected to reach 875.5 million units, up 2.4 percent YoY, supported by pulled-forward demand in Q1 2025. However, TV and monitor display segments are likely to see negative growth, as panel makers focus on stabilizing prices and avoiding further financial losses, the latest Omdia report indicated.

Chinese manufacturers are taking a cautious, production-to-order approach in the LCD TV segment and are projected to increase monitor LCD shipments by 4.8 percent YoY, while non-Chinese competitors are expected to reduce theirs by 12.6 percent YoY. Despite a 2.1 percent decline in LCD TV unit shipments, shipment area is forecast to grow 4.9 percent YoY due to ongoing size migration trends.

Large-area OLED displays will see stronger growth, with unit shipments up 15.5 percent and area up 10.4 percent YoY, though both figures have been revised downward from previous forecasts due to weakening demand. Korea will dominate OLED shipments with an 85.2 percent share, led by Samsung Display and LG Display, Peter Su, Principal Analyst of Omdia, said.

Regionally, China will lead in LCD shipments with a 66.7 percent share, driven by BOE and China Star, while Taiwan and Korea trail behind. Panel makers are also ramping up production of mobile PC displays to gain share in segments still held by competitors from other regions, contributing to the overall shipment increase. Tablet PC OLED shipments, while still in decline, show signs of recovery compared to earlier forecasts.

Investment strategies

Recent media reports have highlighted investment strategies of key display panel makers in the Asia Pacific region.

BOE Technology

BOE continues to ramp up its investment in advanced LCD technologies, including oxide TFT and Mini LED backlighting to retain its leadership in large-area LCD shipments. In 2025, the company is focusing on improving production efficiency at its G10.5 and G8.6 LCD fabs. BOE is also accelerating OLED expansion, especially for IT applications like tablets and notebooks, as part of its diversification strategy.

China Star Optoelectronics Technology (CSOT)

CSOT, a TCL subsidiary, is enhancing its competitiveness in LCD by upgrading its large-area panel lines and expanding into high-end sectors like 8K and gaming monitors. It recently invested in new OLED module production lines and is partnering with domestic tech firms to strengthen local OLED ecosystem capabilities.

Innolux

Innolux is prioritizing profitability by shifting focus to value-added LCD segments such as medical, automotive, and industrial displays. It is also pushing innovations in ultra-thin, bezel-less LCDs and leveraging AI-based manufacturing processes to optimize yields. The company has scaled back on OLED plans to concentrate on niche LCD opportunities.

Samsung Display

Samsung Display is reinforcing its lead in large-area OLEDs by expanding QD-OLED production capacity. It is also investing heavily in developing next-gen OLED technologies like phosphorescent blue OLEDs and flexible OLEDs for IT and automotive markets. Samsung is exploring AI integration to improve color accuracy and power efficiency in OLED panels.

LG Display

LG Display is continuing its strategic pivot from LCD to OLED, especially for large-size TVs and premium monitors. It is expanding its WOLED production and exploring transparent OLED solutions for commercial use. The company has also announced new partnerships in automotive displays, where it aims to deploy P-OLED and tandem OLED panels.

EverDisplay Optronics (EDO)

EDO is rapidly emerging in the OLED segment with new investments in Gen 6 flexible OLED fabs. The company is focusing on mid-size OLED displays for tablets and automotive applications and is receiving significant support from regional governments in China to build localized OLED supply chains. EDO is also investing in R&D for hybrid OLED structures to compete with Korean players on quality and durability.

Baburajan Kizhakedath