The global wrist-worn device market grew 10.5 percent year-on-year in Q1 2025, with total shipments reaching 45.6 million units, according to IDC. This growth was fueled by a strong rebound in key markets like Western Europe, the U.S., Latin America, and much of Asia-Pacific. China saw especially strong growth, with shipments rising 37.6 percent to 17.6 million units, driven by government subsidies.

Smartwatch shipments increased 4.8 percent globally to 34.8 million units, including a 25.3 percent jump in China to 11.4 million units. Wristbands saw stronger momentum, growing 34.0 percent worldwide to 10.8 million units, with China accounting for 6.2 million units — a 67.9 percent surge.

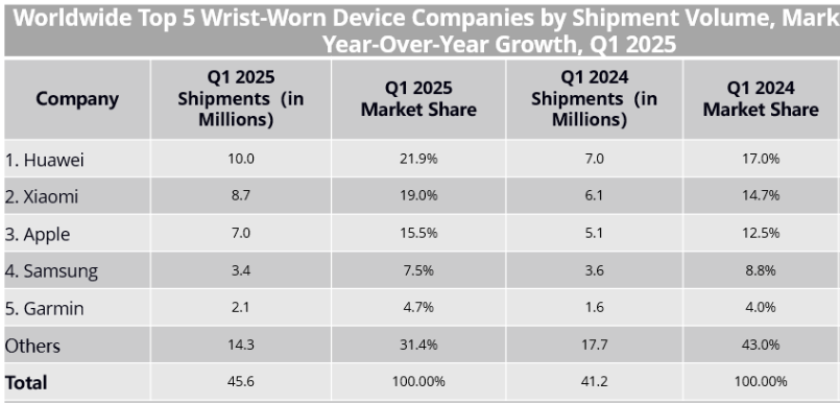

In Q1 2025, Huawei emerged as the global leader in wrist-worn device shipments, reaching 10 million units and capturing a 21.9 percent market share, up from 7 million units and 17 percent share in Q1 2024. The company maintained its dominance in China, benefiting from HarmonyOS ecosystem integration and cross-device synergy. Its new Band 10 wristband, launched globally, played a key role in boosting shipments, while its FIT series and upcoming upgraded WATCH series are expected to help Huawei move further into the mid-to-high-end market.

Xiaomi recorded strong shipment growth, reaching 8.7 million units in Q1 2025 with a 19 percent market share, up from 6.1 million units and 14.7 percent a year earlier. The brand saw rapid expansion in China, Latin America, and the Asia/Pacific region. Xiaomi’s success was driven by its entry-level wristbands and Redmi smartwatches, supported by its broader smartphone and IoT ecosystem. Its mid-range S series also gained traction under the company’s ongoing premiumization strategy.

Apple posted its strongest year-over-year growth since 2023, shipping 7 million units in Q1 2025 and holding a 15.5 percent market share, compared to 5.1 million and 12.5 percent the previous year. Anticipating possible tariffs, U.S. retailers increased inventory, and shipments were accelerated globally to mitigate supply chain risks. In China, government subsidies and competitive pricing helped boost Apple Watch sales significantly.

Samsung experienced a slight decline, shipping 3.4 million units and capturing a 7.5 percent share in Q1 2025, down from 3.6 million and 8.8 percent in Q1 2024. The company faced stiff competition from Chinese brands offering better value in overseas markets, as well as from Apple, Huawei, and Garmin in the mid-to-premium segment.

Garmin returned to the global top five with a shipment increase to 2.1 million units and a 4.7 percent share, compared to 1.6 million and 4 percent in Q1 2024. The growth was driven by strategic expansion into lower-priced models, such as the more affordable Forerunner series, and a dual-generation approach to its Fenix line. These moves strengthened Garmin’s position in the sports and outdoor smartwatch market.

While the ‘Others’ category saw a shipment decline from 17.7 million units in Q1 2024 to 14.3 million in Q1 2025, its market share dropped more sharply—from 43 percent to 31.4 percent—as top vendors consolidated their lead. Overall, the global wrist-worn device market grew from 41.2 million shipments in Q1 2024 to 45.6 million in Q1 2025, driven by ecosystem integration, regional growth strategies, and expanded product portfolios among the leading brands.

TelecomLead.com News Desk