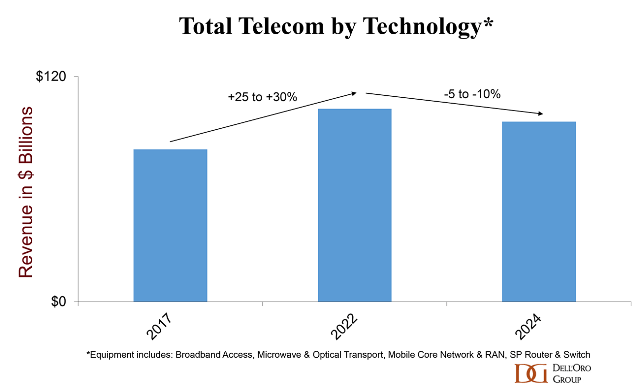

Global telecom equipment revenues are anticipated to experience a decline of up to 5 percent in 2024, according to Dell’Oro Group.

The outlook for telecom equipment manufacturers is clouded by various factors including currency fluctuations, economic uncertainty, inventory normalization, and instability in certain regions and technology segments.

The outlook for telecom equipment manufacturers is clouded by various factors including currency fluctuations, economic uncertainty, inventory normalization, and instability in certain regions and technology segments.

The Dell’Oro Group, which tracks various sectors including Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch, reported a significant shift in the industry. After five years of consecutive growth and stable trends up until the first half of 2023, telecom equipment revenues saw a notable 5 percent decline in 2023. Dell’Oro Group did not reveal the size of the telecom equipment market.

This downturn was attributed to challenging comparisons in advanced 5G markets with higher 5G population coverage, compounded by the slow transition towards 5G SA (Standalone). The decrease in wireless-based investments affected not only the RAN and MCN segments but also impacted home broadband Capex after years of robust PON (Passive Optical Network) investments.

Regionally, the North American market experienced a substantial drop of approximately a fifth in telecom equipment revenues, driven by weak activity in both RAN and Broadband Access sectors. However, worldwide revenues, excluding North America, saw advancements in 2023, primarily due to positive developments in the Asia Pacific region which managed to offset weaker growth across Europe.

Contributing to these regional and technological trends were disruptions caused by Covid-related inventory hoarding and the ongoing supply chain crisis. While these challenges affected various segments differently, the impact was particularly notable in the RAN sector.

Renewed concerns about macroeconomic conditions, fluctuations in foreign exchange rates, and higher borrowing costs are further dampening prospects for growth in the industry. The recent gains in the USD against the Yuan and the Yen are particularly affecting USD-based equipment revenue estimates in China and Japan.

Renewed concerns about macroeconomic conditions, fluctuations in foreign exchange rates, and higher borrowing costs are further dampening prospects for growth in the industry. The recent gains in the USD against the Yuan and the Yen are particularly affecting USD-based equipment revenue estimates in China and Japan.

Leaders in telecom equipment business

While supplier rankings remained largely unchanged, there were slight shifts in vendor revenue shares in 2023. Nevertheless, the overall concentration in the market remains stable, with the top 7 suppliers continuing to dominate around 80 percent of the market share.

Huawei (30 percent share), Nokia (15 percent), Ericsson (13 percent), ZTE (11 percent), Cisco (6 percent), Ciena (4 percent), and Samsung (2 percent) are the leaders in the worldwide telecom equipment business.

Despite efforts by the US government to restrict Huawei’s market access and limit its use of the latest silicon, Huawei remains the global leader in telecom equipment. In fact, Huawei widened its lead in 2023 from 28 percent to 30 percent, partly due to its limited exposure to the North American market, which proved to be advantageous relative to its competitors.

Ericsson has lost share in the telecom equipment business – to 13 percent in 2023 as against 14 percent in 2022.

Ciena has increased its share in the telecom equipment market – to 4 percent in 2023 from 3 percent in 2022.

Cisco has also enhanced its share in the telecom equipment market — to 6 percent in 2023 from 5 percent in 2022.

Nokia has maintained its share in the telecom equipment market at 15 percent. ZTE has also maintained its share in the telecom equipment market at 11 percent.

Baburajan Kizhakedath