ASML, the world’s largest supplier of computer chip-making equipment, reported a 9.5 percent decline in revenue, reaching 6.2 billion euros for the quarter ended June 30. The company’s net income also fell by 19 percent to 1.6 billion euros ($1.74 billion) for the same period.

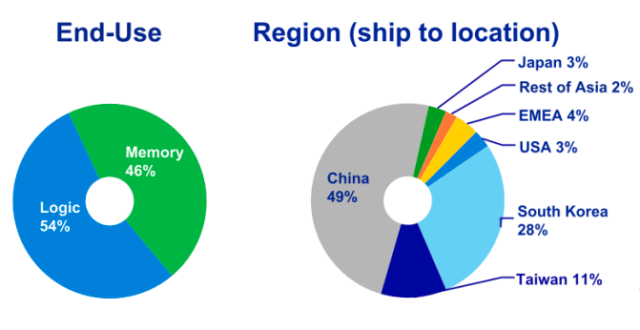

Veldhoven, the Netherlands-based ASML, which dominates the market for lithography systems — has been facing restrictions on selling most of its advanced product lines in China. Despite these restrictions, China remains a significant market for ASML, accounting for over 2 billion euros in lithography system sales in the second quarter, approximately 49 percent of the total sales.

The company’s other major markets include South Korea, contributing 28 percent to sales, and Taiwan, contributing 11 percent. Japan and the USA each contribute 3 percent, and the rest of Asia contributes 2 percent.

Sales in the EMEA region (Europe, the Middle East, and Africa) have dropped to 4 percent from 20 percent.

Sales to the United States have halved in the second quarter, whereas sales to Taiwan have almost doubled. The steep decline in sales to EMEA is notable, with a significant drop from 20 percent to just 4 percent.

ASML CEO Christophe Fouquet stated that the company views 2024 as a transitional year with overall flat performance, setting the stage for a strong recovery in 2025. “We see strong developments in AI, driving most of the industry recovery and growth, ahead of other market segments,” Christophe Fouquet said in a statement.

ASML’s top customer, Taiwan’s TSMC, manufactures chips for major companies like Nvidia and Apple. The company reported that new bookings increased to 5.6 billion euros from 3.6 billion euros in the first quarter, with about half of these bookings coming from its most advanced EUV product lines, which are crucial for manufacturing AI and smartphone chips.

Baburajan Kizhakedath