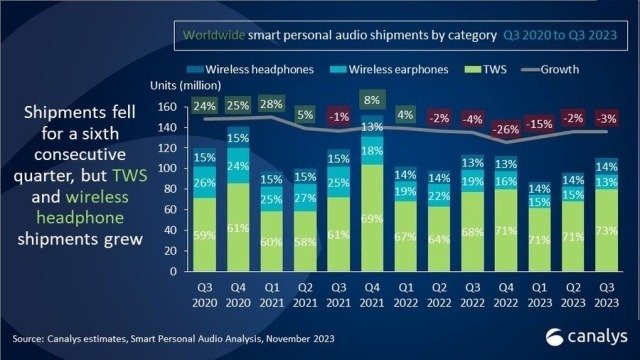

Global smart personal audio shipments decreased 3 percent, amounting to 110 million units in the third quarter of 2023, says Canalys, a market research firm.

This decline predominantly affected developed regions, while emerging regions experienced robust growth, marking a notable shift in the dynamics of the smart personal audio market. The True Wireless Stereo (TWS) category accounted for a substantial 73 percent of these shipments, consolidating its presence in the accessible mass-market sectors.

This decline predominantly affected developed regions, while emerging regions experienced robust growth, marking a notable shift in the dynamics of the smart personal audio market. The True Wireless Stereo (TWS) category accounted for a substantial 73 percent of these shipments, consolidating its presence in the accessible mass-market sectors.

Leading suppliers in the smart personal audio market are: Apple (23.4 million), Samsung (9.2 million), Boat (6.5 million), Sony (5.2 million), Xiaomi (4.3 million) and Others 61.4 million.

A shift was observed as shipments of wireless headphones surpassed those of wireless earphones for the first time. This transformation was primarily driven by vendors strategically focusing on bolstering revenue through wireless headphone sales while witnessing a gradual displacement of wireless earphones by TWS models.

Interestingly, alternative wearable forms such as air and bone conduction devices constituted less than 2 percent of the total shipments in Q3. Despite their niche presence, these devices underscore ongoing innovation in form factors, signaling attempts to carve out profitability and distinctiveness within a saturated market.

Jack Leathem, a Research Analyst at Canalys, remarked, “Demand for smart personal audio devices remains resilient despite the quarter’s decline.”

The report highlighted significant regional disparities, citing a 12 percent and 10 percent drop in North America and Western Europe, respectively. This decline was partly attributed to strategic decisions by vendors to elongate refresh cycles by skipping yearly flagship releases.

Moreover, the mid-range segment experienced a slump in Q3 due to a dearth of compelling value-for-money offerings, as features like superior audio quality and Active Noise Cancellation (ANC) became pervasive even in the lower-priced segment.

The report emphasized the resurgence in China’s market after five consecutive quarters of decline, crediting this turnaround to accessible audio quality at lower price points. Notably, Huawei has emerged as one of the fastest-growing players, leveraging its smartphone success to cross-sell ecosystem devices and witnessing a 30 percent increase in shipments compared to Q3 2022.

Looking ahead, Canalys anticipates a resurgence in Q4 driven by inventory restocking and holiday season deals. Moreover, the forecast for 2024 includes an anticipated 3.3 percent increase in shipments, primarily fueled by feature-based innovation, economic improvements, and expected flagship launches from industry giants like Apple and Samsung.

However, in a fiercely competitive landscape, building brand strength and visibility will be pivotal for vendors, necessitating innovative strategies such as partnerships, special editions, and interactive in-store experiences to entice consumers and drive market share.