According to TrendForce’s latest report, Taiwan currently commands a significant 46 percent share of the global semiconductor foundry capacity in 2023, outpacing major players like China, South Korea, the US, and Japan.

Projections indicate a potential decline in Taiwan and South Korea’s semiconductor production capacity due to government initiatives favoring local production in China and the US. By 2027, Taiwan’s share in the semiconductor foundry capacity is expected to decrease to 41 percent, while South Korea’s capacity may dwindle to 10 percent.

Projections indicate a potential decline in Taiwan and South Korea’s semiconductor production capacity due to government initiatives favoring local production in China and the US. By 2027, Taiwan’s share in the semiconductor foundry capacity is expected to decrease to 41 percent, while South Korea’s capacity may dwindle to 10 percent.

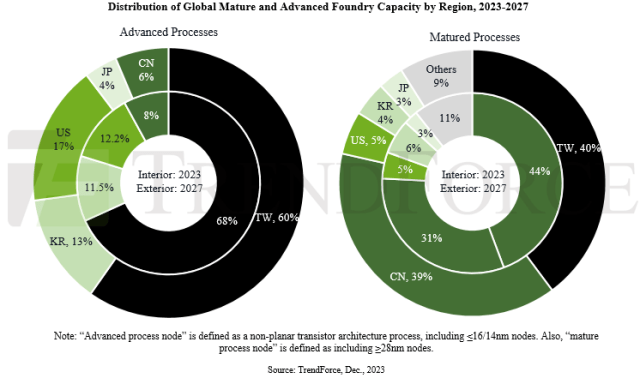

Emphasizing Taiwan’s stronghold in advanced manufacturing processes, the report predicts that by 2027, the nation is poised to concentrate 60 percent of these processes, maintaining a firm grip on key technologies.

Currently leading in advanced manufacturing processes with a 68 percent global capacity share, Taiwan faces competition primarily from the US, South Korea, and China in this sector. Particularly in EUV generation processes like 7nm and beyond, Taiwan commands an impressive 80 percent share.

Acknowledging Taiwan’s dominance, the US, with a soaring demand for advanced processes, is actively supporting major players such as TSMC, Samsung, and Intel. By 2027, the US aims to elevate its share of advanced process capacity to 17 percent, primarily through collaborations with TSMC and Samsung.

Meanwhile, Japan is making moves to re-enter the semiconductor manufacturing arena, supporting local companies like Rapidus in achieving the most advanced 2 nm process. Plans are underway to create a semiconductor cluster in Hokkaido, with subsidies being offered to foreign companies, including Japan Advanced Semiconductor Manufacturing (JASM) and PSMC’s Sendai plant (JSMC).

China, with an aggressive focus on maturing process technologies, aims to bolster its capacity significantly by 2027, reaching a projected 39 percent. Responding to export controls from other nations, Chinese manufacturers are rapidly expanding mature process capacities, potentially triggering intense price competition, particularly impacting Taiwanese foundries like UMC, PSMC, and Vanguard.

This expansion in China’s capabilities might affect Vanguard the most, given its product line consisting of LDDI, SDDI, PMIC, and power discrete components. On the other hand, UMC and PSMC are anticipated to maintain advantages in sectors like 28/22nm OLED DDI and memory.

The semiconductor industry is grappling with chip shortages and geopolitical influences, leading fabless customers to diversify risks by engaging multiple foundries. However, this strategy might escalate IC costs and pose concerns regarding duplicate orders. Customers are also demanding global validation of production lines, necessitating flexibility even with long-term foundry partnerships.

Amidst these challenges, foundries face the daunting task of managing larger-scale capacities, price competition, profitability, capacity adjustments, depreciation pressures, and maintaining technological leadership in a rapidly evolving landscape.