African mobile operators are accelerating 5G monetisation through Fixed Wireless Access (FWA), enterprise networks, and digital content strategies, driving sustainable telecom growth.

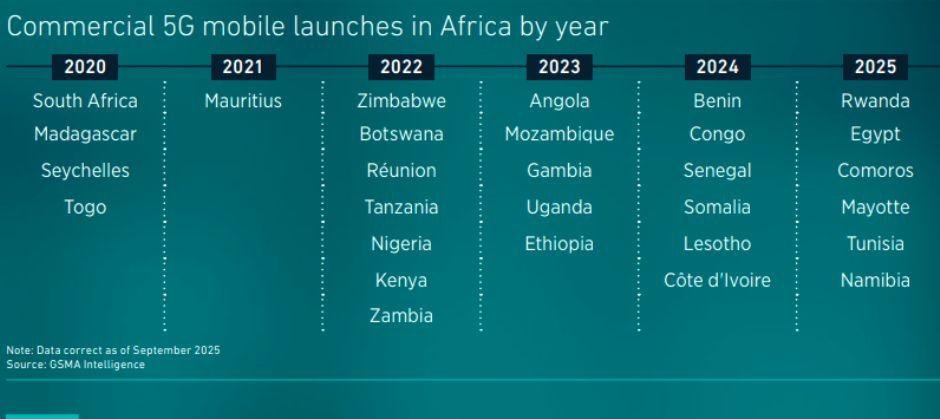

Africa’s 5G story is moving from deployment to monetisation. As operators expand coverage across key markets, new opportunities are emerging in FWA, enterprise services, and consumer innovations, according to GSMA Intelligence. As of September 2025, 53 mobile operators across 29 African markets have launched commercial 5G services — a major milestone in the continent’s digital evolution. Another 14 countries are preparing to roll out 5G, underscoring regional momentum.

While 5G adoption is still in its early stages, around 54 million 5G connections are expected by end-2025, representing 3.8 percent of total mobile connections. Growth is set to accelerate as affordable sub-$100 5G smartphones and new spectrum allocations, particularly in North Africa, become available. By 2030, 5G is forecast to account for over 20 percent of all mobile connections, reaching up to 390 million users.

FWA: The Leading Monetisation Opportunity

Limited fixed broadband infrastructure has made 5G FWA a crucial early revenue driver. By 2025, more than 25 operators have launched 5G FWA services, often bundled with mobile 5G. However, affordability of customer-premises equipment (CPE) and spectrum access remain key challenges.

MTN Group is leading this segment, aiming to expand its home broadband base from 20.6 million in 2021 to 37.3 million by 2025, targeting R120 billion ($8 billion) in revenue. Its multi-tier broadband strategy spans mobile broadband, FWA, and fibre-to-the-home (FTTH) services. Mobile broadband caters to the top 30 percent of households with $8–$12 ARPU, FWA serves the top 10 percent with $24–$32 ARPU, and fibre targets the top 1 percent with $40–$50 ARPU.

MTN saw robust growth in 2023 — a 70 percent increase in postpaid FWA subscribers in South Africa and 87,000 new FWA and FTTH connections in Nigeria — driven by rising demand for entertainment, remote learning, and home working.

Consumer 5G: Testing New Pricing Models

With 5G adoption still nascent, mobile operators are experimenting with innovative pricing and content strategies. GSMA Intelligence highlights three key approaches:

Speed-based pricing: tiered plans based on data speeds.

Customer segmentation: tailored offers like Vodacom’s NXT LVL, targeting digital-first youth, now with 2.6 million users.

Bundling and zero-rating: integrating entertainment and connectivity, as seen with Safaricom, whose content revenue rose 50 percent year-on-year to KES 0.7 billion ($5.4 million) in March 2023.

Enterprise 5G: Private Networks and Edge Innovation

Africa’s enterprise 5G market is emerging as a key long-term growth pillar. Operators are deploying private networks, IoT, and edge computing to serve industries such as mining, energy, and manufacturing.

MTN operates the region’s largest 5G-enabled smart mine in South Africa with Huawei.

Ooredoo supports private 5G for the energy sector.

Orange and AWS have introduced Wavelength Zones in Morocco and Senegal — Africa’s first commercial edge computing sites — enabling low-latency enterprise applications.

5G Spectrum Expansion Across Africa

Between 2023 and 2025, several African countries accelerated 5G readiness through key spectrum assignments. Namibia, Senegal, Egypt, Tunisia, and Comoros all completed major allocations in the 700 MHz and 3.5 GHz bands, collectively enabling broader coverage and improved network capacity. Egypt alone raised $700 million through spectrum sales to Telecom Egypt, Vodafone, Mobinil (Orange), and Etisalat.

Widespread 5G Launches

Since 2020, 5G has steadily expanded from early adopters like South Africa, Madagascar, and Togo to broader markets including Nigeria, Kenya, Zambia, Senegal, Côte d’Ivoire, Egypt, and Namibia by 2025. The rollout now spans nearly every region, reflecting stronger infrastructure investment and growing demand for high-speed connectivity.

Outlook: Toward 5G-Advanced

Africa’s 5G monetisation journey is evolving rapidly. Mafab Communications (Nigeria) and Rain (South Africa) have launched 5G Standalone (SA) services, while MTN and Huawei demonstrated 5.5G (5G-Advanced) speeds of 8.6 Gbps in Johannesburg trials. GSMA Intelligence notes that Africa’s next growth phase will hinge on scalable FWA expansion, targeted consumer offerings, and enterprise diversification — supported by spectrum reforms and ecosystem partnerships.

Fasna Shabeer