5G deployment in Africa continues to accelerate, with 53 operators in 29 markets having launched commercial services as of September 2025, and operators in 14 additional countries committed to future rollouts, according to a GSMA Intelligence report.

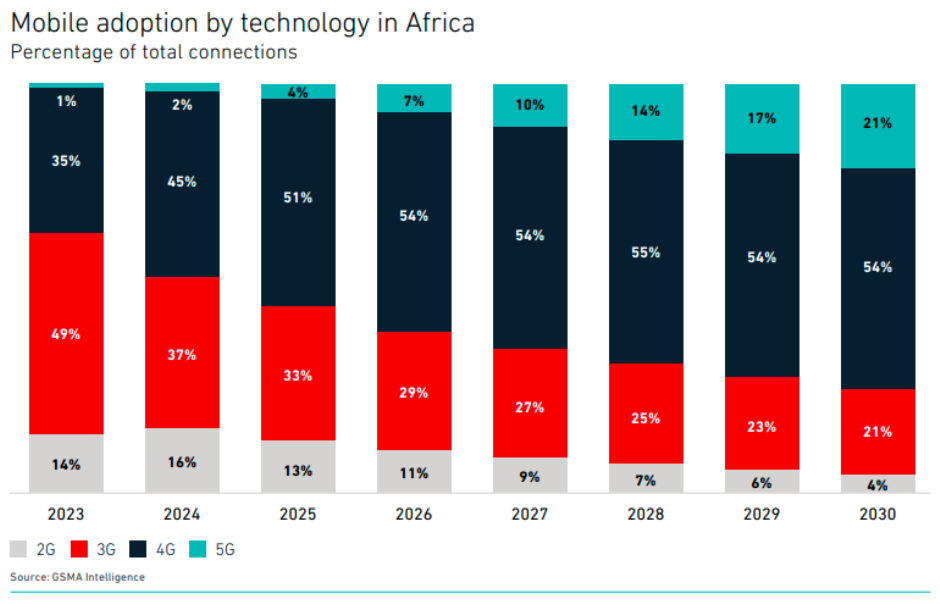

5G adoption in Africa remains in its early phase — with only 54 million 5G mobile connections expected by the end of 2025, representing 3.8 percent of total mobile users. Adoption of 5G is forecast to surge in the second half of the decade, driven by the availability of sub-$100 5G smartphones and new spectrum allocations in North Africa. By 2030, over 380 million 5G connections are expected, accounting for more than 20 percent of Africa’s mobile connections.

As 5G uptake rises, operators are increasingly focused on monetisation strategies. Fixed Wireless Access (FWA) has emerged as a leading early revenue opportunity, with 25 operators already offering commercial 5G FWA services — often bundled with mobile 5G. FWA is positioned as a premium service, with MTN targeting the top 10 percent of households, achieving monthly ARPU between $24 and $32.

Leading telecoms in Africa

MTN Group, Orange Group, Airtel Africa, Vodafone Group / Vodacom, Etisalat (through Moov Africa and Etisalat Misr), Telecom Egypt (We), Safaricom, Glo (Globacom), Tunisie Telecom, Ooredoo Africa, Free Senegal, Telecom Namibia (TN Mobile), MTC, Loc8 Mobile and Axian Telecom are the leading mobile service providers in Africa.

2G and 3G networks

Legacy networks are rapidly being phased out as users shift to 4G and 5G technologies. Between 2010 and June 2025, 183 2G and 3G networks were shut down globally, with half of these sunsets occurring in the last three years. In Sub-Saharan Africa, however, legacy networks remain prevalent — with fewer than 15 percent of countries beginning 2G shutdowns and less than 10 percent starting 3G shutdowns.

Mobile operators have invested heavily to support this transition, spending over $1 trillion in capex during the past five years — largely on 5G rollouts. The global capex-to-revenue ratio peaked at 20 percent in 2022, marking the height of the 5G investment cycle. Nevertheless, total capex between 2025 and 2030 is expected to exceed $1.1 trillion, reflecting ongoing network upgrades and capacity expansion.

Mobile data consumption

Meanwhile, mobile data consumption continues to soar, reaching an average of 15.6 GB per connection per month in 2024, up from 5.3 GB in 2019 — driven mainly by short-form video usage on social media. Although data traffic growth is expected to moderate as emerging technologies like AR/VR and the metaverse mature slowly, total global mobile data traffic is still set to nearly double between 2025 and 2030, underscoring the continued need for 5G investment and spectrum allocation.

Spectrum allocation remains a critical factor for advancing 5G across Africa. As of June 2025, only 16 African countries had assigned spectrum for 5G services — representing less than 30 percent of the continent, compared to over 90 percent in Europe. The gap is particularly stark in North Africa, where only Egypt and Tunisia have allocated 5G spectrum so far.

Despite growing investment in next-generation networks, 4G and 3G remain dominant mobile technologies in Africa, accounting for 46 percent and 37 percent of total connections at the end of 2024, respectively. 4G is projected to stay the leading technology through 2030, driven by strong adoption in Ethiopia and Nigeria, which are each expected to add around 10 million new 4G users annually between 2024 and 2026.

5G spectrum allocation

Between October 2023 and June 2025, several African countries advanced their 5G spectrum assignments, signaling growing momentum for commercial 5G deployment across the continent.

Egypt was among the early movers, awarding 3.5 GHz spectrum in January 2024 to Telecom Egypt (We) for a $150 million fee. Later, in October 2024, Egypt conducted a larger auction for the same band, generating $550 million and awarding licenses to Vodafone, Mobinil (Orange), and Etisalat.

Senegal assigned 90 MHz in the 3.5 GHz band in December 2023 to Free Senegal, though financial details were not disclosed.

Namibia allocated 60 MHz each in the 700 MHz and 800 MHz bands in October 2023, collecting modest fees of $0.28 million and $0.43 million, respectively. The spectrum went to TN Mobile (Telecom Namibia), MTC, and Loc8 Mobile.

Tunisia followed in December 2024, assigning 30 MHz in the 700 MHz band and 300 MHz in the 3.5 GHz band to Tunisie Telecom, Orange, and Ooredoo, with no fees disclosed.

Finally, Comoros entered the 5G spectrum landscape in May 2025, awarding licenses to Yas (Axian) and Huri (Comores Telecom), though spectrum details and costs were not made available.

These developments highlight a gradual but steady push toward 5G readiness in Africa, with Egypt leading in terms of both investment value and multi-operator participation, while other markets such as Senegal, Namibia, Tunisia, and Comoros are laying the groundwork for broader 5G rollout in the coming years.

5G adoption

Meanwhile, 5G adoption is still at an early stage, with about 54 million 5G connections anticipated by the end of 2025 (3.8 percent of total). However, growth will accelerate in the second half of the decade, supported by affordable sub-$100 5G smartphones and expanded spectrum availability, particularly in North Africa. By 2030, 5G is expected to represent over 20 percent of all mobile connections in Africa, reaching approximately 390 million users.

5G spectrum

Between October 2023 and June 2025, several African countries advanced their 5G spectrum assignments, signaling growing momentum for commercial 5G deployment across the continent.

Egypt was among the early movers, awarding 3.5 GHz spectrum in January 2024 to Telecom Egypt (We) for a $150 million fee. Later, in October 2024, Egypt conducted a larger auction for the same band, generating $550 million and awarding licenses to Vodafone, Mobinil (Orange), and Etisalat.

Senegal assigned 90 MHz in the 3.5 GHz band in December 2023 to Free Senegal, though financial details were not disclosed.

Namibia allocated 60 MHz each in the 700 MHz and 800 MHz bands in October 2023, collecting modest fees of $0.28 million and $0.43 million, respectively. The spectrum went to TN Mobile (Telecom Namibia), MTC, and Loc8 Mobile.

Tunisia followed in December 2024, assigning 30 MHz in the 700 MHz band and 300 MHz in the 3.5 GHz band to Tunisie Telecom, Orange, and Ooredoo, with no fees disclosed.

Finally, Comoros entered the 5G spectrum landscape in May 2025, awarding licenses to Yas (Axian) and Huri (Comores Telecom), though spectrum details and costs were not made available.

These developments highlight a gradual but steady push toward 5G readiness in Africa, with Egypt leading in terms of both investment value and multi-operator participation, while other markets such as Senegal, Namibia, Tunisia, and Comoros are laying the groundwork for broader 5G rollout in the coming years.

Baburajan Kizhakedath

My brother suggested I might like this blog He was totally right This post actually made my day You can not imagine simply how much time I had spent for this info Thanks