5G Americas, a prominent telecom industry association, has released a new white paper detailing the current challenges and opportunities in spectrum sharing.

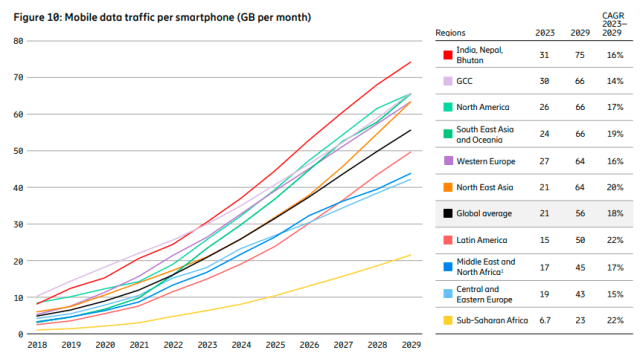

Ericsson Mobility Report earlier said global 5G subscriptions are forecast to exceed 5.3 billion in 2029, making up 58 percent of all mobile subscriptions. North America and GCC will have the highest 5G penetration in 2029 at 92 percent, followed by Western Europe at 85 percent.

This briefing paper from 5G Americas provides an in-depth examination of spectrum management models, including licensed, unlicensed, and shared spectrum mechanisms, and highlights the complexities of maximizing spectrum utility while addressing both legacy users and the wireless industry.

The white paper from 5G Americas underscores the importance of licensed spectrum for incentivizing the substantial investments needed to develop efficient 5G networks. However, it also recognizes the increasing scarcity of spectrum, particularly in the low and mid-band ranges, necessitating spectrum sharing models to expand access for commercial mobile use.

Dynamic Spectrum Sharing (DSS): A Key Focus

A major focus of the briefing is on Dynamic Spectrum Sharing (DSS), which allows for the shared use of spectrum by enabling disparate use cases to operate on the same frequency band. DSS aims to minimize interference and maximize spectral efficiency by considering space, frequency allocation, and time. This concept is particularly relevant for the 3.1-3.45 GHz range, presenting new opportunities for spectrum access by commercial services.

Spectrum Management Models Overview

The paper provides a comprehensive overview of various spectrum management models:

Licensed Spectrum Model: Essential for mobile networks, allowing effective network dimensioning and alignment with traffic demands. Regulatory authorities have reallocated spectrum bands to address growing demand, ensuring performance requirements are met.

Unlicensed Spectrum Model: Traditionally used for Wi-Fi services in homes and offices, with increasing demand for higher data rates and new applications.

Shared Spectrum Models and Mechanisms:

Standardized Same Technology Spectrum Sharing: Utilized for more than a decade globally, enabling efficient cost deployments.

Standardized Multi-Technology Spectrum Sharing: Facilitates the introduction of new technologies over existing spectrum.

Evolved Spectrum Access Systems: Use coordination databases to share spectrum with incumbents, ensuring efficient and interference-free operations.

Technical, Regulatory, and Economic Challenges

The briefing paper identifies numerous challenges associated with spectrum sharing:

Technical Challenges: Protocol overhead, power limitations, access uncertainty, sensing accuracy, design flexibility, interference management, and fairness in resource sharing.

Regulatory Challenges: Need for regulatory flexibility, coverage optimization, simple sharing frameworks, flexible use regulations, and incentive mechanisms for efficient spectrum use.

Economic Challenges: Financial incentives for existing spectrum holders, valuation of shared spectrum, transactional costs, network costs, and business model predictability.

5G in North America

The addition of mid-band spectrum enables superior multi-band 5G experiences for users. In 2023, 5G adoption has grown strongly, and 260 million subscriptions are expected by the year’s end.

FWA, providing high-speed internet to homes and small businesses, remains the primary technology fueling fixed broadband growth. 5G is growing in the enterprise segment with wireless WAN to branch office locations and to serve mobile professions. By 2029, around 430 million 5G subscriptions are expected, accounting for 92 percent of mobile subscriptions in North America.

Conclusion

5G Americas concludes spectrum sharing requires careful consideration of technical, regulatory, and economic factors, ensuring performance equivalent to licensed spectrum and maintaining the United States’ leadership in the global wireless ecosystem.