Airtel India’s capital expenditure (Capital) in 5G and fiber will propel the company to garner more market share in the country, according to research reports.

Ambit

Ambit

Airtel is making 5G investments in the hopes of getting more high-value consumers. B2B revenue growth remained healthy. Airtel capitalized on increased demand for data leverage on adoption of new digital products launched in FY21.

Airtel India’s mobile Capex increase is in tune with the company’s guidance. Airtel India stated that it continued to accelerate site rollout to enhance coverage.

Airtel is best equipped to benefit from this and digitisation-led opportunities in mobile and non-mobile segments.

Morgan Stanley

Capex higher than expectations led by India mobile business, and revenue growth in Airtel business was muted while Digital TV services margins disappointed vs expectations.

IIFL

Airtel India’s management attributed the healthy 4G additions to improved rural coverage. Airtel India has identified 40k high-potential rural clusters where it targets profitable market share gains. 5G mostly serves 4G data offloads; 5G handsets should rise to 20 percent of installed base by March-2024.

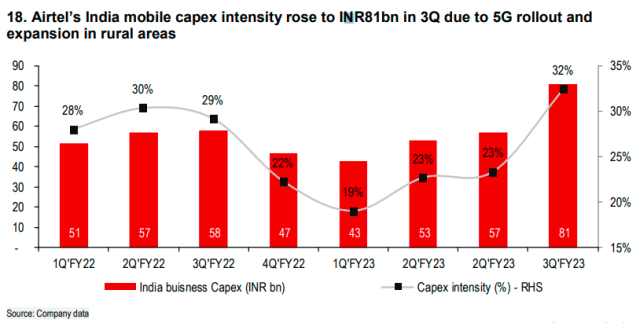

Tower count addition and mobile BB BTS addition remained high, and in line with recent trends. 5G BTS rollouts progressively picked up through 3Q and mobile BB BTS addition will pick up from 4Q. Airtel India’s India capex was Rs81bn/Rs191bn in 3Q/9M and this may stay elevated in 4Q and FY24 as 5G Capex gets front-loaded.

HSBC

Airtel is well positioned for ROIC improvement with margin expansion and improving invested capital turnover.

There will be robust mobile revenue growth, and ARPU to rise, driven by: (1) sub migration from 2G to 4G, (2) sub migration to higher bucket data plans due to a surge in data usage, (3) gains in high-value post-paid subs, and (4) segmented tariff hikes.

The 5G network rollout will not impede the rise in ROIC as the rollout will vary across cities and will be driven by 5G sub handset adoption. In addition, the company continues to invest in growth areas such as home broadband, enterprise, digital assets and data centers.

Airtel India’s Capex rose to INR81bn in 3Q as 5G rollout begins and rural expansion continues. It will not pose a risk to FY24e India Capex forecasts of cINR270bn. 5G demand will rise at a moderate pace as 5G smartphone prices are high.

Airtel India raised entry level prepaid tariffs to INR155 from INR99 in more telecom circles, bringing it to 17 circles out of 22 circles, which should support ARPU improvement.

Airtel India company aims to expand rural coverage in 60k more villages. Airtel India stated top 150 towns account for 40 percent of industry revenue across its segments. In these towns the strategy would be (a) drive post-paid subscriber growth with 5G rollout, (b) expand transport network which can be used across segments, and (c) deepen engagement with enterprises.

Airtel India’s post-paid ARPU is c1.6x-1.7x of prepaid ARPU. Airtel India believes this ratio is balanced and it should help to drive post-paid growth.

Around 11 percent of subs have 5G enabled handsets in India and c35-40 percent of new shipments are 5G handsets. Thus, the company expects c20 percent of subs to have 5G devices by March 2024.

All urban towns and key rural areas should have 5G coverage by March 24. Beyond which, 5G rollout pace would depend on 5G handset adoption.

BoFA:

Airtel India management does not seen step up in Capex over a 3-year cycle, but frontloading would be seen in early years. Overall India business Capex could be in similar range per year for a 3 year period.

Airtel India is stepping up expansion in rural areas especially in circles where the 3rd player is weaker and other operator’s entry level pricing is at similar high price point. Entry level price plan increase saw lower churn in 2 test circles and was thus rolled out to 17 circles.

Airtel India indicated that this plan may not be extended to remaining five circles, as this is a battle of winning smartphone share/4G customer and not a 2G customer.

Sub-GHz spectrum would not give capacity and will enhance coverage, Airtel India management does not see additional marginal utility in more sub-GHz spectrum.

Airtel India would look to complete 5G urban rollout by March 2024. Depending on 5G device adoption, further rollout would be seen as Airtel India would not want to rollout 5G in absence of device penetration or lower traffic.

Airtel India is working on FWA to be ready in next six months as costs come down. Currently, cost of router is high at $180-200 vs for fiber, $25-30, considering 30-32 percent utilization rate, cost per connected home passed is c.$100.