GlobalData analysts have revealed what will be the size of the telecom and pay-TV services revenue in Hong Kong.

The telecom and pay-TV services revenue in Hong Kong is projected to grow at a CAGR of 1.8% from 2024 to 2029, driven by mobile data and fixed broadband services.

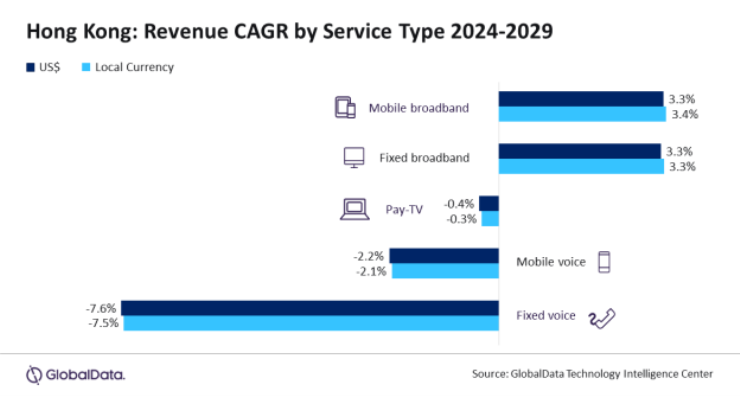

Mobile voice service revenue will decline at a CAGR of 2.1% during the forecast period due to consumers increasingly using OTT communication platforms and decreasing mobile voice ARPU.

Mobile data revenue will grow at a CAGR of 3.4%, fueled by increased mobile internet subscriptions, rising mobile data ARPU, and greater adoption of 5G services.

In 2024, 4G services held the largest share of mobile subscriptions, but this share is expected to decrease as more users migrate to 5G services.

The growth of 5G subscriptions is attributed to consumer demand for high-speed connectivity, expanded 5G coverage, and promotional offers on 5G plans and devices.

The allocation of 300 MHz spectrum in the 6/7 GHz band by OFCA in 2024 will accelerate 5G deployment, increase adoption, and enable innovative use cases for 5G.

Fixed voice service revenue will decline due to losses in circuit-switched subscriptions and falling fixed voice ARPU, while fixed broadband service revenue will grow at a CAGR of 3.3%, supported by the increasing fiber broadband subscriptions.

Fiber broadband growth is driven by government and telecom operators’ efforts to upgrade infrastructure, along with promotional offers from providers like SmarTone and 3 Hong Kong.

The OFCA’s subsidy scheme for fiber-optic networks has facilitated the deployment of fiber in 176 underserved villages, with plans to reach the remaining villages by 2026.

Pay-TV services revenue will decline as users increasingly shift to OTT video services, and aggregate pay-TV ARPU continues to decrease, while China Mobile Hong Kong and PCCW lead in the mobile and fixed broadband segments, respectively.

Baburajan Kizhakedath