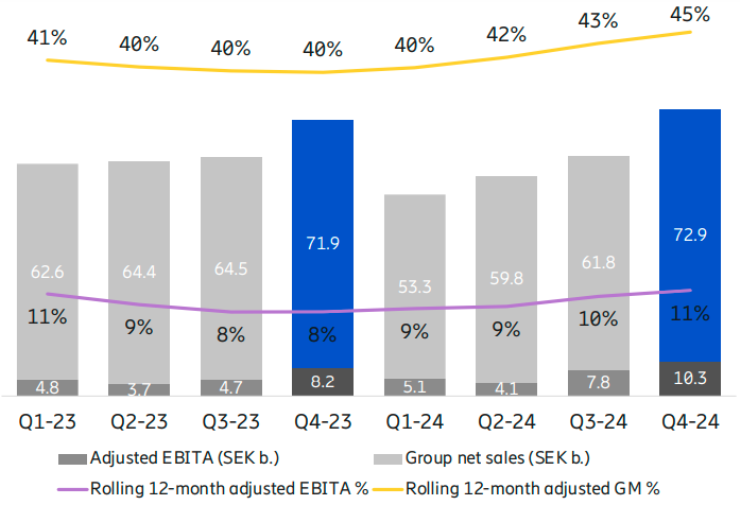

Ericsson has reported 6 percent decrease in revenue in 2024 to SEK 247.880 billion from SEK 263.351 billion in 2023 as fourth-quarter sale dropped 1 percent.

Ericsson’s first-quarter sale fell 1 percent to SEK 72.913 billion in Q4 2024 from SEK 71.881 billion in Q4 2023.

In 2024, Ericsson’s top telecom markets are the United States (40 percent), India (6 percent), China (4 percent), Japan (4 percent) and the United Kingdom (4 percent).

Ericsson has generated sales of SEK 158.207 billion (down 8 percent) from Networks, SEK 62.635 billion (down 2 percent) from Cloud Software and Services and SEK 24.863 (down 3 percent) billion from Enterprises in 2024.

“We progressed well against our strategic plan and generated strong free cash flow. Momentum around programmable networks for differentiated performance continued to build, and customers increasingly recognize the benefits of making mobile networks accessible through APIs,” Borje Ekholm, President and CEO of Ericsson, said.

“RAN market is stabilizing, with strong growth in North America supporting a return to Networks sales growth in Q4. For 2025, Our Networks business will benefit from product leadership position, with the best performance and energy efficiency in the industry,” Borje Ekholm said.

Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group, said RAN revenues are projected to grow at a 0 percent CAGR over the next five years, as drop in 4G / LTE equipment revenues will offset 5G investments.

RAN segments such as 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells are expected to grow over the next five years.

Baburajan Kizhakedath