Latin America’s smartphone market – in terms of shipments – has increased 14.5 percent in Q2 2024, according to Counterpoint’s latest Market Monitor report.

This marks the second consecutive quarter in which Latin America led global regions in growth. Overall shipments were below Q2 2022 levels. Despite this YoY growth, Latin American smartphone market has faced decline quarter-over-quarter, reflecting an unusual shift in seasonal shopping patterns, with key sales periods like Father’s Day and Mother’s Day celebrations kicking off early in Q1 2024.

All countries in Latin America, except Argentina, have reported growth in smartphone shipments. Argentina’s economic struggles, a holdover from last year’s crisis, have kept its smartphone market stagnant. Smaller markets such as Central America, the Caribbean, and Venezuela experienced the highest growth rates.

Market Leaders

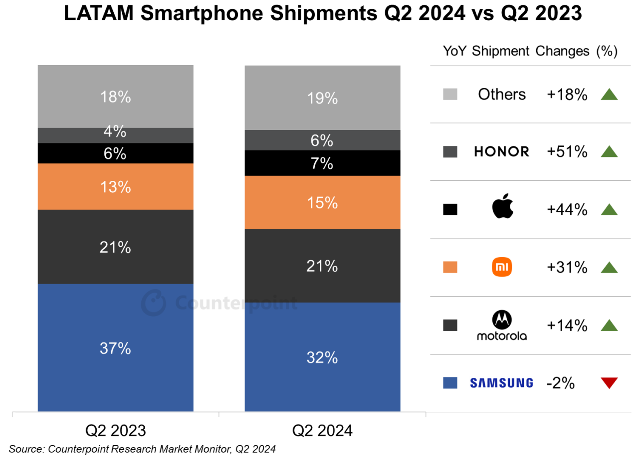

Samsung (32 percent), Motorola (21 percent), Xiaomi (15 percent), Apple (7 percent) and Honor (6 percent), Others (19 percent) are the leading smartphone brands in Latin America in Q2 2024.

Smartphone growth in Latin America is driven largely by fierce competition among Chinese smartphone brands.

Samsung retained its position as the dominant brand in the Latin America region, with one out of every three smartphones sold bearing its name. However, Samsung saw a decline in both volume and market share due to mounting competition from Chinese manufacturers in the mid and low-mid price segments.

Motorola, despite a nearly 14 percent increase in sales volume, experienced a slight dip in market share. Motorola is focused on streamlining its model portfolio while aggressively targeting key markets such as Mexico, Brazil, and Argentina.

Xiaomi also reported growth both YoY and QoQ, though it is slowing down in the grey markets of Brazil and the Southern Hemisphere. Xiaomi saw gains in Mexico, Venezuela, and Central America during Q2 2024.

Apple, driven by strong performance in Brazil, grew YoY. Apple is employing aggressive pricing strategies for its locally assembled legacy models. The shift from 4G to 5G models is becoming more pronounced, with 5G expected to soon dominate Apple’s sales in Latin America.

HONOR made significant strides in the region during Q2 2024, expanding into new markets such as Brazil and Venezuela.

Infinix and Realme achieved triple-digit YoY growth. Both brands have found Brazil to be a key market for their rapid expansion, highlighting their growing influence in the region.

Baburajan Kizhakedath