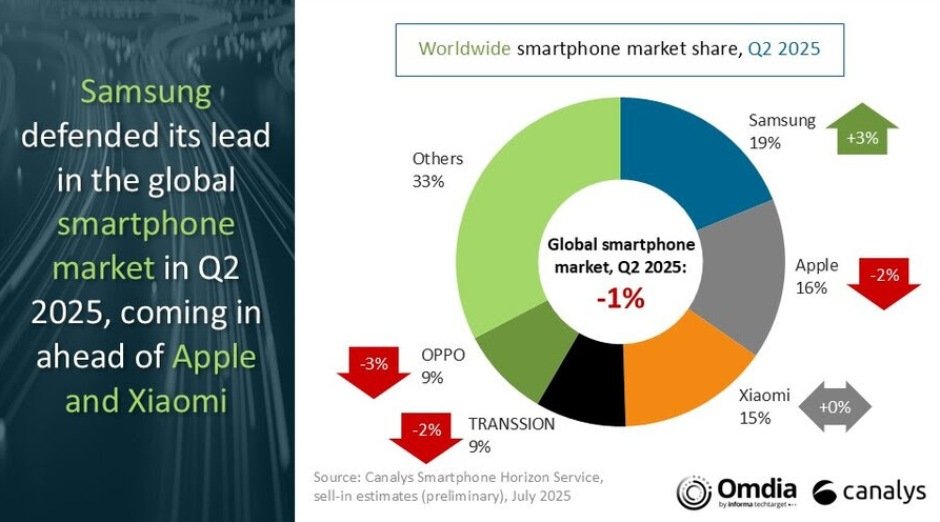

The global smartphone market declined by 1 percent year-on-year in Q2 2025, marking its first contraction in six quarters, according to the latest research from Canalys (now part of Omdia). The slight drop in shipments reflects the fading impact of the pandemic-era replacement cycle and subdued consumer sentiment in a volatile global economic environment.

Despite the market’s softness, sales performance of smartphone makers remained relatively stable in Q2-2025.

Samsung held on to its leading position with a 19 percent market share, buoyed by the popularity of its Galaxy A series.

Apple followed with 16 percent.

Xiaomi maintained at 15 percent.

TRANSSION and OPPO each secured 9 percent, rounding out the top five.

Vendors have increasingly focused on operational efficiency and tactical execution to navigate uncertain conditions. Several brands scaled back production targets in Q2 to avoid oversupply, a move reflecting careful inventory management. The U.S. market presented a unique case, with vendors like Apple, Samsung, and Motorola frontloading inventory in anticipation of potential tariff shifts under the Trump administration, underscoring the geopolitical complexities at play.

Canalys notes that the second half of 2025 is expected to bring renewed momentum, driven by pent-up consumer demand and major shopping events. While premium features like slimmer designs and ecosystem integration are being promoted, the core market growth is likely to come from price-sensitive consumers seeking value upgrades. Huawei and Apple’s strong performances during China’s 618 shopping festival illustrate how effective pricing and targeted promotions can unlock demand even in challenging times.

With healthy inventory levels and a strategic focus on affordability and channel replenishment, the smartphone industry is preparing for a potential rebound in the latter half of the year, despite expectations of overall flat growth for 2025.

Baburajan Kizhakedath