Samsung has retained its leadership in the global smartphone market in Q2 2025 by leveraging the success of its mid-range Galaxy A series, according to reports from IDC and Canalys (now part of Omdia).

IDC report noted that Samsung outperformed the overall market, driven by strong sales of the Galaxy A36 and A56 models. These devices introduced AI capabilities to mid-range smartphones, helping boost consumer interest and in-store engagement. The integration of advanced features at accessible price points enabled Samsung to consolidate its position amid challenging economic conditions and weakening demand in the low-end segment.

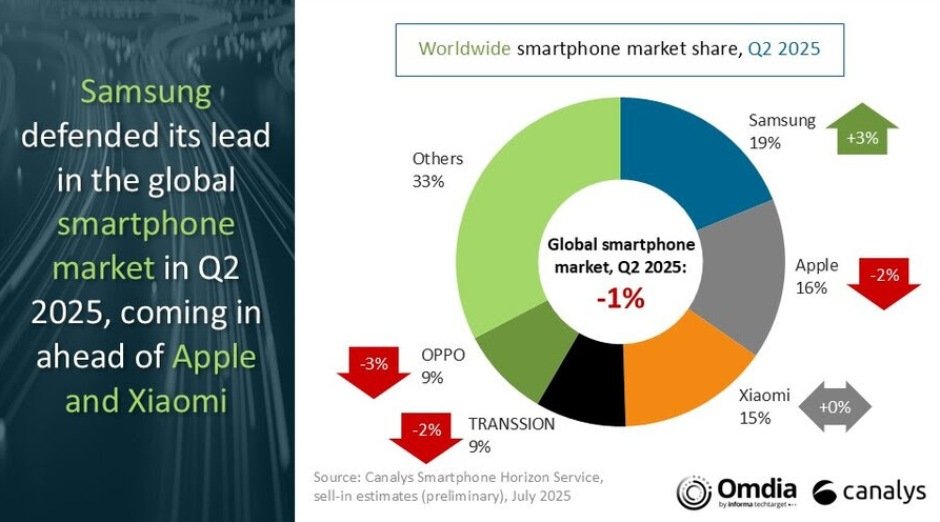

Canalys report confirmed Samsung’s leading position, reporting a 19 percent market share in Q2 2025, attributing its success primarily to the popularity of the Galaxy A series. IDC also highlighted Samsung’s effective strategies, including operational efficiency, AI-focused retail promotions, and well-timed product launches, which helped the company navigate global uncertainties such as geopolitical tensions, tariff fluctuations, and cautious consumer spending.

Samsung’s leadership was further supported by disciplined inventory management and supply chain optimization, which allowed it to maintain profitability without overextending its promotional efforts. While Samsung avoided deep price cuts in its premium segments, it offered value-added services, trade-in programs, and bundle deals to stimulate demand. In emerging markets like India and Southeast Asia, Samsung localized its pricing to accommodate currency volatility and regional preferences.

The company’s dual focus on innovation and market responsiveness — particularly in embedding AI across product tiers — helped it stay ahead of intensifying competition, especially from Chinese brands applying pricing pressure in global markets.

Market Share Snapshot

In Q2 2025, Samsung shipped 58.0 million smartphones, achieving a 19.7 percent global market share —up from 53.8 million units and an 18.4 percent share in Q2 2024.

Apple shipped 46.4 million units, capturing 15.7 percent market share, compared to 45.7 million units and 15.6 percent share a year earlier.

Xiaomi maintained stable shipments at 42.5 million units, with market share slipping slightly from 14.5 percent to 14.4 percent.

Vivo grew its shipments from 25.9 million to 27.1 million units, raising its market share from 8.8 percent to 9.2 percent.

Transsion shipped 25.1 million units, down marginally from 25.5 million, with market share declining from 8.7 percent to 8.5 percent.

Other brands collectively shipped 96.1 million smartphones, down from 99.1 million units, with their combined market share falling from 33.9 percent to 32.6 percent.

Global Market Outlook

According to IDC, global smartphone shipments grew 1 percent year-over-year to 295.2 million units in Q2 2025, signaling cautious optimism amid persistent macroeconomic headwinds. Factors such as inflation, unemployment, and currency instability have tempered consumer spending, particularly in the low-end Android segment, which remains highly price-sensitive.

While emerging markets drove growth, China underperformed despite the 618 e-commerce festival generating strong sales. The event focused more on clearing existing inventory than on new shipments. Apple, though the top performer during the festival, recorded a 1 percent decline in China — offset by strong double-digit growth in emerging markets, leading to a 1.5 percent global increase in Q2.

IDC analysts warned that risks from political instability, trade conflicts, and ongoing global tensions could still impact long-term recovery. However, Q2 2025 marked the eighth consecutive quarter of growth — something not seen since 2013 — driven by innovation in design and broader AI adoption across price segments.

Looking ahead, IDC expects the smartphone market to recover gradually through the remainder of 2025. Replacement cycles, AI-based feature enhancements, and improving economic conditions in key regions are expected to support growth. OEM strategies emphasizing AI integration, channel efficiency, and localized promotions in emerging markets will be critical to maintaining momentum and shaping future competitive dynamics.

Baburajan Kizhakedath