The latest Canalys report – prepared by Senior Analyst Manish Pravinkumar — has revealed main brands in Middle East smartphone market in 2024 and their winning strategies.

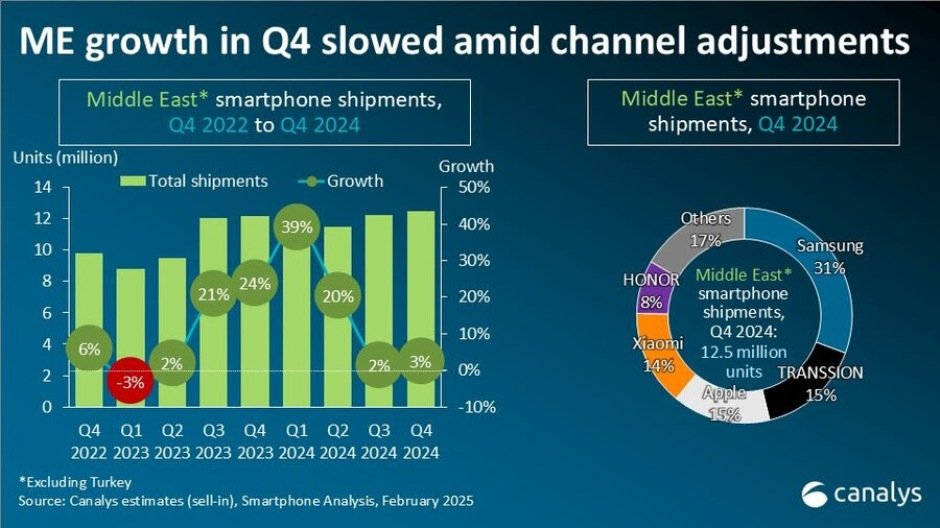

The Middle East smartphone market (excluding Turkey) saw strong growth in 2024, with a 14 percent increase in shipments, nearly double the global recovery rate of 7 percent. A total of 48.4 million smartphones were shipped, driven by market expansion and growing demand for premium devices. However, growth slowed in the fourth quarter, with shipments rising just 3 percent year-on-year to 12.5 million units, following a 29 percent surge in the first half of the year.

In 2024, the smartphone market in the Middle East saw mixed performances across different countries, Canalys Senior Analyst Manish Pravinkumar, said.

Saudi Arabia’s market grew 6 percent in Q4, down from double-digit gains earlier in the year, influenced by an “always-on” shopping culture but tempered by rising housing and energy costs. The UAE’s market saw a modest 4 percent growth, driven by promotions and loyalty-driven offers from retailers like Jumbo and Emax.

Iraq’s market, however, declined by 4 percent, affected by inflation and unemployment. In contrast, Kuwait and Qatar performed well, with growth rates of 19 percent and 15 percent, respectively, fueled by strong consumer spending in Kuwait and a retail boom driven by tourism in Qatar.

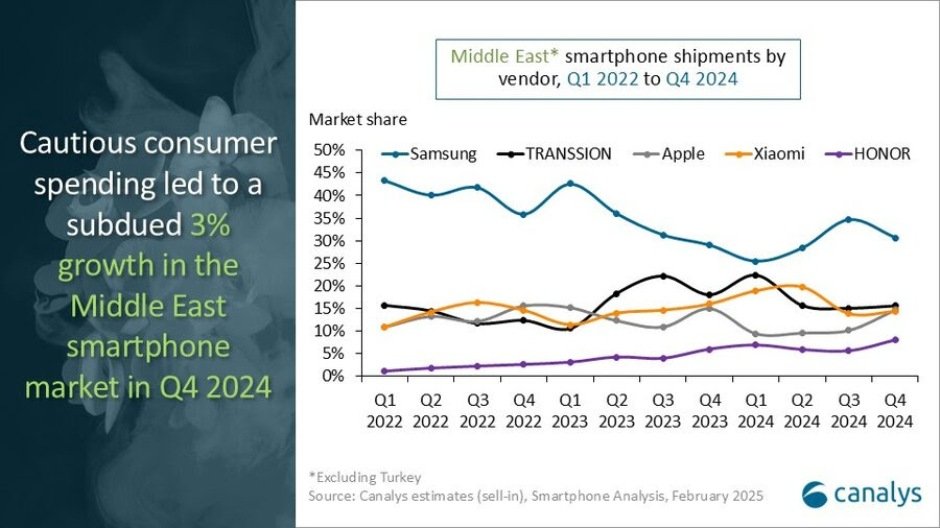

Top smartphone brands focused on strengthening their premium offerings and expanding their market presence through product innovation and channel-driven strategies.

Samsung saw a 27 percent increase in its ASP, fueled by strong demand for its AI-powered Galaxy S24 series, aggressive marketing, and trade-in incentives.

Xiaomi’s shipments declined, but its ASP grew 15 percent, with a focus on channel-led branding for 2025.

Apple retained its 15 percent premium market share while expanding retail and online presence in Saudi Arabia to tap into high-end demand.

Emerging brands like HONOR and Motorola achieved double-digit growth, with HONOR marking a 30 percent year-on-year shipment increase driven by product launches and regional expansion, while Motorola focused on CMF design to attract Gen Z and planned B2B expansion.

Looking ahead, vendors are expected to emphasize AI-driven innovations, ecosystem-based offerings, and enhanced trade-in programs to drive upgrades in a market shaped by shifting retail trends, non-oil economic growth, and evolving consumer behaviors.

Baburajan Kizhakedath