Apple has introduced its first custom-designed modem chip — Apple C1 – marking a significant shift in its reliance on Qualcomm, impacting both companies while offering key benefits to Apple customers.

The Apple C1 modem, along with the A18 processor, enables fast and power-efficient 5G connectivity while improving battery life. This modem marks Apple’s move away from Qualcomm, giving it greater control over hardware optimization.

The iPhone 16e is designed for Apple Intelligence, integrating AI-powered tools like Clean Up for photo editing, natural language search in Photos, and seamless ChatGPT access via Siri and Writing Tools. It also features a powerful 48MP Fusion camera with a 2x Telephoto lens, allowing users to capture high-quality photos and videos with optical zoom.

The device includes advanced safety features like Emergency SOS and Messages via satellite, ensuring connectivity in remote areas. With a 6.1-inch Super Retina XDR display, IP68 water and dust resistance, and a durable ceramic shield front, the iPhone 16e combines performance, intelligence, and reliability in a sleek and affordable package.

For Qualcomm, the impact is substantial. Apple has been one of Qualcomm’s biggest customers, sourcing all of its modem chips from the company. With Apple now developing its own modem, Qualcomm is expected to see its share of Apple modems drop from 100 percent to as low as 20 percent by next year, Reuters news report said.

Although Qualcomm still holds a technology licensing agreement with Apple until at least 2027, the long-term shift threatens a major revenue stream. Additionally, Apple’s move further intensifies competition, as Qualcomm will have to rely more on its Android and Windows customers to offset potential revenue declines. However, Qualcomm shares remained relatively stable following the announcement, indicating that investors may have already anticipated the transition.

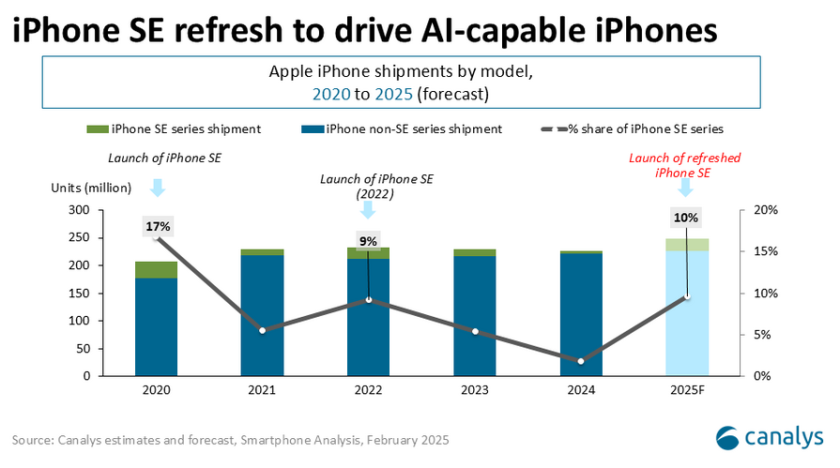

The above chart prepared by analysts at Canalys and Omdia indicates that the AI-enabled iPhone SE will drive the demand for AI smartphones.

For Apple customers, the transition to an in-house modem promises several benefits. The new C1 subsystem is designed to work seamlessly with Apple’s processors, ensuring faster and more efficient performance. One key advantage is improved responsiveness on congested networks, as the iPhone’s processor can prioritize time-sensitive data over other transfers.

Apple’s new modem also enhances GPS and satellite connectivity, offering better location accuracy and coverage in areas with limited mobile networks. Furthermore, the tight integration of Apple’s hardware and software could lead to better battery efficiency, as seen in the iPhone 16e, which now boasts the best battery life of any 6.1-inch iPhone.

However, the transition is not without limitations. Apple’s new modem will initially lack support for millimeter-wave 5G technology, an area where Qualcomm remains a leader. This could affect users who rely on the fastest 5G speeds in certain regions. While Apple has not disclosed when it will incorporate millimeter-wave 5G into its chips, it is likely working toward closing the gap in future iterations.

Apple’s launch of the iPhone 16e with its proprietary ‘C1’ 5G modem marks a significant step toward reducing reliance on Qualcomm, Anisha Bhatia, Senior Technology Analyst at GlobalData, said.

Priced at $599, the device serves as a test platform to evaluate the modem’s performance before potential integration into premium models. While Qualcomm’s modems remain the industry standard, Apple’s transition will be gradual, with Qualcomm chips expected in some Apple devices until at least 2027.

As Qualcomm shifts focus to automotive, PCs, and IoT, Apple’s self-designed modem strategy aims for long-term benefits, including improved efficiency, battery optimization, and deeper integration within its ecosystem.

Overall, Apple’s move signals a long-term strategy to control more of its hardware ecosystem, providing tailored benefits to its users while reducing its reliance on external suppliers. Qualcomm, while still a dominant player, will need to adapt to a future where Apple is no longer one of its primary modem customers.

Baburajan Kizhakedath