Music streaming major Spotify has reported revenue of €4.193 billion, reflecting an increase of 10 percent, for Q2-2025.

Premium revenue of Spotify grew 12 percent to €3.740 billion, supported by a 12 percent rise in Premium subscribers and ARPU growth. Ad-Supported revenue declined by 1 percent.

Revenue growth was impacted by unfavorable foreign exchange movements, which reduced the reported figures by approximately €104 million. While Premium revenue growth remained strong, the ad-supported segment faced pressure from pricing softness and content mix changes. Gross margin improved to 31.5 percent, up 227 basis points year-over-year, driven by better margins in both Premium and Ad-Supported businesses.

Subscribers

Spotify added 18 million Monthly Active Users (MAUs) in Q2 2025, bringing the total to 696 million, an 11 percent increase year-over-year. This exceeded the company’s guidance by 7 million and reflected consistent growth across all regions, particularly in the Rest of World and Latin America.

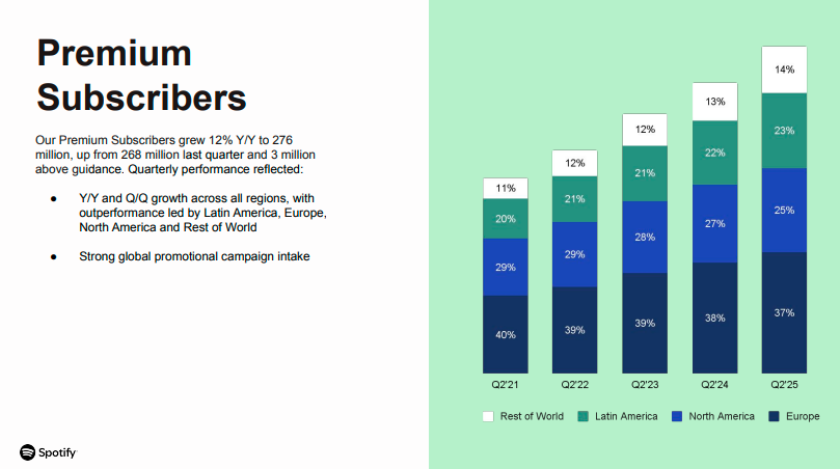

Premium subscribers of Spotify rose by 8 million during the quarter to reach 276 million, a 12 percent year-over-year increase and 3 million above guidance. The growth was driven by strong global promotional campaigns and subscriber additions across all regions, including Europe, North America, Latin America, and Rest of World. The company also noted improved intake from marketing efforts and favorable shifts in competitive dynamics.

ARPU

Spotify’s Premium Average Revenue Per User (ARPU) declined by 1 percent year-over-year to €4.57 in Q2 2025, primarily due to foreign exchange impacts. On a constant currency basis, ARPU increased by 3 percent, reflecting the positive effect of price increases across various markets.

The ARPU trend showed influences from product and geographic mix, which partially offset pricing benefits. Despite the slight decline in reported ARPU, the underlying trend indicates healthier monetization per user when currency fluctuations are excluded.

Investment

Spotify’s investment trends in Q2 2025 focused on supporting long-term growth, with capital expenditures rising €8 million year-over-year to €10 million, primarily for office build-out and optimization.

Operating expenses increased 8 percent year-over-year, largely due to higher personnel-related costs, professional services, and marketing. A significant factor in expense growth was €115 million in Social Charges tied to share price appreciation.

Innovation

Spotify continued to drive innovation in Q2 2025 by expanding access to audiobooks and enhancing music experiences. The company introduced voice-activated DJ features in over 60 markets, significantly increasing user engagement. Audiobooks+ was launched as a new add-on subscription, offering extra listening hours for Premium users and their families, while audiobook access was extended to Germany, Austria, Switzerland, and Liechtenstein.

AI Playlist capabilities were rolled out to over 40 new countries, making personalized playlist creation more accessible. Additional product updates included the Upcoming Releases hub for music discovery and special digital content tied to major artist events, reinforcing Spotify’s focus on deepening user engagement and supporting creators.

TelecomLead.com News Desk