Africa’s streaming market is expanding, with global platforms increasing their presence while investing in local productions. Despite strong local markets like Nigeria, Egypt, and South Africa, international services continue to dominate in terms of volume and reach.

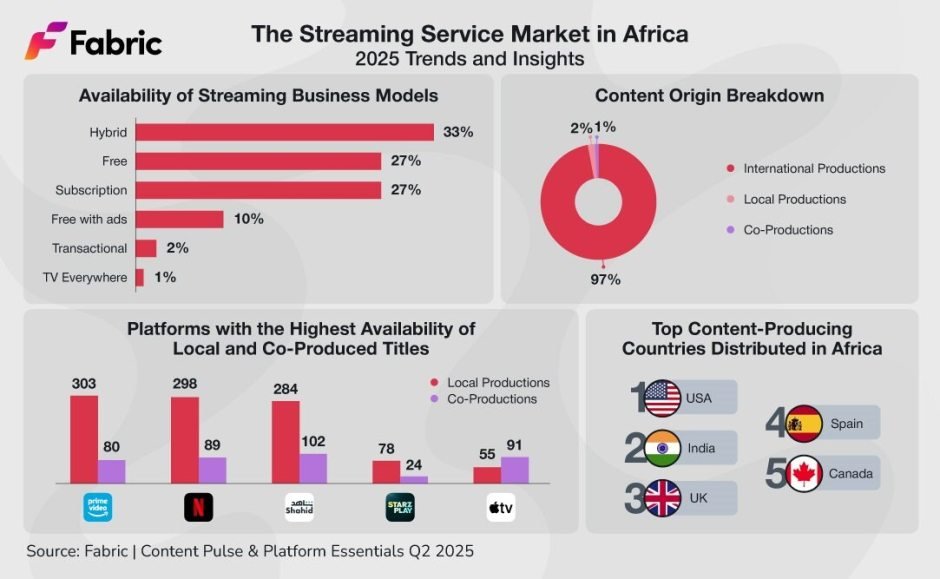

By 2025, Africa hosts over 560 streaming services. Most (67 percent) use a single business model, while 33 percent offer hybrid models. Subscription-based access is the most common (56 percent), followed by free access (43 percent), and free with ads (21 percent). Transactional models (13 percent) and subscription with ads are less common, with only 12 platforms using the latter.

Among local players, Showmax is a standout, operating in 44 countries and refocusing strategically on the African market. Globally, Netflix leads in penetration, available in all 60 African countries, followed by Prime Video. Disney+ has limited reach, available in just 13 countries, and Max has no presence or plans for entry.

Content Strategies of Netflix, Prime Video, and Showmax in Africa

Streaming giants in Africa, including Netflix, Prime Video, and Showmax, are employing a content strategy that heavily favors international productions while cautiously exploring regional partnerships and local content development, Juliana Tartara, Marketing Analyst at BB Media, a Fabric Data Company, said in the report.

Across platforms, Africa offers access to over 60,000 unique titles. Yet only 2 percent are fully local productions, while 97 percent are international imports and 1 percent are co-productions involving African countries. This highlights a clear imbalance that reflects both opportunity and challenge for local industry growth.

Co-Production Focus

Co-productions represent a small fraction of content but reveal a strategic lens into which international players prefer to engage with African markets.

The United States dominates co-productions in Africa, accounting for 44 percent of over 360 such projects.

The UK and France follow at 13 percent and 12 percent, respectively, reflecting their broader global strategies and historical ties with parts of Africa.

Among African countries, South Africa leads with 139 coproduced titles, followed by Egypt (130) and Nigeria (46). South Africa’s production infrastructure and regulatory environment likely make it attractive for foreign collaborators.

Local Production Strength

While co-productions are limited, local production activity tells a different story:

Egypt leads in homegrown content with 449 titles, showing a robust national media ecosystem.

Nigeria, with 447 local titles, is nearly on par, affirming its position as a content powerhouse — though less involved in co-productions.

South Africa, despite being the most sought-after for international co-productions, lags in local-only output with 175 titles.

Platform Strategies

Netflix and Prime Video continue to leverage global libraries to drive viewership in Africa, offering a mix of blockbuster hits and curated regional categories.

Showmax is working to localize more content, capitalizing on its African roots and regional insights.

Fabric Data highlights growing efforts to expand visibility of platforms like Showmax and iBAKATV, crucial distributors of Nigerian content. These steps are intended to better showcase Nollywood’s global relevance, which remains underrepresented despite Nigeria’s massive output.

Upcoming Co-Productions

Although still limited, new co-productions are emerging, including:

Superstore

Lagos Love Stories

Alex From Oil & Gas

These early ventures may pave the way for more collaborative storytelling that merges local themes with international investment and distribution.

Foreign countries dominate content distribution on African streaming platforms, with the US leading at over 27,000 titles, followed by India and the UK. In contrast, Egypt, Africa’s top content producer, offers only 449 titles. Despite increasing local production, African stories remain underrepresented.

Drama is the most popular genre across all content types, followed by thrillers and documentaries in foreign and co-produced content, and comedy in local productions. While foreign dominance persists, rising output from Egypt and Nigeria, and South Africa’s appeal for co-productions, highlight growing opportunities for a more balanced content ecosystem.

Africa’s streaming content industry is dominated by foreign productions, but local industries — particularly in Egypt, Nigeria, and South Africa — are rising forces. Content strategies currently emphasize global content supplemented by regional engagement, with growing recognition of the need for deeper local investment and co-production ecosystems to serve and reflect African audiences more meaningfully.

Baburajan Kizhakedath