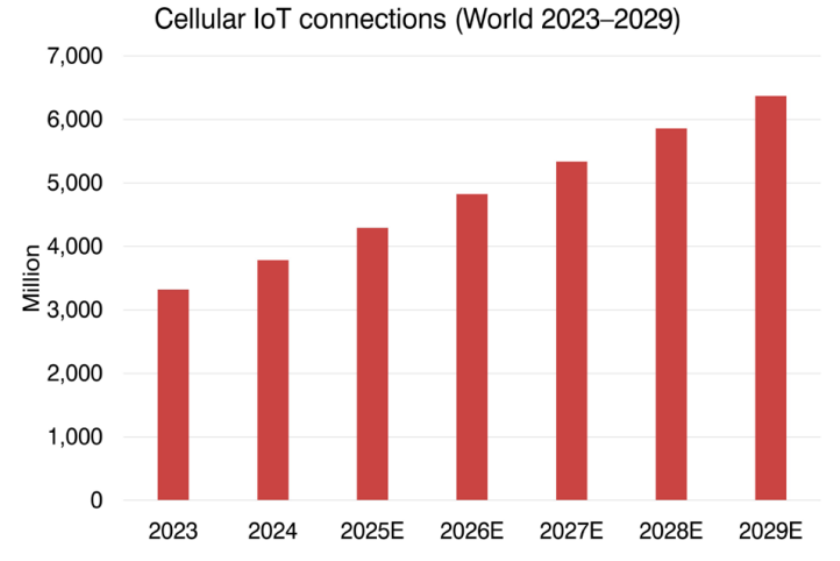

Global cellular IoT connections grew by 14 percent in 2024 to reach 3.8 billion, and are projected to hit 6.4 billion by 2029, according to Berg Insight.

While connectivity volumes are expanding at a CAGR of 11.0 percent, IoT connectivity revenues are growing more slowly at 9.6 percent CAGR—from €14.2 billion in 2024 to €22.4 billion in 2029. Monthly ARPU is declining, expected to fall from €0.33 to €0.30, reflecting intensifying price competition and commoditization of basic connectivity.

China continues to dominate the IoT landscape with 2.7 billion connections, accounting for 70 percent of the global total. This leadership is attributed to strong state support, with government-led initiatives driving massive deployments across urban surveillance, energy efficiency, and public safety. In contrast, North America (294 million) and Western Europe (279 million) are commercially driven markets, where the connected car is a key driver—over 90 percent of new vehicles are now shipped with embedded cellular connectivity.

Despite rapid growth in subscriber numbers, IoT connectivity revenue growth is lagging, with a 12 percent rise in 2024 and declining ARPU across most markets. Connectivity now represents only about 2 percent of mobile operators’ total revenues. This is pushing telecom players to diversify their IoT portfolios beyond connectivity, investing in value-added services like cloud integration, edge security, and vertical-specific applications such as smart metering, logistics tracking, and automotive telematics.

China Mobile remains the world’s largest IoT connectivity provider with 1.42 billion connections and 8 percent annual growth, followed by China Telecom and China Unicom. Among Western operators, Vodafone leads with 204 million connections, while AT&T follows with 143 million. Deutsche Telekom, Verizon, Telefónica, KDDI, and Orange round out the top 10.

Main IoT initiatives

China Mobile, the world’s largest cellular IoT provider, continues to scale its platform with a focus on massive IoT deployment across industrial sectors. The company supports over 1.4 billion IoT connections and is expanding smart city solutions, automotive connectivity, and industrial automation, aligning with government-backed digital infrastructure goals.

China Telecom is enhancing its IoT capabilities through 5G-based smart applications and industrial integration, focusing on verticals such as healthcare, manufacturing, and logistics.

China Unicom is pursuing partnerships and smart solution portfolios for agriculture, energy, and public services, leveraging AI and big data integration into its IoT offerings.

AT&T is focusing on connected vehicles, asset tracking, and enterprise IoT services, supported by its leadership in automotive connectivity in North America. The company is expanding its international IoT footprint with multi-network access and private 5G offerings.

Deutsche Telekom is pushing for IoT growth across Europe through its T-IoT platform, offering global connectivity, eSIM, and edge computing solutions for smart logistics, utility metering, and industrial control.

Verizon is focusing on vertical solutions, particularly in smart transportation, logistics, and public safety, and is investing in private 5G networks and edge services to support enterprise-grade IoT deployment.

Telefonica is advancing its global IoT strategy through a multi-country approach, offering integrated services that combine connectivity, cybersecurity, and data analytics. It is especially active in smart cities, utilities, and fleet management.

KDDI is supporting IoT adoption in Japan with industrial solutions, smart factories, and infrastructure monitoring, and is leveraging its global partnerships to offer end-to-end IoT services across Asia.

Orange is developing international IoT solutions with a focus on Europe and Africa, offering global M2M connectivity and managed services that support smart mobility, energy, and industrial automation.

To maintain competitiveness, operators and managed service providers are expanding globally and vertically. Managed service providers now support over 200 million connections and differentiate by offering multi-network, multi-technology solutions that span international markets.

Players like Wireless Logic, KORE, floLIVE, Soracom, and Tata Communications are focusing on aggregating multiple networks and offering services like private LTE/5G, global eSIM, and IoT security stacks.

Strategic moves include vertical integration, often through acquisition of local solution providers, and development of bundled services that combine connectivity with hardware, management platforms, and data services. As margins on basic connectivity continue to erode, players across the ecosystem are aggressively shifting toward holistic IoT offerings that drive recurring value and deeper enterprise engagement.

Baburajan Kizhakedath