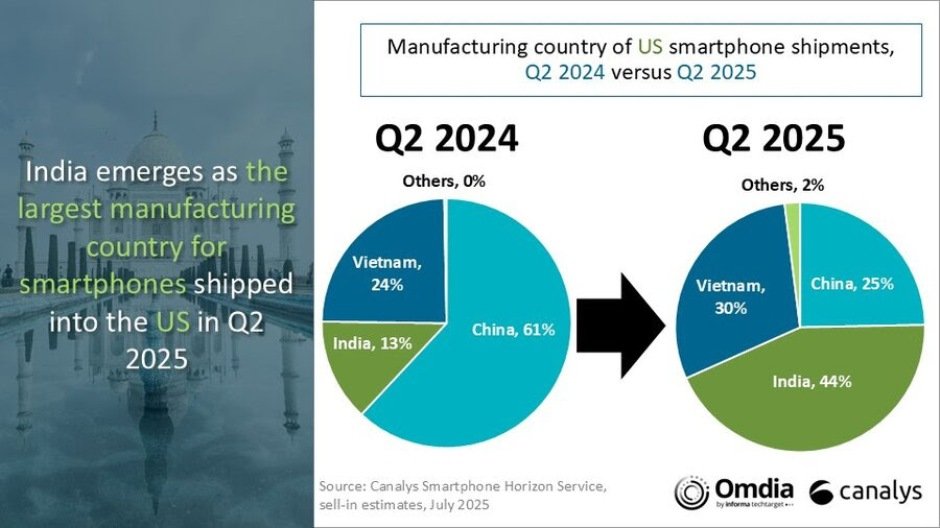

The U.S. smartphone market is undergoing a shift in its supply chain, with India surpassing China as the leading manufacturing hub for smartphones shipped to the United States for the first time in Q2-2025.

Data from Canalys (now part of Omdia) reveals that only 25 percent of U.S.-bound smartphones were assembled in China during the quarter — down sharply from 61 percent a year earlier — while India’s share surged to 44 percent, up from 13 percent.

The Canalys report did not disclose the number of smartphones manufactured in India for the U.S. market.

This 240 percent growth in Made-in-India smartphone shipments reflects an industry push to diversify manufacturing away from China amid geopolitical tensions and tariff uncertainty. The stalled U.S.-China trade negotiations have accelerated a “China Plus One” strategy among major vendors, with India emerging as the primary beneficiary.

Apple has led this transformation, significantly expanding its production footprint in India. The company has ramped up manufacturing of the iPhone 16 series in the country, including Pro models, and redirected much of its Indian output to serve the U.S. market.

While China remains critical for the large-scale production of premium models, Apple’s pivot to India underscores its effort to mitigate geopolitical risks and reduce over-reliance on Chinese factories.

Samsung and Motorola have also started sourcing more devices from India, though at a more measured pace. Motorola, like Apple, has historically relied heavily on Chinese manufacturing, whereas Samsung has primarily used Vietnam. India is now becoming an increasingly important node in their supply strategies, driven by the need for regional diversification and tariff hedging.

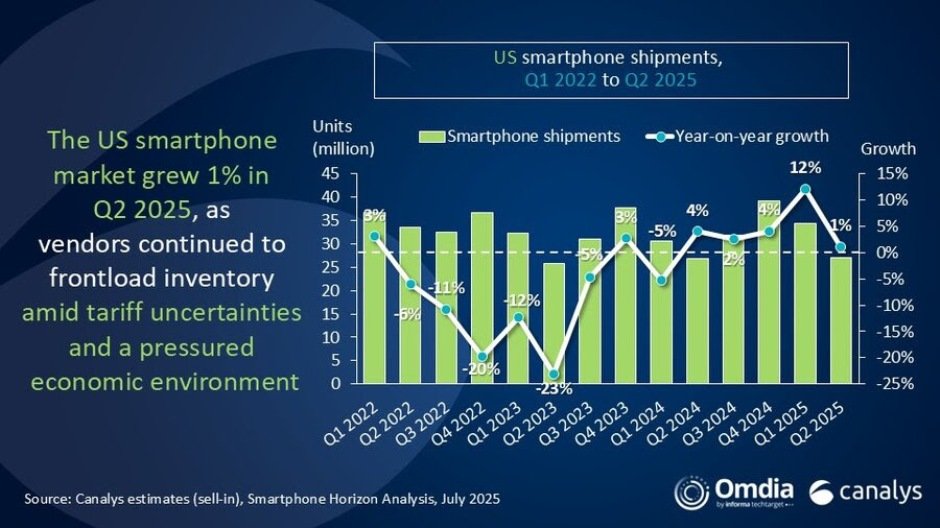

This manufacturing shift coincides with vendors aggressively frontloading shipments to the U.S. in anticipation of possible new tariffs, said Runar Bjorhovde, Senior Analyst at Canalys (now part of Omdia), said.

U.S. smartphone market

The U.S. smartphone market recorded 1 percent year-on-year growth in Q2-2025, reflecting a cautious consumer spending environment despite inventory buildup by vendors.

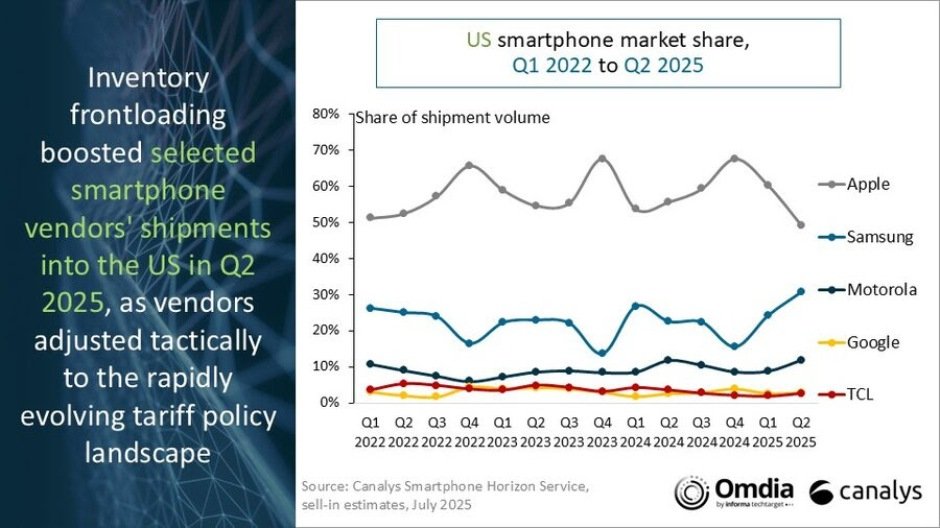

Apple remained the market leader but saw a decline in shipments from 14.9 million to 13.3 million, reducing its market share from 56 percent to 49 percent.

Samsung experienced significant growth, with shipments increasing from 6.0 million to 8.3 million, raising its market share from 23 percent to 31 percent.

Motorola maintained a stable position, with shipments slightly rising from 3.1 million to 3.2 million, keeping its market share steady at 12 percent.

Google also held steady, with a marginal increase in shipments from 0.7 million to 0.8 million, maintaining a 3 percent market share.

TCL saw a drop in shipments from 1.0 million to 0.7 million, leading to a decline in market share from 4 percent to 3 percent.

The frontloading strategy adopted by vendors like Apple and Samsung was aimed at building buffers against tariff risks. However, the tepid overall market growth reveals a gap between vendor shipments (sell-in) and consumer purchases (sell-through), pointing to soft demand under inflationary pressures and shifting spending behavior.

The U.S. smartphone market is becoming increasingly polarized, with over 90 percent of market share held by Apple, Samsung, and Motorola. Smaller players face high barriers to entry due to regulatory, logistical, and investment hurdles.

Companies like OnePlus and Nothing are experimenting with direct-to-consumer and retail-partner approaches, but their scale remains limited. Meanwhile, HMD Global is pulling back from the U.S. market, underlining the challenges faced by mid-tier vendors in justifying continued investment.

Baburajan Kizhakedath