In a market dominated by global streaming giants, South African audiences are showing a strong preference for local platforms, demonstrating the importance of homegrown content and affordability in consumer choices.

With a diverse selection of streaming services, ranging from subscription-based to free-with-ads models, the country’s streaming landscape continues to evolve to meet the needs of its cost-conscious and entertainment-driven consumers, according to BB Media.

Preference for Local Streaming Services

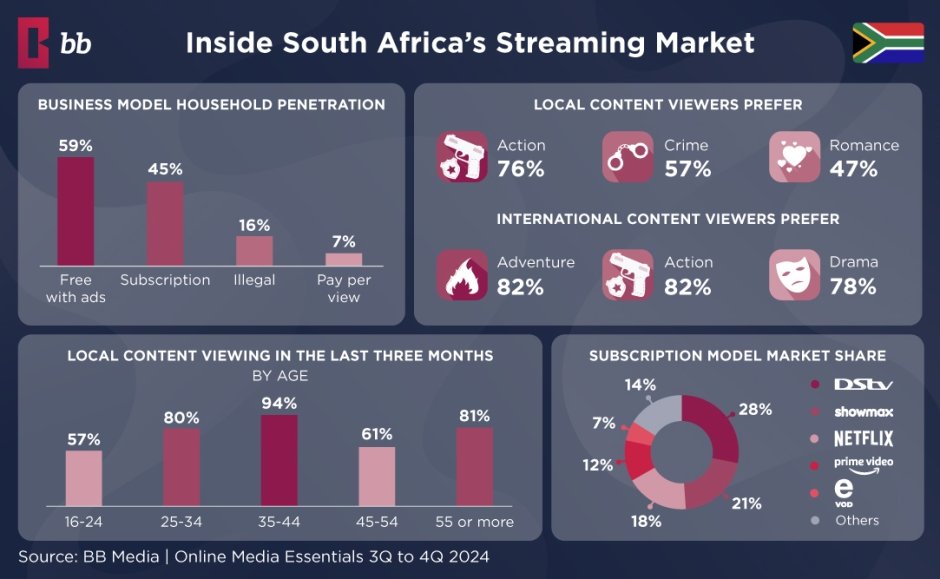

Among subscription-based streaming services, South African companies are leading the market. DStv’s streaming service holds the highest net penetration at 16 percent as of Q3 2024, followed by Showmax at 11 percent, while Netflix ranks third at 10 percent. Despite the presence of over 500 streaming platforms, only seven are local — DStv, Showmax, SABC+, eVOD, Todazon, AfriDocs, and Freevision Play — yet they successfully cater to a significant portion of viewers. Many of these platforms offer free or ad-supported tiers, making them more accessible to consumers, particularly in a price-sensitive market.

South Africans Favor Local Content

A key trend in the South African streaming market is the demand for locally produced entertainment. In the past three months, 76 percent of online content consumers reported watching local programming. Among these viewers, Action (76 percent) is the most popular genre, followed by Crime (57 percent) and Romance (47 percent). Those who have not recently streamed local content gravitate toward Adventure (82 percent), Action (82 percent), and Drama (78 percent).

Despite the demand for local content, the volume of South African productions remains limited. The country currently offers 259 local movies and 55 local series, whereas U.S.-produced content dominates with over 15,000 available titles. Within local content, Comedy accounts for 13 percent of productions, while U.S. content is led by Documentaries at 14 percent. Across all platforms, Drama emerges as the most widely available genre, comprising 23 percent of titles.

The Rise of Free-with-Ads Models

South African consumers are increasingly embracing free-with-ads streaming models, which now boast the highest penetration rate at 59 percent. In contrast, traditional subscription-based services hold a 45 percent penetration rate. Despite this growing preference, only 15 percent of platforms currently operate under the free-with-ads model, compared to 40 percent offering traditional subscriptions. Some platforms employ a hybrid approach, offering both free and paid tiers.

Subscription-with-ads remains the least common model, representing only 2 percent of available services. However, consumer interest in affordable ad-supported plans is significant—76 percent of households express a willingness to switch to lower-cost, ad-supported tiers to reduce expenses. This suggests a potential expansion in ad-supported offerings as platforms adjust to shifting consumer priorities.

Piracy: A Major Challenge

Illegal streaming continues to impact South Africa’s entertainment industry, with piracy platforms holding a 13 percent market share. Goojara, the leading illegal platform, alone has a 12 percent penetration rate. Many consumers turn to piracy due to financial constraints, highlighting the need for legitimate streaming services to offer more affordable and ad-supported options.

For subscription-based platforms, cost is a significant factor influencing consumer decisions. Among former Netflix subscribers, 40 percent cited financial struggles as the reason for canceling, while 27 percent found the service too expensive. Comparatively, Showmax has gained traction with its lower price point — averaging $4.83 per month in late 2024 — compared to Netflix’s $6.75.

Future of Streaming in South Africa

As local platforms maintain their stronghold in the market, demand for regional content continues to shape South Africa’s streaming trends. The increasing popularity of free-with-ads services underscores affordability as a key factor in consumer preferences. Meanwhile, piracy remains a challenge, but it also presents an opportunity for legitimate services to attract cost-sensitive viewers with budget-friendly options. By focusing on local content production, expanding ad-supported offerings, and addressing pricing concerns, South Africa’s streaming industry can continue to evolve in response to its audience’s needs.

Baburajan Kizhakedath