The U.S. streaming industry is entering a defining phase. With saturation nearing in urban markets and competition intensifying, platforms are shifting from rapid customer acquisition toward sustainable retention.

The dual challenge is clear: attracting new subscribers while keeping existing ones from cancelling (churn). To achieve this, companies are experimenting with pricing models, bundling strategies, targeted promotions, and content tailored to shifting viewer habits.

Subscription Prices and Promotional Offers

Pricing remains the most visible battleground. In the United States, ad-free streaming plans average USD 19.46 per month, while ad-supported options average USD 16.81. For viewers willing to tolerate advertisements, this represents a 14 percent saving. However, this discount is smaller compared to other regions: in EMEA, ad-supported subscriptions are on average 17 percent cheaper at USD 16.66.

To attract cost-sensitive consumers, platforms rely heavily on seasonal and targeted promotions. Disney+, HBO Max, and Prime Video offer discounts tied to major retail events such as Black Friday and Prime Day. Other promotional tactics include:

Disney+ and Hulu bundle for USD 2.99 (with ads, March 2025)

Early-bird annual discounts on HBO Max

Prime Day offers on Prime Video channels

Frequent promotional pricing from MUBI every 3–4 months

While 72 percent of platforms still offer free trials, limited-time promotions (now used by 18 percent) are becoming an increasingly popular acquisition strategy.

Strategic Partnerships and Bundled Services

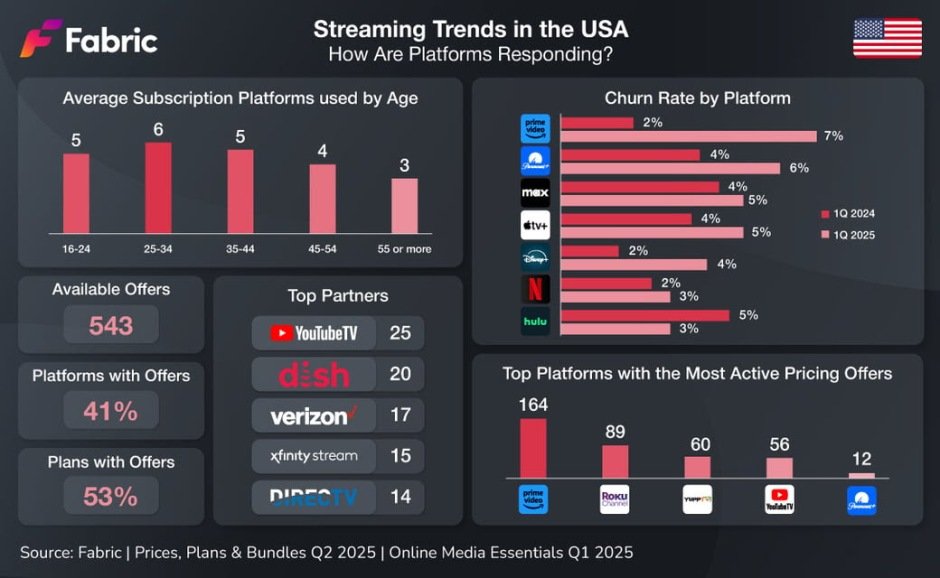

Bundles and partnerships are reshaping the streaming experience. In the U.S., 43 percent of platforms maintain commercial partnerships, most commonly (55 percent) with telecom operators. These deals expand distribution, simplify billing, and reduce churn risk.

Cross-platform bundles also play a pivotal role. Prime Video integrates over 160 channels, while packages like AMC+ & Discovery+ at USD 13.99 per month deliver substantial savings — each standalone subscription costs USD 9.99, so the bundle offers a 30 percent discount.

This approach creates a “lock-in effect.” Cancelling a single subscription within a bundle often means losing access to multiple services, making customers less likely to churn. HBO Max currently leads in bundle adoption, followed by Paramount+, Starz, MGM+, Disney+, and AMC+.

Churn Rates and Reasons for Cancellation

Despite these efforts, churn remains high. In Q1 2025, most platforms — including Prime Video, Netflix, and Disney+ — saw churn rates climb. The outlier was Hulu, which managed a 35 percent reduction in cancellations.

The top reason for churn remains pricing pressure. Surveys reveal that:

47 percent of Netflix churners left due to high cost

45 percent of HBO Max churners cited pricing issues

40 percent of Disney+ churners also pointed to expense

Other key drivers include:

Completion of a specific series or season

Limited content variety

Household budget constraints

Lack of viewing time

This highlights the importance of both affordable tiers and long-tail content that retains interest beyond a single show.

Viewer Behaviour by Age Group

Age demographics significantly influence streaming engagement.

Ages 25–34: The most active segment, subscribing to an average of 6 platforms (including account sharing).

Ages 55+: Engagement declines, with an average of just 3 subscriptions.

This disparity underscores the appeal of bundles, which simplify content discovery and reduce subscription fatigue for older, less tech-savvy viewers while still catering to younger multi-platform users.

Retention Strategies and Content Offering

Retention now sits at the heart of streaming economics. Platforms are realizing that sustainable growth requires long-term engagement, not just one-time subscriber spikes. Key retention levers include:

Content longevity: Programs designed for sustained interest, such as multi-season franchises and staggered releases.

Bundles as retention tools: Packages that consolidate access and discourage cancellations.

Demographic alignment: Producing content tailored to age-specific viewing habits and cultural preferences.

As consumer expectations evolve, platforms must strike a delicate balance between pricing innovation and content relevance. The future winners will be those who can integrate affordable, flexible plans with compelling, consistent programming.

Conclusion

The U.S. streaming industry is no longer defined by who can gain subscribers the fastest. Instead, the challenge is keeping them engaged month after month. Through bundles, pricing flexibility, strategic partnerships, and data-driven content strategies, platforms aim to reduce churn and secure long-term loyalty.

In this competitive landscape, success hinges on one principle: sustainable engagement is more valuable than rapid expansion.

Baburajan Kizhakedath