Canalys and IDC have revealed their market reports on the tablet industry, showing growth for Apple and Samsung in Q2 2024.

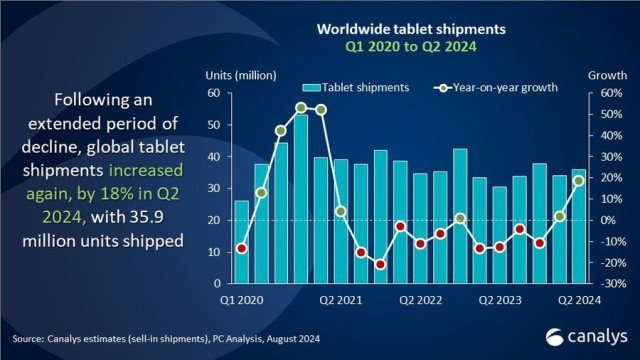

According to the latest data from Canalys, the worldwide tablet market experienced significant growth in the second quarter of 2024, with shipments increasing by 18 percent year-on-year to reach 35.9 million units. Apple and Samsung, the leading vendors in the market, both contributed to this growth with notable performances.

Apple

Apple maintained its dominant position in the global tablet market, shipping 13.9 million iPads in Q2 2024. This represents an 18.5 percent increase from the 11.7 million units shipped in Q2 2023. Apple’s market share remained steady at 38.7 percent. The company’s success can be attributed to the release of new products and advancements in display technology and integrated AI functionality, which have appealed to consumers, particularly in the premium segment.

Samsung

Samsung also showed strong performance, shipping 6.8 million tablets in Q2 2024, marking a 12.7 percent year-on-year increase from the 6.0 million units shipped in Q2 2023. Despite this growth, Samsung’s market share slightly decreased from 19.8 percent to 18.9 percent. The growth in Samsung’s shipments was driven by robust sales of its flagship models and increasing demand in emerging markets across the Asia Pacific region.

Market Overview

The positive trend in the tablet market is attributed to cyclical refresh demand and the innovation in display technology and AI integration. The Chinese market, in particular, showed tremendous growth due to aggressive promotional strategies by domestic vendors, increasing tablet penetration in the country. International expansion of these vendors has also led to a rise in shipments in regions such as the Middle East, Central and Eastern Europe. In India, government education tenders have boosted demand, with future growth expected due to policies favoring local device manufacturing.

Top Five Vendors

Apple: 13.9 million units shipped, 38.7 percent market share, 18.5 percent annual growth.

Samsung: 6.8 million units shipped, 18.9 percent market share, 12.7 percent annual growth.

Huawei: 2.5 million units shipped, 7.0 percent market share, 50.8 percent annual growth.

Lenovo: 2.5 million units shipped, 6.9 percent market share, 16.3 percent annual growth.

Xiaomi: 2.1 million units shipped, 6.0 percent market share, 106.4 percent annual growth.

The latest IDC report indicated the global tablet market rose 22.1 percent to 34.4 million units in the second-quarter of 2024.

Apple

Apple has shipped 12.3 million units of iPads in Q2 2024, marking 18.2 percent growth. This surge can be attributed to the launch of the new 11” and 13” iPad Air and iPad Pro models, which have resonated well with consumers. Apple’s growth was widespread across the globe, though it faced stiff competition in China from local players like Huawei and Xiaomi, impacting its performance in that market. Despite this, Apple’s focus on advanced technologies such as OLED displays for its premium devices has helped maintain its strong market position.

Samsung

Samsung, securing the second position, shipped 6.9 million units in Q2 2024, representing a year-over-year growth of 18.6 percent. Unlike Apple, Samsung’s growth was not driven by major product launches. Instead, the company benefited from several commercial deployments and a favorable comparison to Q2 2023. Samsung’s ability to expand in the commercial sector and leverage its existing product line has been key to its robust performance.

Conclusion

The tablet market had a robust second quarter in 2024, with Apple and Samsung leading the charge. Apple’s continued innovation and Samsung’s strategic market expansion have solidified their positions as the top vendors in the industry. As the market evolves with new technologies and increased demand, both companies are well-positioned to capitalize on future growth opportunities.

Baburajan Kizhakedath