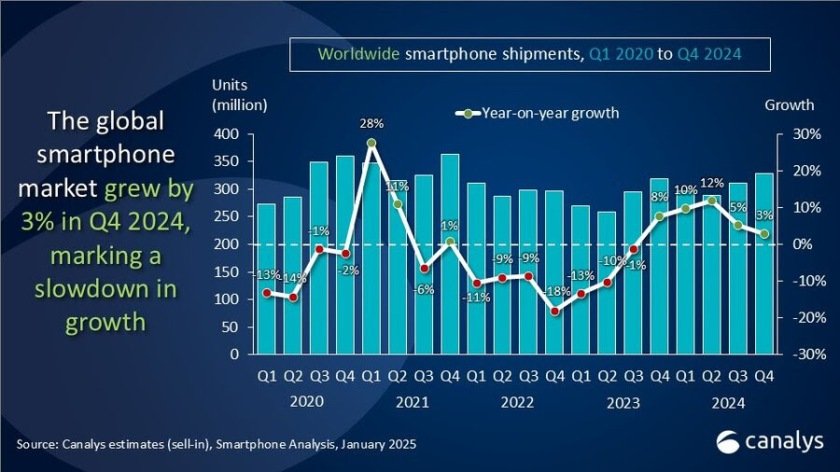

The global smartphone market grew by 3 percent in Q4 2024, reaching 330 million units, marking the fifth consecutive quarter of growth.

For the entire year 2024, global smartphone shipments totaled 1.22 billion units, reflecting a 7 percent year-on-year increase.

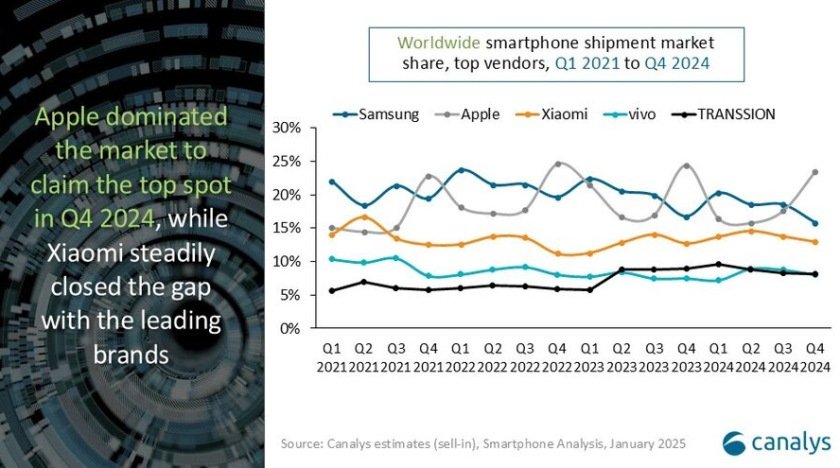

Apple secured the top position in Q4 2024 with a 23 percent market share, continuing its lead over Samsung for the second consecutive year.

Samsung ranked second with a 16 percent market share in Q4 2024 but experienced a decline in shipments.

Xiaomi retained third place with a 13 percent market share, the only brand in the top three to achieve year-on-year growth, driven by its strong presence in China and globalization efforts.

TRANSSION and vivo, ranked fourth and fifth respectively, benefited significantly from the recovery in emerging markets, particularly in the Asia-Pacific region.

Apple expanded its channel coverage and marketing efforts in India and Southeast Asia, solidifying its position in emerging markets.

Growth in 2024 was fueled by demand for value-for-money and mass-market smartphones, especially in emerging economies, while premium devices saw higher average selling prices in mature markets.

The market faces challenges like demand fluctuations, prolonged replacement cycles, geopolitical conflicts, and macroeconomic uncertainties, which could hinder growth in 2025.

To maintain competitiveness, vendors are expected to prioritize AI integration, hardware upgrades, product innovation, and regional market expansion in 2025.

“The prosperity of mass-market products was a key driver of global smartphone growth in 2024,” said Canalys Senior Analyst Toby Zhu.

Despite challenges from rising supply chain costs since early 2024, Android brands like Xiaomi, TRANSSION and vivo achieved double-digit growth, supported by extensive channel networks, competitive products, and effective inventory management.

Mid-range smartphone faced demand pressure as consumers in emerging markets favored value-for-money products, while mature markets showed a trend toward higher average selling prices.

Baburajan Kizhakedath