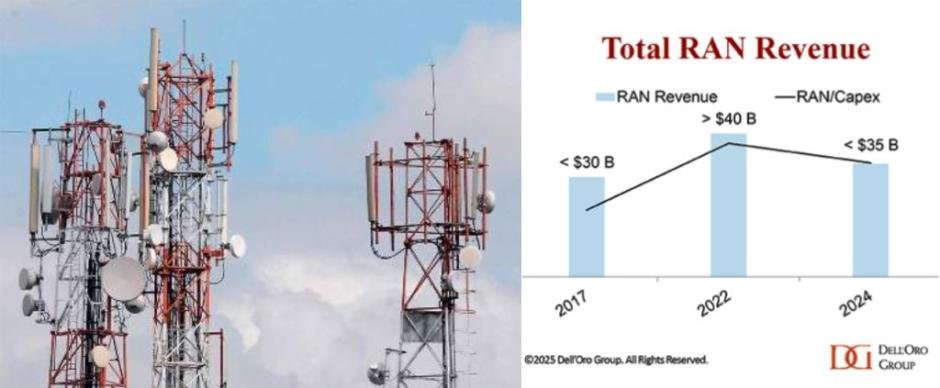

The latest report from Dell’Oro Group – authored by Stefan Pongratz – has details about the global Radio Access Network (RAN) market.

RAN market contracted by 10-20 percent year-over-year during the first three quarters of 2024, with a notable slowdown in mobile infrastructure investments.

Top RAN vendors are: Huawei, Ericsson, Nokia, ZTE and Samsung.

The other RAN vendors are:

5G coverage reached 55 percent of the global population by 2024, but slower growth in mobile data traffic has delayed the need for capacity-related investments.

RAN revenues in 2024 saw sharper declines than expected, with double-digit contractions in regions like India and China.

Private wireless RAN grew by 20-30 percent in 2024, driven by industrial adoption, with manufacturing emerging as the largest vertical.

Open RAN revenues fell by 30 percent year-over-year in 2024, but growth is anticipated in 2025, with Open RAN expected to account for 8-10 percent of total RAN revenues.

Dedicated Fixed Wireless Access (FWA) RAN investments are projected to remain below $1 billion in 2025, constrained by network capacity and ROI challenges.

Market concentration in the RAN sector remained stable, with the top five suppliers capturing 94-95 percent of revenues from Q1 to Q3 2024.

Global RAN revenues are expected to stabilize in 2025, with growth projected at 5-10 percent outside of China, reflecting regional variations in recovery.

Contract activity in private wireless slowed in 2024, but the value of deals improved due to larger, multi-site agreements and bundled offerings.

The RAN market is anticipated to remain under pressure in 2025, but sub-segments like private wireless and regions such as India and North America may show improved performance.

Baburajan Kizhakedath