Malaysia’s telecommunications market in 2025 is entering a mature yet transformative phase. With mobile penetration already exceeding 140 percent, the sector’s growth now relies on data usage, fibre expansion, and enterprise digitalization.

The four most-used operators — CelcomDigi, Maxis, U Mobile, and Telekom Malaysia (TM/Unifi) — each pursue distinct strategies in network investment, customer experience, and business diversification.

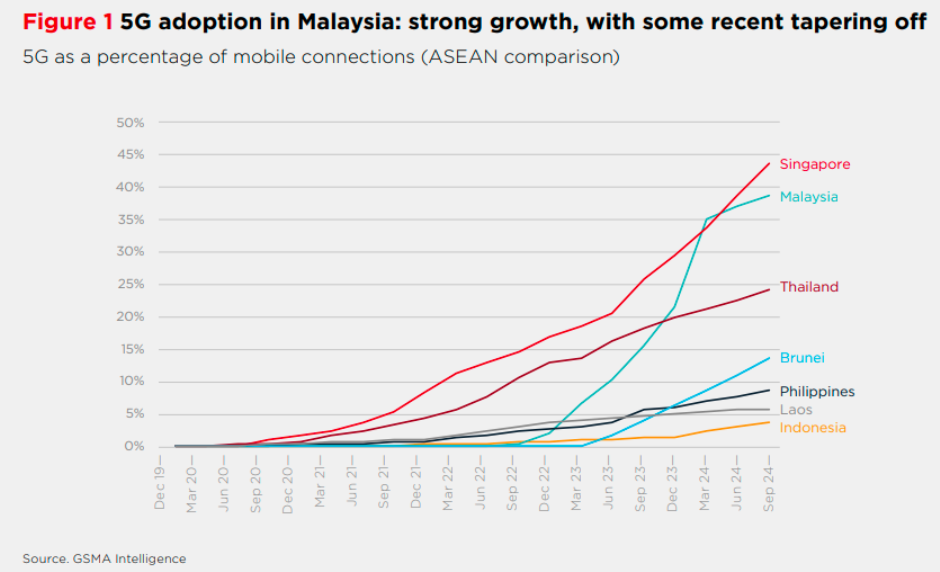

The 5G adoption in Malaysia has now reached around 40 percent of mobile connections, according to a GSMA report released in February 2025. In 2023, Malaysian operators spent around 12 percent of their revenues on Capex.

Market Context & Trends

Malaysia’s telecom market is characterised by high penetration, moderate growth, and infrastructure investment. Subscriber expansion is slowing, but data consumption and fibre adoption are accelerating. Operators are diversifying into enterprise services and digital ecosystems. 5G coverage is expanding – from roughly 83 percent in 2024 to 98 percent in 2025 – supported by the dual-network model allowing competition in infrastructure.

The market’s average revenue CAGR remains around 3–3.5 percent, and mobile connection growth is flat. However, network quality and availability have remained consistent near 98 percent, indicating high reliability.

As ARPU stagnates, the industry’s focus shifts from subscriber acquisition to value creation – through premium services, enterprise solutions, IoT, and digital transformation. Fibre broadband continues to expand, and TM’s leadership ensures nearly universal fibre access in urban areas.

CelcomDigi

CelcomDigi, Malaysia’s largest mobile operator, continues to strengthen its market leadership following the merger between Celcom and Digi. The company reported 18.81 million subscribers in Q1 2025, rising to 20.4 million by Q2 2025, driven mainly by growth in its postpaid and fibre segments. Revenue for Q2 2025 reached RM 3.18 billion, up 2.3 percent year-on-year, while profit after tax increased 5.5 percent to RM 439 million. The merger has delivered efficiency gains, with network integration 80 percent complete by early 2025.

Kesavan Sivabalan serves as CelcomDigi’s Chief Technology Officer. CelcomDigi’s capital investments focus on network modernization, rural 4G expansion, and 5G densification. The operator’s strategic push toward convergence packages that bundle mobile, fibre, and entertainment services has boosted its Home & Fibre division, which grew 45 percent year-on-year. While its postpaid and broadband businesses perform strongly, the prepaid segment continues to weaken, reflecting lower spending among users. Overall, CelcomDigi remains Malaysia’s most profitable telecom player, though it faces challenges in prepaid recovery and maximizing 5G revenue opportunities.

Maxis

Maxis, one of Malaysia’s leading telecom operators, reported 13.24 million mobile subscriptions as of Q1 2025, maintaining a stable but mature customer base. The company continues to strengthen its premium positioning in both consumer and enterprise markets, expanding its fibre broadband footprint to over 727,000 households.

Chee Sun Yap is Maxis’s Chief Network Officer. Maxis’ strategy focuses on network densification, 5G readiness, and partnerships in cloud, cybersecurity, and managed services. In Q2 2025, the operator posted revenue of RM 2.20 billion, down 0.5 percent year-on-year, while profit rose 11.8 percent to RM 398 million, supported by effective cost control and a 4.6 percent increase in EBITDA. Despite strong profitability and growth in home broadband and enterprise segments, Maxis faces revenue pressure from a saturated mobile market and declining postpaid ARPU, which fell from RM68 to RM65 due to competitive pricing. Overall, Maxis remains a stable and profitable player, though long-term growth will depend on its ability to monetize 5G and sustain enterprise expansion.

U Mobile

U Mobile, holding around 9.8 million connections and roughly 20 percent of Malaysia’s mobile market, continues to challenge larger incumbents through competitive pricing and innovative services. In 2025, it became a key contractor for Malaysia’s second 5G network, partnering with Huawei and ZTE, and its Ultra5G network now covers 54.9 percent of populated areas, including nearly all of Putrajaya.

Woon Ooi Yuen is the Chief Technology Officer of U Mobile. The operator targets high-consumption digital users with unlimited data plans, youth discounts, and device financing, while focusing on capacity growth, cost efficiency, and digital-first services. In FY2024, U Mobile’s mobile revenue grew 3.4 percent year-on-year, though it recorded a core net loss of RM 19 million due to expansion costs.

Its 5G network delivers speeds of approximately 274 Mbps, among the fastest in Malaysia, and the company aims to reach 80 percent coverage of populated areas by 2026. While smaller than its rivals, U Mobile is recognized for agility, affordability, and strong appeal to younger consumers, though heavy 5G investments mean profitability will take time to fully materialize.

Telekom Malaysia

Telekom Malaysia (TM), through its Unifi brand, remains the leader in fixed broadband and converged services, recording 3.185 million broadband subscribers in Q1 2025, a 1.6 percent increase year-on-year. Q1 revenue reached RM 2.85 billion, with capital expenditure of RM 280 million, approximately 10 percent of revenue, directed toward fibre, submarine cables, and data-centre infrastructure.

TM’s customer offerings, including UniVerse packages, bundle fibre, mobile, streaming, and smart devices, while its enterprise arm, TM One, focuses on cloud, cybersecurity, and digital platforms. Fixed broadband ARPU for Unifi was RM 127 per month in Q1 2025, down from RM 134 in Q4 2024, reflecting competitive pricing pressures. Despite a slight dip in overall revenue to RM 2.77 billion, profit rose 1.7 percent to RM 403 million, supported by strong enterprise and wholesale performance.

Mohamed Tajul Mohamed Sultan is the Chief Network Officer of Telekom Malaysia. TM continues to expand fibre backhaul to support Malaysia’s second 5G network rollout, maintaining its position as a stable, infrastructure-driven company focused on long-term growth in broadband and enterprise technology.

Conclusion In 2025, Malaysia’s telecom leaders reflect a sector moving from voice and subscriber competition to data monetization and digital convergence. CelcomDigi leverages scale and integration; Maxis builds enterprise value; U Mobile drives 5G expansion with agile strategies; and TM (Unifi) anchors fibre infrastructure and digital ecosystems.

Fasna Shabeer

Great leap for malaysia !