In the first half of 2023, India witnessed a significant surge in smart TV shipments, with 4.5 million televisions shipped, reflecting an impressive 8 percent year-over-year (YoY) increase. This data comes from the Quarterly Smart Home Devices Tracker by the International Data Corporation (IDC), a globally recognized market research firm.

Online Sales Fuel Growth

The rise can be attributed to frequent online sales by e-tailers, multiple new model launches and refreshes by vendors, and the clearance of older channel inventories in preparation for the festive season. Online channels witnessed a remarkable 25 percent YoY growth, reaching a 39 percent share in 1H23, driven primarily by online sales festivals.

Shift towards Larger Screens

While 32-inch and 43-inch screens remain mainstream, larger screen sizes, notably the 55-inch category, saw a surge in popularity, capturing a 12 percent share, up from 9 percent the previous year in 1H23. This shift resulted in a 35 percent YoY growth in the USD$400+ price segment, the report said.

Consumer Trends and Pricing Dynamics

The decline in prices of smart TVs has led consumers to opt for affordable smart TVs over retrofitting non-smart TVs with streaming sticks, which saw an 85 percent decline in shipments during 1H23. The average selling price (ASP) of smart TVs decreased by 3 percent YoY to US$380 in 1H23. Brands are focusing on low-priced models in the budget segment, causing a significant increase in the share of sub-US$200 TVs from 26 percent to 39 percent.

Key Features and Preferences

Consumer preferences are also evolving, with an emphasis on features like inbuilt storage, particularly 8GB internal storage, which witnessed a 33 percent YoY growth in 1H23. Apart from essential features, aesthetic elements such as narrow bezels or bezel-less designs in affordable price segments, HDR, better DCI-P3 coverage, Dolby certification, and improved sound output are highly sought after.

Market Outlook and Top Performers

In 2022, India saw a YoY growth of 7 percent with 9.8 million smart TVs shipped. The market is expected to remain flat or register single-digit growth in 2023, driven by a plethora of festive season offers and discounts across channels.

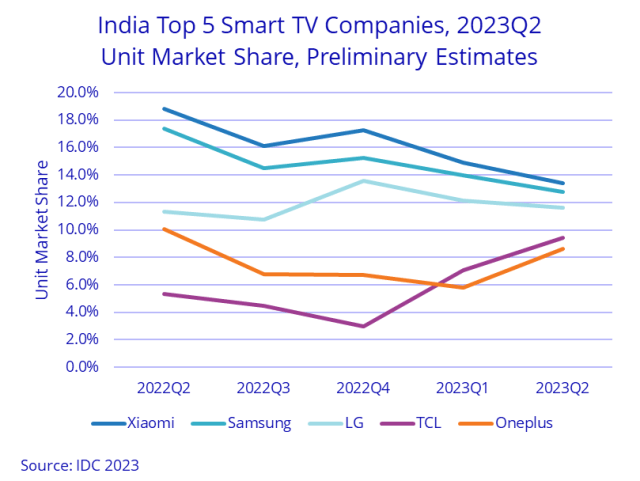

In the first quarter of 2023, Xiaomi maintained its leadership position in the TV market with a 14 percent share, focusing on the 5A and Redmi series. Samsung secured the second position with a 13 percent market share, notably excelling in high-end QLED TVs and the budget-friendly T4000 series. LG secured the third position with a 12 percent share, showcasing strength in the budget segment and gaining momentum in Nano cell and OLED TVs. TCL and OnePlus stood fourth and fifth, respectively, showcasing their strengths in the market.