Global smartphone panel shipments surged to 2.157 billion units in 2024, marking an 11.4 percent increase, driven by strong sales of new models and rising demand for refurbished devices.

Smartphone panel market in main countriesHowever, 2025 is expected to see a 3.2 percent decline in the smartphone panel as new phone demand stabilizes and the second-hand market plateaus.

BOE led the market with 613 million units in 2024, projecting a modest 2.7 percent growth in 2025.

Samsung Display ranked second, benefiting from AMOLED demand but facing a 3.5 percent dip as Apple diversifies suppliers.

HKC’s rapid expansion in a-Si LCD shipments secured its third-place ranking, with marginal growth expected amid competition from CSOT.

CSOT, buoyed by strong ties with Xiaomi, recorded an 83.2 percent YoY increase, sustaining momentum into 2025.

Tianma, despite weakening LTPS LCD demand, anticipates a 10 percent growth in AMOLED shipments.

The market remains driven by AMOLED panel demand, while LTPS LCD panels face declining interest.

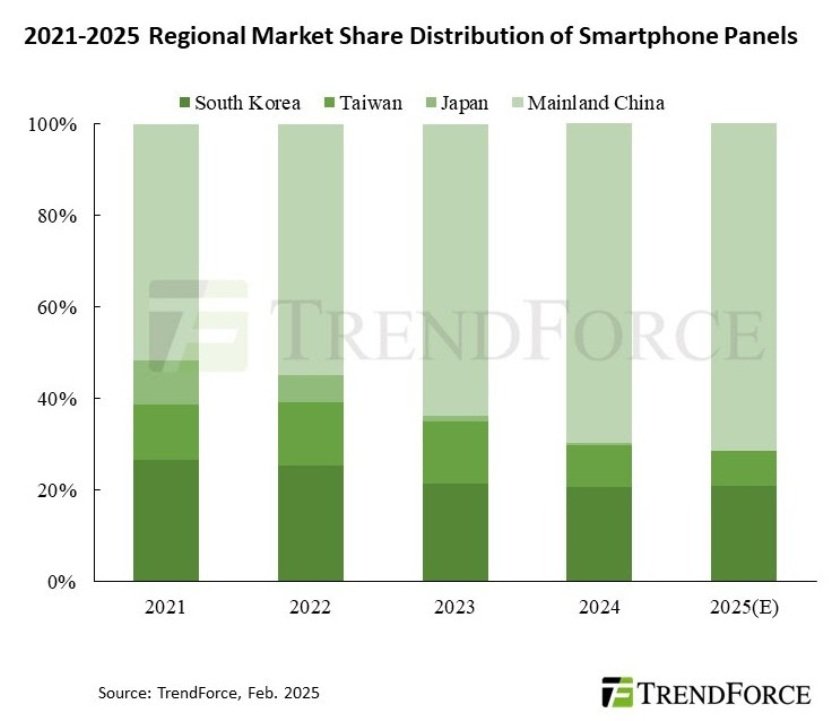

Chinese manufacturers continue aggressive expansion, projected to surpass 70 percent market share in 2025, while South Korean firms maintain leadership in high-end AMOLED technology. Japanese players further retreat, and Taiwanese a-Si LCD suppliers struggle amid intensifying competition, according to TrendForce report.

TelecomLead.com News Desk