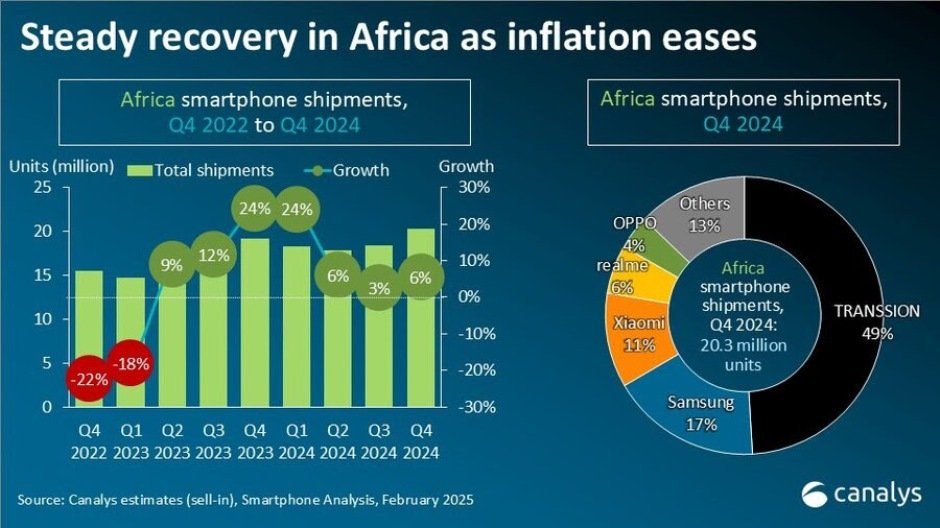

Africa’s smartphone market is set to experience slow growth in 2025, with shipments forecasted to increase by 2 percent compared to the 9 percent growth achieved in 2024, Canalys report said.

This deceleration in the smartphone market in Africa is attributed to persistent macroeconomic challenges, including inflationary pressures, currency volatility, and geopolitical uncertainties, which continue to weigh on consumer purchasing power.

While inflation is expected to decline from 18.6 percent in 2024 to 12.6 percent in 2025, affordability of smartphones remains a key concern, prompting vendors to focus on price-competitive, mass-market products.

Despite efforts to enhance accessibility through device financing and open-market channels, the market’s complexity, driven by shifting tax policies and operational challenges, limits faster growth.

The replacement cycle that fueled 2024’s recovery has also slowed, as the peak shipment year of 2021 remains unmatched. While Africa continues to offer strong long-term potential, the near-term outlook remains constrained by economic headwinds, leading to a more measured expansion in 2025.

Key markets

Nigeria’s smartphone market declined by 1 percent in Q4 2024, holding a 14 percent regional share, as rising living costs offset seasonal demand, with further strain expected in 2025 due to potential telecom tariff hikes.

Egypt sustained its growth momentum with a 12 percent increase, supported by fiscal stability, though a new import tax of up to 38.5 percent on mobile phones in 2025 highlights the country’s push for local production.

Algeria saw an 11 percent growth, benefiting from post-2020 economic reforms, while Morocco’s market dropped 34 percent as higher customs duties reduced consumer spending and delayed upgrades.

Kenya’s smartphone shipments declined by 4 percent, impacted by new tax compliance regulations that added operational burdens for vendors.

South Africa saw only a mild 1 percent drop, as improving economic conditions, lower interest rates, and stronger consumer confidence helped stabilize the market.

Main brands

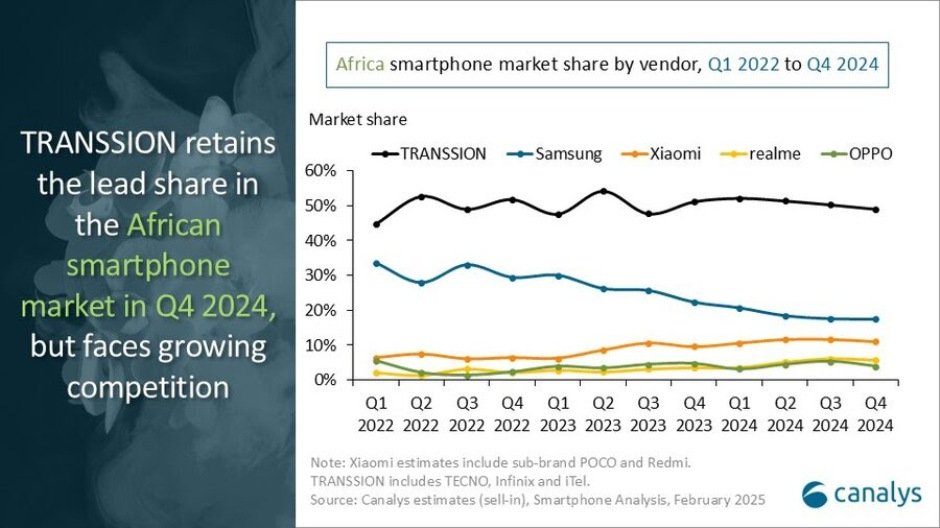

TRANSSION has strengthened its leadership in Africa’s smartphone market, growing shipments by 10 percent from 34.5 million in 2023 to 37.9 million in 2024, increasing its market share from 50 percent to 51 percent.

Xiaomi experienced the highest growth among major vendors, with a 38 percent increase, rising from 6.1 million shipments in 2023 to 8.4 million in 2024, expanding its market share from 9 percent to 11 percent.

Realme recorded significant growth, surging 89 percent from 2.0 million to 3.8 million shipments, pushing its market share from 3 percent to 5 percent.

OPPO maintained stable performance with a 10 percent growth, increasing shipments from 2.8 million to 3.1 million while retaining its 4 percent market share.

Samsung faced a sharp decline, with shipments falling by 22 percent from 17.7 million in 2023 to 13.9 million in 2024, reducing its market share from 26 percent to 19 percent.

The “Others” category saw a 39 percent rise, reaching 7.6 million shipments and increasing its market share from 8 percent to 10 percent.

Overall, Africa’s smartphone market grew by 9 percent in 2024, reaching 74.7 million shipments, with Chinese vendors gaining ground while Samsung struggled.

Baburajan Kizhakedath