The latest Omdia report prepared by Zaker Ali indicated that there will be changes in the global smartphone industry due to the Luxshare acquisition of Wingtech’s ODM businesses.

Geopolitical conflicts have influenced the ODM/IDH industry, with Wingtech divesting affected segments and shifting its focus to semiconductors, leaving Luxshare to enhance its business layout. This reshaping will intensify competition among top ODM manufacturers.

Wingtech on December 30, 2024 signed an agreement with Luxshare, transferring nine subsidiaries involved in Android product integration, including R&D, manufacturing, and business order-receiving centers. However, the transaction excludes Apple’s camera module factory.

Intense competition in the ODM sector has led to low profit margins — averaging 10 percent — with Wingtech’s ODM business contributing over 80 percent of its revenue but incurring significant losses. For 3Q24, Wingtech reported a gross profit margin of 3.8 percent in ODMs, with a net loss of CNY249 million.

The semiconductor business, by contrast, offers much higher profitability, prompting Wingtech to exit the ODM space. Additionally, inclusion on the US Entity List on December 3, 2024, further accelerated the sale, as brands avoided engaging with Wingtech on new projects.

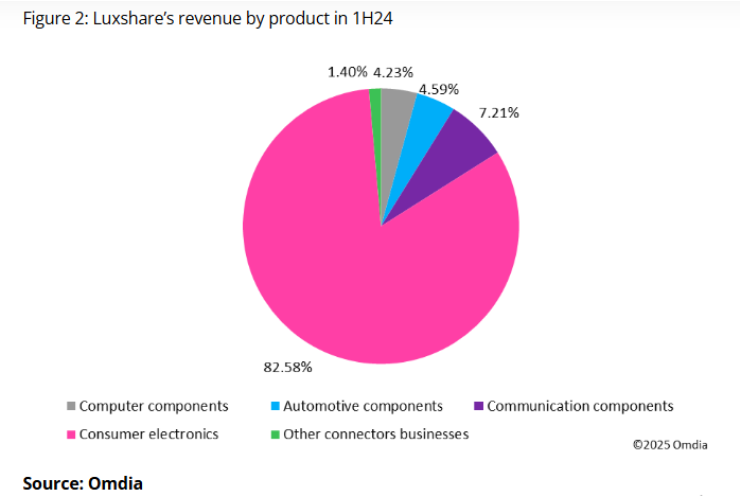

Luxshare, a company with roots in connector manufacturing, has aggressively expanded through acquisitions since its listing in 2010. Its long-term strategy focuses on consumer electronics, communications, and automotive sectors. In 1H24, 82.6 percent of Luxshare’s total revenue of CNY103.6bn came from consumer electronics, with Apple contributing 75 percent in 2023.

Acquiring Wingtech’s ODM/IDH business aligns with Luxshare’s goals to increase revenue by over CNY40bn, diversify its customer base, and reduce reliance on Apple by integrating Android-focused clients like Samsung, OPPO, and Lenovo. Additionally, Wingtech’s production sites in China, India, and Indonesia provide Luxshare with global capacity expansion opportunities.

The acquisition reshapes the ODM industry by allowing Wingtech to refocus on semiconductors while Luxshare strengthens its position in software and hardware integration. This development poses challenges to other ODM players, who may face increased competition and reduced profitability as they vie for limited resources.

However, smartphone manufacturers stand to benefit from reduced reliance on a single supplier like Wingtech, fostering a more balanced industry dynamic. Luxshare’s entry could stabilize the ODM landscape, offsetting disruptions caused by Wingtech’s inclusion on the US Entity List.

TelecomLead.com News Desk