There will be a steady rise in demand for automotive display panels, driven by the gradual recovery of the automotive market and expanding promotional activities related to smart cockpits.

There will be a continued growth in the overall supply of automotive panels throughout 2023, with estimates soaring beyond 240 million pieces annually by 2026, the latest analysis from TrendForce on the “Automotive Display Market” suggests.

With the consumer electronics demand witnessing a downturn due to ongoing inflation, panel manufacturers are strategically shifting their focus towards automotive displays. Automotive manufacturers now demand increased integration in design and functionality, offering panel makers a chance to expand their footprint downstream by providing system integration services. This marks a shift from the traditional Tier-1 automotive supplier control over various automotive parts and components.

Automotive displays, spanning rear-seat entertainment screens, passenger-side displays, central information displays, and digital clusters, are evolving into powerful communication mediums. The demand for larger screens with flexible spatial designs is prompting advancements in display technologies.

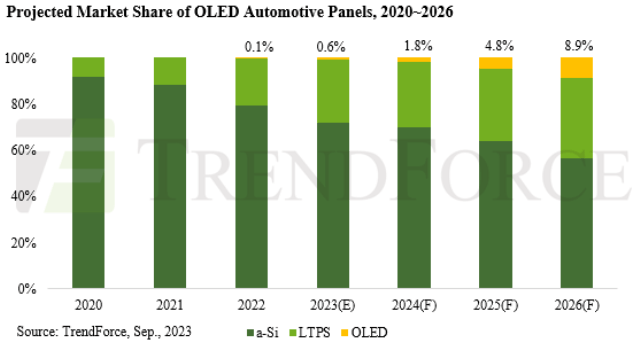

Combining LCDs with Mini LED backlight significantly enhances display brightness, making them more visible in varying external conditions. Conversely, OLED panels, with their self-emissive properties and slim build, offer superior advantages, driving their projected market share to 8.9 percent by 2026.

To address OLED’s durability concerns in automotive applications, Tandem OLED technology, stacking multiple OLED components, is employed to form a high-efficiency OLED structure. This advancement reduces power consumption and significantly improves the panel’s lifespan. Hybrid OLED panels, integrating rigid OLED glass substrates and thin-film packing technology, bring cost-efficiency and lightweight benefits to the automotive sector.

TrendForce underscores the necessity for stronger partnerships between panel makers and automobile manufacturers, given the stringent testing and qualification processes for automotive displays, lasting approximately 2-3 years.

Following Samsung Display’s success with major orders from leading automakers like Ferrari and BMW, industry frontrunner LG Display has announced an enhanced partnership with nine luxury automotive brands, focusing on incorporating high-end automotive OLED panels.

Samsung Display will mass-produce its second-generation Tandem OLED, boasting improved brightness and power consumption. In this competitive landscape, LCD, backed by Mini LED backlight technology, is racing to seize the automotive market, leveraging its cost advantages, while OLED is making rapid strides into the high-end automotive display market with ultra-large, rollable, and transparent product launches.