The US streaming market is experiencing a tightening phase, with more platforms shutting down than launching.

In 2024, 36 new services emerged, but 39 became inactive, indicating an industry shift toward consolidation. This marks a significant departure from the peak of 2020, when 68 platforms debuted, showing how rapid expansion has now given way to restructuring and strategic adjustments.

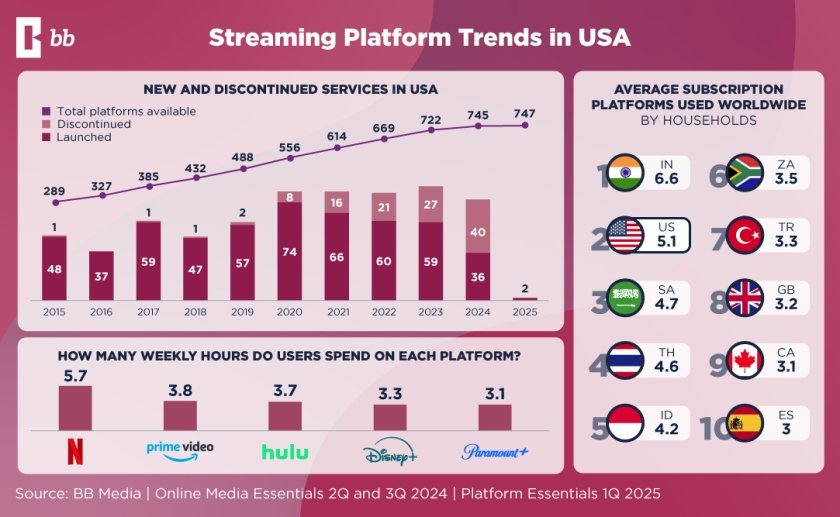

According to recent data from BB Media, the number of available platforms has grown from 289 in 2015 to 747 in 2025. However, the past few years have seen a notable number of services shutting down, with 74 platforms discontinued in 2020, 66 in 2021, 60 in 2022, and a peak of 74 closures again in 2023. Despite this, new services continue to emerge, although at a declining rate, with only two new platforms launching in 2025.

Consumer habits reveal that Netflix remains the dominant streaming service, with users spending an average of 5.7 weekly hours on the platform. Prime Video follows with 3.8 hours, Hulu at 3.7 hours, Disney+ at 3.3 hours, and Paramount+ at 3.1 hours. These figures indicate that while competition among platforms is increasing, the top players continue to command significant attention from viewers.

Globally, households in different countries vary in the number of streaming services they subscribe to. India leads the chart, with an average of 6.6 subscription services per household, followed by the United States at 5.1 and South Africa at 4.7. Other notable markets include Thailand at 4.6, Indonesia at 4.2, and South Africa at 3.5. Countries like Turkey, the United Kingdom, Canada, and Spain show lower averages, ranging from 3.3 to 3.1.

BB Media’s analysis highlights that US viewers engage with an average of five subscription streaming services. With users already managing multiple subscriptions, new entrants face a challenging environment. To survive, platforms must adopt a well-defined strategy, whether through exclusive content, strategic bundling, or differentiated monetization models. Without a clear value proposition, streaming services risk being phased out as the industry continues to evolve.

Major companies have been restructuring their offerings to optimize their content distribution and market presence. Warner Bros. Discovery and Paramount Global have led platform shutdowns, each discontinuing eight services. Paramount has primarily integrated its closures into Paramount+, demonstrating a strategic approach to content centralization. In total, 24 platforms merged into existing services in 2024, contrasting with 2023, when shutdowns often led to complete discontinuation.

Bundling strategies have gained prominence as a way to enhance user experience and attract broader audiences. The Disney+, Hulu, and Max bundle, available in both ad-supported and ad-free versions, simplifies access to diverse content and strengthens user retention. Prime Video expanded its catalog by integrating Apple TV+ content, creating additional value for its subscribers.

Additionally, Sling TV and The Roku Channel have strengthened their offerings by incorporating Max, while The Roku Channel has also added Crunchyroll to its lineup. These moves emphasize the growing trend of content unification, improving accessibility and engagement. By 2025, more streaming services are expected to adopt similar bundling approaches to stay competitive.

During the first three quarters of 2024, the market share of subscription-based streaming services remained stable at the top. Netflix maintained its lead, followed by Prime Video in second place and Hulu in third. As subscription costs continue to rise, account sharing has persisted, with 19 percent of users engaging in sharing on subscription-based platforms and 18 percent on TV Everywhere platforms.

Streaming services have responded with new alternatives to balance accessibility with profitability. Disney+ and Hulu introduced “extra member” plans, and Max is set to launch a similar feature in 2025. Netflix, in January 2025, unveiled an ad-free “extra member” plan, providing an additional option for shared access while maintaining revenue growth.

Ad-supported streaming plans gained significant traction in 2024. While food brands dominated advertising spots, streaming platforms themselves were among the most recurrent advertisers, showcasing the evolving landscape where advertising plays an increasingly central role in revenue models. Leading streaming services, including Netflix (14.82 percent), Prime Video (12.02 percent), Hulu (9.63 percent), Disney+ (9.11 percent), Peacock (7.11 percent), Paramount+ (7.14 percent), Max (6.13 percent), and Apple TV+ (4.7 percent), expanded their ad-supported tiers to attract cost-conscious viewers.

Subscription price hikes have also been notable. Max increased its monthly plan to $16.99 (a 6 percent increase) and its Ultimate plan to $20.99 (a 5 percent increase) in June 2024. Prime Video introduced an ad-supported tier, positioning itself to compete more directly with Discovery+ and distancing itself from Amazon Freevee, its free ad-supported platform. Ad volume fluctuated across platforms.

Freevee increased its ad time by 1.2 minutes per hour, despite being set for discontinuation in 2025. Max raised its ad time to 3 minutes per hour, surpassing Discovery+, which saw a decline. Paramount+ reduced its ad time by 4 minutes per hour.

Meanwhile, Netflix maintained an ad duration of approximately 45 seconds to 1 minute per hour, with projections to increase to 1 to 1.5 minutes by 2025. Ad-supported streaming continues to expand, with 66 percent of users now expressing tolerance for ads, an increase of 2 percent compared to the previous year.

Looking ahead to 2025, streaming services are likely to continue refining their ad-supported models, carefully balancing ad volume with user experience. Further consolidation and bundling strategies will shape the industry as platforms strive to maintain their competitive edge while adapting to evolving viewer preferences and market dynamics.

Baburajan Kizhakedath