Streaming giants are leveraging sports to drive revenue and expand their customer base by securing exclusive broadcasting rights, adopting varied monetization models, and enhancing viewer engagement through technological innovations.

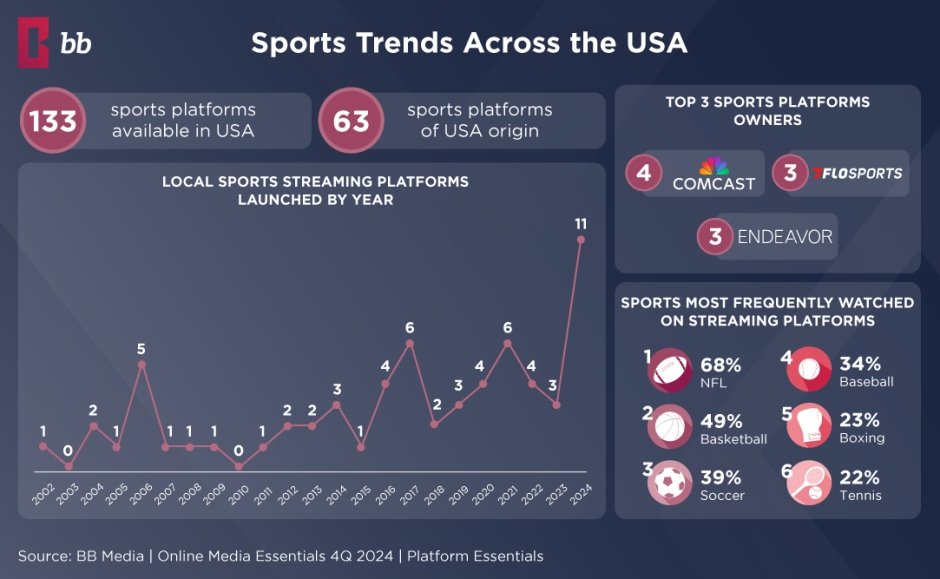

The specialized sports streaming industry in the U.S. reflects this trend, with 133 dedicated sports platforms catering to fans across a spectrum of leagues and events. These services surpass the popularity of streaming platforms focused on reality TV, science, or even news, demonstrating the immense demand for live and on-demand sports content.

The business models within the sector are diverse, with 11 percent of platforms offering ad-supported free access, such as FIFA+, while subscription-based services like NFL+ account for 24 percent. Another 25 percent of sports streaming platforms, such as Red Bull TV, operate entirely for free, relying on sponsorships and advertising. This range of monetization strategies highlights the balance streaming platforms seek between accessibility, revenue generation, and audience engagement in an increasingly competitive digital landscape.

The increasing dominance of sports streaming is also evident in online sports consumption trends. In the fourth quarter of 2024, NFL football was the most watched sport among digital viewers, with 68 percent of online sports fans tuning in. Basketball followed with 49 percent, while soccer (39 percent) and baseball (34 percent) maintained strong followings.

Emerging categories, such as e-sports (13 percent) and niche sports like bare-knuckle boxing (6 percent), indicate that streaming platforms are catering to an increasingly fragmented and diverse audience. The shifting preferences of viewers require streaming services to continuously adapt their offerings, ensuring they provide relevant content across both mainstream and specialized sports categories.

The Super Bowl, as one of the most-watched sporting events in the world, illustrates how streaming giants are reshaping sports broadcasting. While traditional broadcast networks such as CBS, NBC, and Fox have long held exclusive rights, digital platforms have begun playing a bigger role in Super Bowl distribution.

In 2025, Fox secured the broadcast rights for Super Bowl LIX and streamed it for free on Tubi, an ad-supported platform. This move signified a larger trend of making high-profile sports events more accessible via digital platforms, according to BB Media.

In addition to Tubi, other streaming services such as DirecTV, Sling TV, and FuboTV offered Super Bowl access, though they required subscriptions. The presence of the Super Bowl across multiple streaming platforms demonstrates how streaming services are integrating live sports into their content libraries to attract and retain subscribers while also capitalizing on advertising revenue.

Beyond distribution, streaming services are enhancing viewer engagement with innovative features such as augmented reality (AR) overlays, interactive stats, and multi-angle viewing options. Tubi, for example, restructured its mobile platform to provide an exclusive Super Bowl experience, allowing users to explore pre-game content, purchase team merchandise, and access behind-the-scenes footage.

While mobile streaming remains secondary to large-screen viewing, with 46 percent of users choosing mobile as their primary device, this strategy reflects a push toward personalized and interactive experiences that can differentiate platforms from traditional broadcast television.

The future of sports streaming is set to be defined by innovation, accessibility, and audience-driven content strategies. As sports continue to dominate the niche streaming market, platforms must evolve to meet the growing demands of a fragmented and dynamic audience.

The increasing presence of the Super Bowl and other major sporting events on digital platforms underscores the shift toward ad-supported free streaming models, which are gaining traction among viewers. As streaming services refine their approach to monetization and engagement, it is evident that sports will remain a key driver in shaping the future of digital entertainment.

Baburajan Kizhakedath