China is the number one telecom market in terms of mobile phone subscribers including 5G subs in the world. This article illustrates growth and investment pattern of leading telecom operators such as China Mobile, China Telecom and China Unicom — in China.

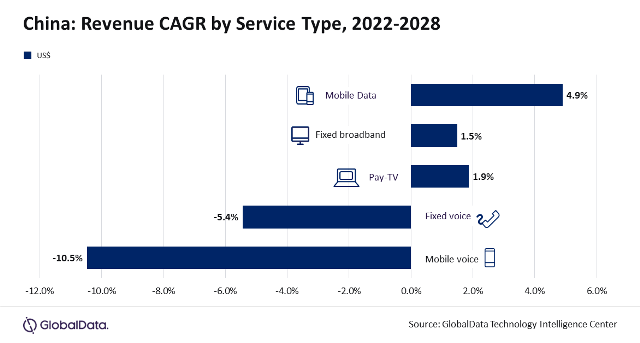

The telecommunications and pay-TV services sector in China is projected to see moderate growth over the next few years.

According to GlobalData, total revenue in this sector is expected to rise from $468.8 billion in 2023 to $502.9 billion in 2028, achieving a compound annual growth rate (CAGR) of 1.4 percent. This growth will be primarily driven by the increasing adoption of 5G services and a steady rise in fiber broadband subscriptions, as detailed in GlobalData’s China Telecom Operators Country Intelligence Report.

Key Trends and Projections:

Mobile Voice Service Revenue:

Expected to decline due to the bundling of free voice minutes with mobile service plans.

Increased use of over-the-top (OTT) communication apps for voice calling.

Decline in mobile voice average revenue per user (ARPU).

Mobile Data Service Revenue:

Predicted to increase, driven by a rise in mobile internet subscriptions.

Growing adoption of higher ARPU yielding 5G services.

Investment in 5G Infrastructure:

5G Market Share:

By 2028, 5G services are projected to account for more than 87 percent of mobile subscriptions in China.

Growth will be driven by support from the Ministry of Industry and Information Technology (MIIT) for 5G infrastructure development and network expansion.

Announced plans to expand 5G-A to over 300 cities in 2024, aiming to establish the world’s largest 5G commercial network.

Plans to reduce capital expenditure (Capex) by 4 percent to CNY173 billion ($23.9 billion) in 2024.

Investment in 5G networks to drop by 21.6 percent to CNY69 billion.

Forecasts Capex for 2024 at RMB96 billion, down from RMB98.8 billion in 2023.

Expects Capex to be around RMB65 billion in 2024 as its 5G network coverage nears completion.

Fixed and Broadband Services:

Fixed Voice Revenue:

Predicted to decline as customers switch to mobile and internet-based voice services.

Fixed Broadband Service Revenue:

Expected to grow at a CAGR of 1.5 percent, supported by increased fiber broadband subscriptions.

China plans to extend optical fiber network coverage with 1Gbps speed to all townships and counties by 2025.

Pay-TV Services:

Forecast to see steady revenue and subscription growth.

Growth driven by IPTV subscriptions and a slight increase in total Pay-TV ARPU.

Market Leaders:

China Mobile:

Maintained leadership in both mobile and fixed broadband service segments by subscriptions in 2023.

5G network investments are expected to sustain its leadership in the mobile services segment.

Dominance in the fixed broadband segment is due to its strong presence in fiber broadband and efforts to upgrade to gigabit broadband networks.

China’s strategic focus on expanding and modernizing its telecom infrastructure, especially in 5G and fiber broadband, is set to drive moderate growth in the sector over the next five years.

Baburajan Kizhakedath