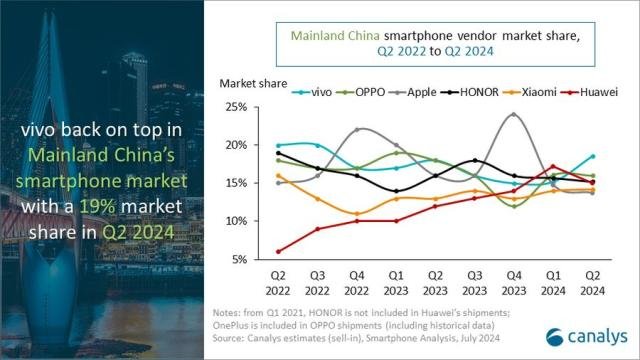

The latest Canalys research has revealed the share of leading smartphone vendors in China — such as Vivo, Oppo, Honor, Huawei, Xiaomi, and Apple — during the second quarter of 2024.

Vivo has regained the number one spot in the China smartphone market by shipping 13.1 million units, capturing a 19 percent market share. Vivo’s 15 percent growth over the previous year was driven by strong performance in offline channels and robust online sales during the 618 e-commerce festival.

Oppo is the second largest brand in the China smartphone market with 16 percent share, shipping 11.3 million units. OPPO secured second place, buoyed by the successful launch of its new Reno 12 series.

Honor is third largest phone maker in the China smartphone market with 15 percent share, shipping 10.7 million units. Honor achieved 4 percent year-on-year increase. Honor’s latest Magic V3, leveraging GenAI, has significantly enhanced the user experience of foldable devices.

Huawei is the fifth leading smartphone maker in the China smartphone market with 15 percent share, shipping 10.6 million units. Huawei’s growth has decelerated slightly.

Xiaomi is the sixth largest vendor in the China smartphone market with 14 percent share, shipping 10 million units. Xiaomi’s growth was driven in part by the significant marketing buzz surrounding its first electric car, the SU7, and solid sales of its K70 and flagship 14 series.

Apple ranked sixth, capturing a 14 percent market share, a 2 percent decrease from Q2 2023. Apple is facing a bottleneck in mainland China. The vendor’s current channel strategy maintains a healthy inventory level, aims to stabilize retail prices, and protects channel partners’ margins.

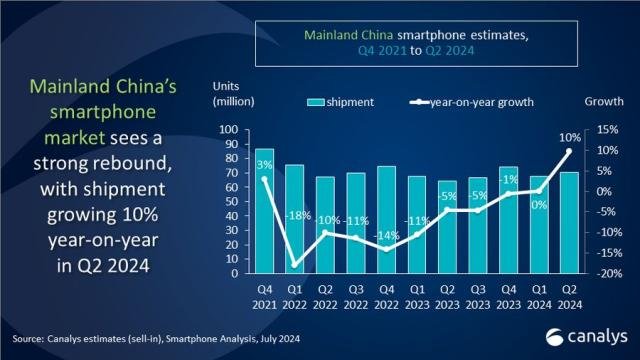

China’s smartphone market experienced 10 percent growth in Q2 2024, with shipments surpassing 70 million units, according to the latest Canalys research.

“The Chinese market is aligning with global recovery speeds,” commented Canalys Research Manager Amber Liu. This alignment has been largely driven by the supply side, leveraging nationwide sales events such as 618.

Smartphone vendors, in collaboration with e-commerce platforms, initiated the promotional cycle with significant discounts and promotions much earlier this year. Vendors with comprehensive smart device portfolios, such as Huawei and Xiaomi, are enhancing their offline channel advantages by expanding channel partners and promoting the up-sell and cross-sell of products within their smart device ecosystems.

Domestic Vendors Dominate Top Five Positions

For the first time, domestic vendors dominate all the top five positions in the market. Chinese vendors’ strategies for high-end products and deep collaboration with local supply chains are starting to pay off in hardware and software features.

In the long term, the Chinese high-end market presents significant opportunities. Local brands such as Huawei, Honor, Oppo, and Vivo are incorporating GenAI technologies into their products and services. Additionally, the localization of Apple’s intelligence services in mainland China will be crucial over the next 12 months.

Future Market Trends

“The growth in the second quarter signals a gradual market normalization, but we still expect a modest single-digit recovery for the year,” said Canalys Senior Analyst Toby Zhu. Three key trends are anticipated to impact the market landscape in the second half of 2024:

Huawei’s Launch of HarmonyOS Next: The market will closely watch Huawei’s upcoming launch of HarmonyOS Next, as the vendor aims to position it as a third major mobile OS alongside Android and iOS.

Investment in AI Infrastructure: Local players are investing in AI infrastructure, developing in-house models, and creating AI applications as key competitive advantages to disrupt the high-end segment.

Overseas Expansion: Intense domestic competition is driving overseas expansion, with Chinese brands expected to achieve new milestones in international markets throughout the rest of 2024.

Baburajan Kizhakedath