GSMA has revealed its report on monetisation strategies for telecom operators from their 5G mobile broadband business.

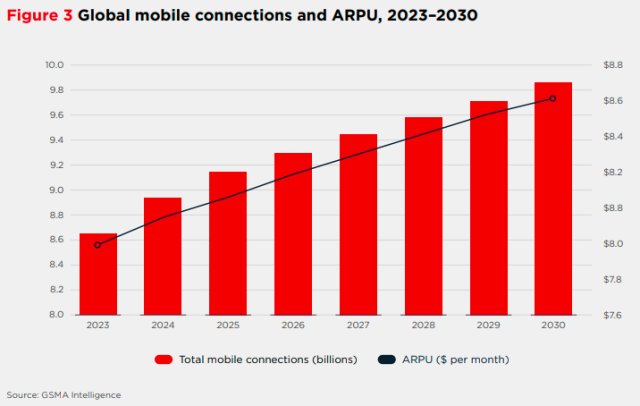

5G monetisation is increasingly important for telecom operators, which have invested significantly in 5G mobile networks and spectrum. Despite investment, 5G subscribers accounted for nearly 20 percent of total mobile connections in 2023. US-based telecoms have invested $30 billion towards Capex in 2023 alone, according to CTIA.

Data traffic

Global mobile data traffic rose from an average monthly usage level per connection of 10.2 GB in 2022 to 12.8 GB in 2023. The six-fold increase in data traffic projected between now and 2030 has significant implications for operators. This means, telecoms need to make more investment in mobile network to manage the unprecedented growth in data traffic.

Telecom operators in Finland record monthly data use per connection of just above 50 GB. The US records around 39 GB per month. India, an emerging market, recorded monthly mobile data use of 20.3 GB per connection in Q1 2024. China and Indonesia have recorded mobile data use of 18.6 GB and 13.7 GB, respectively.

5G ARPU

The growth in mobile ARPU for several 5G mobile operators is encouraging. In 2023, 5G market leaders such as China and the US posted an ARPU growth of 7–8 percent per user – indicating the potential of 5G to make a significant impact on operators’ profit.

Markets such as France and Japan are seeing slow growth in APRU at 3 percent because they started 5G deployments later.

The fact that 5G smartphone user are willing to spend 9 percent more on 5G plans than current 4G plans is also encouraging for telecoms.

Design of mobile tariffs

The effective design of mobile tariffs is a key driver of commercial success in mobile communications, GSMA said. Bundling mobile connectivity with other services such as fixed broadband is one approach used.

Another is consumer segmentation, such as prepaid versus contract, which allows operators to target and address a range of customer needs in a market. The arrival of 5G presents the opportunity for monetisation levers across new domains.

Speed-based pricing

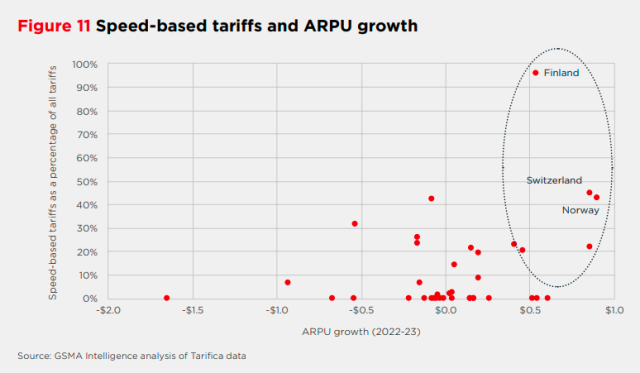

Options available to operators in the consumer segment include higher performance, differentiated offerings, speed-based pricing and the bundling of advanced services such as cloud gaming and XR/VR. Speed-based pricing for mobile has the potential to improve ARPU and, by extension, mobile operator revenue growth.

Operators can offer speed-based tariffs to enable better targeting of specific customer needs. Telecoms will benefit from speed-based tariffs as they can improve the management of data traffic. Speed-based tariffs can help smooth the peaks in network traffic.

Speed-based tariffs provide opportunities to better monetise the higher throughputs available with 5G-Advanced networks, offering better alignment of data traffic with ARPU growth for mobile operators.

But most of the telecoms have not yet started speed-based tariffs. In Finland, 95 percent of tariffs are speed-based. In Switzerland, Spain, Norway and Thailand, the range of speed-based offerings for consumers is extensive. T-Mobile Netherlands and Sunrise Switzerland introduced speed-based tariffs in 2023.

Some countries such as South Korea, Qatar, Philippines, Chile, Greece, India and Indonesia are offering are offering volume-based tariffs.

Markets with a greater number of speed-based tariffs have experienced faster ARPU growth. The three markets with the highest share of speed-based tariffs (Finland, Switzerland and Norway) are among the top performers in terms of ARPU growth.

Network APIs

Operators can use network APIs to monetise higher speeds or network performance. Network APIs expose network functionality (such as network quality) to third-party developers. This in turn enables them to better and more easily build new applications and services.

Quality-on-demand APIs enable application developers to modify the network configuration of users of the application to provide specific download or other network quality features. Key use cases include gaming and streaming. Online gamers and viewers of real-time streaming media require a network with a high level of performance.

China Unicom, China Mobile and AIS Thailand have adopted segmentation models, specifically targeting social media influencers, gamers and travellers. For instance, AIS Thailand’ Living Network initiative allows mobile gamers to boost their 5G mobile broadband on demand by adding a gaming mode that guarantees high network performance.

Capex

GSMA Intelligence report says telecoms need to allocate Capex for the acquisition of new spectrum and deployment of 5G base stations in the radio access network (RAN), to increase coverage and capacity at the network access layer.

Investment in RAN upgrades alone will not reduce the capacity issue for operators. Telecom operators need to spend in upgrades for the backhaul and underlying transport layers of the network. They need to spend on the core network as operators migrate from 4G and other legacy networks to 5G standalone (5G SA) and 5G-Advanced.

Baburajan Kizhakedath