ABI Research has released a whitepaper outlining steps for telecom operators to take for becoming technology companies (techcos) in response to declining revenues and surging consumer demands for digital services.

Dimitris Mavrakis, Senior Director at ABI Research, emphasized the urgent need for a paradigm shift in the traditional telco business model. “Mobile operators must increasingly deploy automated solutions to streamline operations, optimize resource allocation, and drive cost efficiencies,” Mavrakis stated. “Simultaneously, the focus is on expanding consumer services and catering to enterprises requiring 5G connectivity for their digital transformation.”

Dimitris Mavrakis, Senior Director at ABI Research, emphasized the urgent need for a paradigm shift in the traditional telco business model. “Mobile operators must increasingly deploy automated solutions to streamline operations, optimize resource allocation, and drive cost efficiencies,” Mavrakis stated. “Simultaneously, the focus is on expanding consumer services and catering to enterprises requiring 5G connectivity for their digital transformation.”

ABI Research’s whitepaper outlined four crucial steps for telecoms to metamorphose into techcos:

#1. Embrace 5G-as-a-Service Operators are urged to adopt 5G-as-a-Service models targeting specific business use cases such as low-latency live streaming and real-time security verification. Notable examples include Telefónica’s efforts to provide developers universal access to 5G networks and Singtel’s introduction of 5G Security-as-a-Slice feature.

#2. Invest in Vertical Ecosystems Leveraging existing customer bases, telecom companies should diversify by offering additional services beyond connectivity. Examples include Etisalat’s digital ecosystem offering grocery delivery, entertainment, banking, and healthcare solutions, and Jio’s launch of the e-commerce platform JioMart.

#3. Digitalize Network Management To support diverse enterprise services, operators need to transform their networks with technologies like cloud computing, AI/ML-based optimization, big data analytics, and cybersecurity. Automation is deemed crucial for this transition, as seen in recent telco-tech supplier partnerships.

#4. Become Active Contributors to Cellular Innovation Telcos are urged to play an active role in standardizing new deployment options in User Equipment (UE), spectrums, and traffic management. Engaging in the 3GPP 5G standardization process is vital for identifying groundbreaking features tailored to enterprise needs.

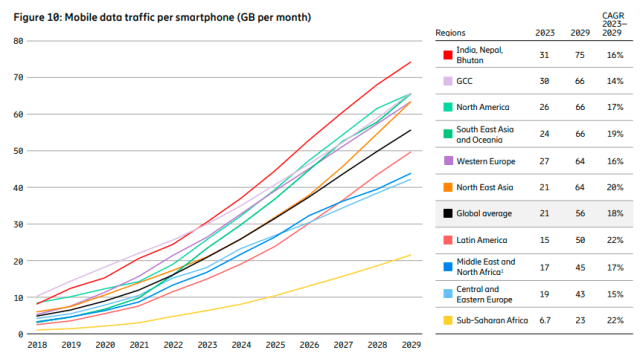

Ericsson Mobility Report in November 2023 said total mobile data traffic is estimated to grow three-fold between 2023 and 2029 – attributed to factors such as improved device capabilities, an increase in data intensive content and continued improvements in the performance of deployed networks.

Ericsson Mobility Report in November 2023 said total mobile data traffic is estimated to grow three-fold between 2023 and 2029 – attributed to factors such as improved device capabilities, an increase in data intensive content and continued improvements in the performance of deployed networks.

In the six years between the end of 2023 and 2029, global 5G subscriptions are forecast to increase by more than 330 percent – from 1.6 billion to 5.3 billion. 5G coverage is forecast to be available to more than 45 percent of the global population by the end of 2023 and 85 percent by the end of 2029, Ericsson Mobility Report said.

ABI Research highlighted the challenge of declining Average Revenue Per User (ARPU) despite the exponential growth of 5G subscriptions. With consumers prioritizing pricing, operators’ efforts to lower prices or bundle data struggle to drive significant revenue growth. Economic uncertainty further compounds this challenge, making it evident that a radical reinvention of the traditional telco model is imperative.

In navigating this transformation, telecom operators face the need for a thorough reassessment of technological capabilities, corporate culture, and target audience to effectively implement strategies supporting this evolution. As the industry evolves rapidly, this shift to techcos could be the linchpin for operators to thrive in the digital era.

Some telecoms like T-Mobile, China Telecom, NTT DOCOMO, Telefonica, and others offer business-specific services, including cybersecurity, data analytics, and the Internet of Things (IoT).

Mobile operators in the northern Asia-Pacific region have been the most successful at transforming into techcos, with China Mobile and NTT DOCOMO pioneering this space. Generating robust revenue streams from new 5G services, these two firms clearly highlight the business case for telcos to position themselves as inherently technology enablers. For example, China Mobile’s digital transformation offerings — China Mobile Cloud Drive and home value-added services — helped the company grow its service revenue by 8.2 percent in 2022, which far outpaces the global average of 3 percent.

In that same time span, NTT DOCOMO saw a 5 percent revenue increase for its enterprise offerings that are tailored for business outcomes. There is considerable effort on the part of American and European operators, as they, too, have contributed significantly to 3GPP Working Groups.

Baburajan Kizhakedath