The semiconductor industry is poised for a temporary contraction in 2023, as per the forecast by SEMI, a global industry association serving the electronics manufacturing and design supply chain.

* Total equipment includes new wafer fab, test, and assembly and packaging. Total equipment excludes wafer manufacturing equipment. Totals may not add due to rounding.

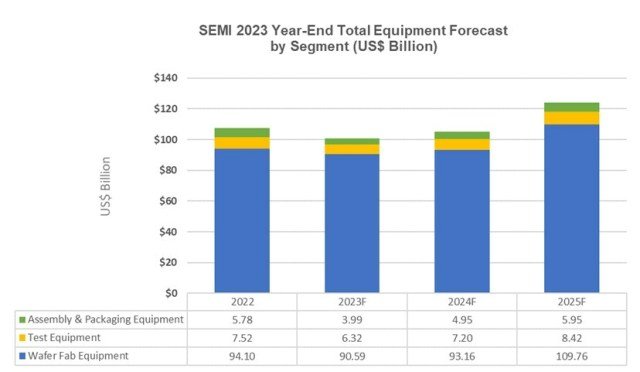

The prediction from SEMI indicates that there will be a significant decrease in sales of semiconductor manufacturing equipment by original equipment manufacturers, foreseeing a 6.1 percent dip in 2023 from the record $107.4 billion posted in 2022.

This announcement was made during the Year-End Total Semiconductor Equipment Forecast – OEM Perspective at SEMICON Japan 2023.

Ajit Manocha, President and CEO of SEMI, attributed this anticipated decline to the cyclical nature of the semiconductor market, highlighting the expectation of a transition year in 2024 followed by a robust rebound in 2025. The rebound is expected to be fueled by capacity expansion, new fab projects, and a high demand for advanced technologies across various segments within the industry.

The breakdown of the forecast reveals that while the wafer fab equipment segment is expected to slip by 3.7 percent to $90.6 billion in 2023, it marks a significant improvement from earlier projections due to strong equipment spending in China. Despite this, the segment is anticipated to grow modestly by 3 percent in 2024, reaching nearly $110 billion in 2025 on the back of new fab projects and technology migrations.

![]()

Conversely, the back-end equipment segment is witnessing a decline due to challenging macroeconomic conditions and softer semiconductor demand. Sales for semiconductor test equipment are projected to contract by 15.9 percent to $6.3 billion in 2023, while assembly and packaging equipment sales are expected to drop by 31 percent to $4.0 billion in the same year. However, both segments are forecasted to rebound in 2024 and continue their growth trajectory in 2025.

The report also highlights the segment-wise breakdown, with foundry and logic applications expected to drive a 6 percent increase in equipment sales to $56.3 billion in 2023. Memory-related capital expenditures, particularly NAND equipment sales, are predicted to drop significantly in 2023 but are forecasted to surge in 2024 and 2025. DRAM equipment sales, on the other hand, are expected to remain stable in the near term before seeing substantial growth in 2025.

Regionally, China, Taiwan, and Korea are projected to maintain their positions as the top three destinations for equipment spending through 2025. China, in particular, is expected to surpass a record $30 billion in equipment shipments in 2023, solidifying its lead in the industry.

While most regions are expected to witness a temporary fall in equipment spending in 2023, followed by growth in subsequent years, China is anticipated to experience a mild contraction in 2024 after substantial investments in the previous year.

The semiconductor industry’s fluctuations in 2023 set the stage for a transformative period, with resilience and growth projected in the coming years, driven by technological advancements and expanding market demands.