DIGI’s entry into Portugal’s telecom market in November 2024 has disrupted the industry, forcing top operators to respond aggressively. DIGI’s low-cost mobile and convergent bundles – starting at €4 for 50 GB – have reset pricing benchmarks and triggered defensive tactics from rivals, including churn management efforts and the use of budget flanker brands priced between €8 and €15.

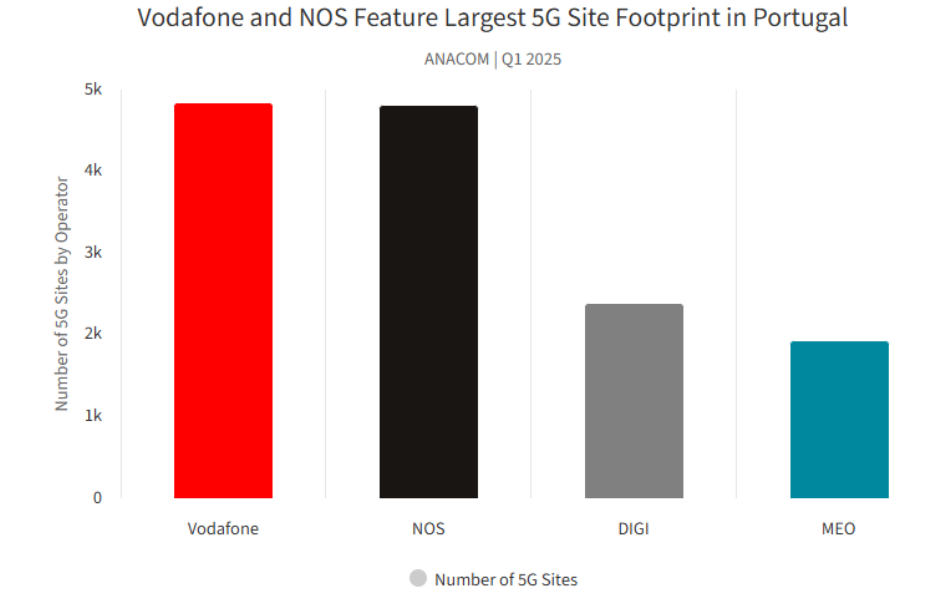

By Q1 2025, DIGI had captured over 3 percent of mobile internet subscriptions and deployed 2,385 5G sites, focusing its capital expenditure on rapid network rollout and dense mid-band 5G coverage, compensating for the lack of national roaming and low-band spectrum.

In contrast, operators such as MEO, NOS, and Vodafone are at advanced stages of the 5G investment cycle. MEO is channeling Capex into a multi-year RAN modernization and equipment swap with Nokia to improve efficiency and performance, Ookla report said.

NOS and Vodafone, which share infrastructure under a MORAN agreement, have prioritized rural coverage and early 5G expansion. NOS has also differentiated through early 5G Standalone (SA) deployment using Nokia’s 5G core, marketed as “5G+,” offering enhanced speed and latency — a move MEO has since emulated.

MEO’s 5G strategy in Portugal combines efficient spectrum utilization with a balanced approach to capacity and coverage, positioning it as the national leader in network access and task success. Despite a smaller 5G site footprint, MEO expanded its network by 30 percent in the past year — the fastest growth among operators — focusing on maximizing performance from its 3.5 GHz (n78) mid-band and 700 MHz (n28) low-band spectrum.

MEO operates a wide 90 MHz contiguous 3.5 GHz channel, the most extensively deployed in the country, used in over two-thirds of national route samples and up to 88 percent in Lisbon. Outside major cities, the 700 MHz band acts as a coverage layer, accounting for roughly one-third of 5G samples nationally and ensuring stable service in less dense areas.

While MEO’s narrower 5 MHz low-band channel and limited carrier aggregation mean users spend less time on 5G compared to Vodafone and NOS, the operator excels in real-world performance. RootMetrics testing for 1H 2025 shows MEO leading in access success, task completion, and call setup speed (about 1.8 seconds), with top reliability nationwide and in Madeira. Even in Lisbon and Porto, MEO performed on par with Vodafone. The results underscore that higher 5G availability alone does not guarantee better user experience — MEO’s efficient spectrum deployment and balanced network design deliver superior consistency.

By Q4 2024, Vodafone had established one of Portugal’s most extensive 5G footprints, matching NOS in the share of time users spent on 5G. Testing showed 84 percent of Vodafone samples on 5G, far ahead of MEO (66 percent) and DIGI (27 percent). The operator’s network strategy mirrors NOS’s, emphasizing intensive use of carrier aggregation, although Vodafone has yet to launch a 5G Standalone (SA) network.

Vodafone combines its 700 MHz (10 MHz) and 3.5 GHz (90 MHz) spectrum through dual-carrier aggregation (2CC), creating a robust 100 MHz capacity layer. Nationally, 2CC appeared in over 20 percent of 5G samples — and in nearly two-thirds of samples in Lisbon and Porto — boosting both peak and median speeds. On the islands, Vodafone relies more evenly on 700 MHz and 3.5 GHz bands due to sparser coverage grids.

The operator’s advanced spectrum management and resource scheduling ensure stable performance, even at the cell edge or under heavy load, giving Vodafone the strongest 5th-percentile results nationally. In RootMetrics testing for 1H 2025, Vodafone shared the top position in overall reliability with MEO and led in the Azores, where it recorded the lowest dropped-call rate. In Lisbon and Porto, Vodafone achieved the best access latency and top video reliability, highlighting that efficient network optimization and CDN placement can rival, or even outperform, Standalone 5G deployments.

NOS’s adoption of 5G Standalone (SA) technology and extensive carrier aggregation have positioned it as Portugal’s most advanced mobile network, leading in responsiveness and user experience. By Q4 2024, NOS operated nearly 4,800 5G sites — the country’s largest grid — placing it alongside Vodafone for 5G time share at 84 percent.

The operator leverages a 100 MHz mid-band (3.5 GHz) allocation paired with 10 MHz of 700 MHz low-band spectrum and applies aggressive dual-carrier aggregation (2CC) across both NSA and SA modes. In Lisbon, 2CC appeared in 59 percent of test samples, enabling up to 110 MHz of aggregated bandwidth — the highest capacity configuration among Portuguese operators. Nationally, 2CC appeared in 20 percent of samples, though NOS used the 3.5 GHz band in a smaller share of tests (32 percent) than Vodafone (37 percent) and MEO (68 percent).

NOS’s early 5G SA rollout is delivering tangible performance benefits. In Lisbon, 94 percent of samples were on 5G and 56 percent on SA, yielding the fastest video start times at around 530 ms, with similar leadership in Porto at 540 ms. Even outside urban centers, where SA usage drops to 9 percent, NOS maintained leading responsiveness due to efficient core routing, optimized CDN placement, and a fast, low-latency scheduler — confirming that its SA-first architecture is translating into a superior, more consistent user experience.

DIGI’s 5G rollout in Portugal reflects the challenges of a greenfield operator without access to low-band spectrum. The absence of 700 MHz holdings has forced DIGI to rely heavily on mid-band frequencies, resulting in limited rural coverage, weaker indoor performance, and frequent 4G fallback. Testing showed that only 27 percent of national route samples were on DIGI’s 5G network — just 16 percent in the Azores, 21 percent in Madeira, and 48 percent in Lisbon — underscoring its urban-centric deployment.

DIGI’s mid-band setup is constrained by non-contiguous 3.5 GHz spectrum: two separate 40 MHz blocks divided by 40 MHz held by Dense Air. While carrier aggregation can mitigate some efficiency losses, split allocations reduce spectral efficiency and device support compared to the single wide carriers used by rivals. In Lisbon, 98 percent of DIGI’s 5G samples used 20 MHz of 2.6 GHz (n41) spectrum, while nationally, traffic was split between 3.5 GHz (n78) and 2.6 GHz (n38/n41) bands — each narrower than competitors’ deployments.

Though DIGI has expanded more rapidly in Porto (with 37 percent of time on 3.5 GHz spectrum), its network still lags peers in reliability, access success, and task completion. RootMetrics testing for 1H 2025 found DIGI joint-best with MEO in call setup time but trailing in call drop rates, reflecting ongoing challenges with sparse 5G coverage and handover stability during its early buildout phase.

Baburajan Kizhakedath