A new analysis from Omdia indicates that 2025 will be a pivotal year for 5G Standalone (SA) networks and Reduced Capability (RedCap) devices, setting the stage for widespread Internet of Things (IoT) adoption across industries. CTOs can expect the convergence of advanced 5G infrastructure with cost-optimized RedCap devices to accelerate deployments in manufacturing, industrial automation, smart cities, and connected healthcare.

5G Standalone Networks Gain Momentum

After delays in 2024, 5G SA rollouts are now accelerating worldwide, delivering on the core promises of 5G — ultra-fast speeds, ultra-low latency, and massive device connectivity. CTOs are uniquely positioned to leverage these capabilities for transformative enterprise applications, particularly in automation and mission-critical IoT.

Omdia’s report, prepared by Alexander Thompson, said 5G SA deployments are enabling the industry to fully realize 5G’s potential, and 2025 is the first year hardware and network ecosystems align on RedCap, as demonstrated by the Apple Watch supporting the technology. For CTOs, this alignment signals a strategic opportunity to plan enterprise adoption and IoT innovation around RedCap-enabled devices.

RedCap Devices Reach Key Milestones

The 5G RedCap ecosystem hit a breakthrough in October 2024, when T-Mobile introduced North America’s first commercial RedCap device — the TCL LINKPORT IK511 dongle. While module costs remain relatively high, Omdia expects prices to fall as adoption grows, especially in China, where government subsidies are expected to stimulate demand.

Designed as a cost-effective bridge between LTE and full 5G, RedCap is positioned as a crucial enabler for wearables, sensors, and industrial IoT deployments.

Advanced 5G Features Expanding Globally

The broader ecosystem is maturing with network slicing, private 5G, and network API monetization. Commercial slicing services such as T-Mobile’s T-Priority and Verizon’s FrontLine have moved beyond pilot projects to real-world adoption.

Omdia’s 2025 IoT Enterprise Survey found that 33 percent of organizations cite security as their top IoT priority, fueling demand for private 5G networks. At the same time, operators are deploying new families of 5G APIs, creating monetization opportunities for developers and enterprises.

Forecasts Highlight Rapid RedCap Growth

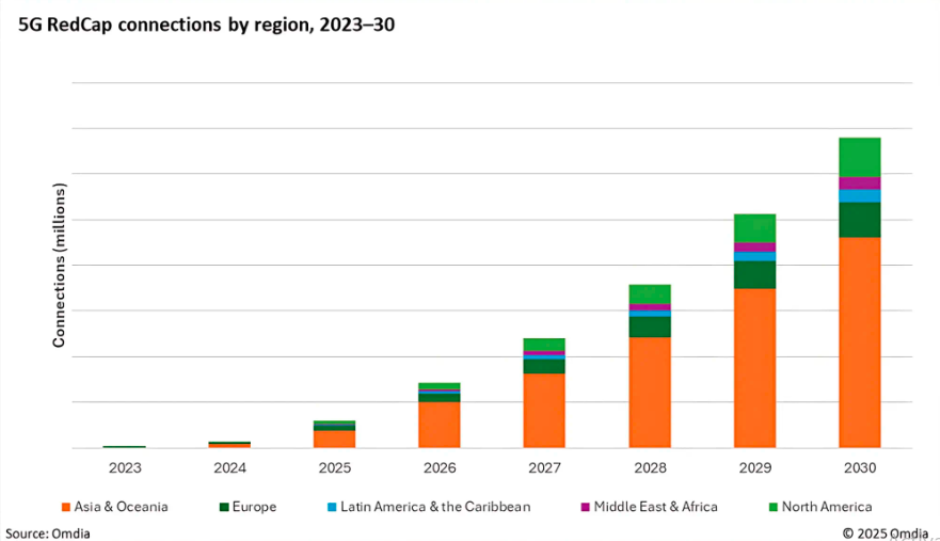

Omdia forecasts a 66 percent CAGR for RedCap connections between 2024 and 2030, reaching 963.5 million connections by the end of the decade.

RedCap modules are projected to account for about 18 percent of global cellular IoT module shipments by 2030.

The cellular IoT market is expected to expand from ~4 billion devices in 2024 to more than 7 billion by 2030, according to Ericsson. Within this growth, RedCap will serve as a mid-tier solution complementing Massive IoT (NB-IoT, Cat-M) and full 5G, making it a key driver of IoT scalability.

Scale of Global 5G SA Deployments

Industry research firm Dell’Oro reports that around 70 mobile network operators (MNOs) have deployed 5G SA networks across 39 markets. In 2025 alone, five new SA networks were launched — including Orange in France, Romania, and Slovakia; Vodafone in Spain; and O2 in Czechia.

Currently, only about 10 percent of global operators have fully commercialized SA, though momentum is building. An AMD survey of operators revealed that 35 percent of respondents are already live with nationwide SA, while another 20 percent expect to launch by end-2025.

Operators Accelerating SA Adoption

T-Mobile US is a frontrunner in nationwide SA, advancing network slicing and 5G Advanced features such as Latency Reduction (L4S).

Verizon is leveraging SA for enterprise/private 5G, with specialized services including FrontLine.

Orange has recently launched SA in France, Romania, and Slovakia; expanding slicing infrastructure.

Vodafone SA is live in Spain; investing in next-gen stacks and signed Ericsson/Nokia 5G contracts for its VodafoneThree UK JV.

O2 Czechia launched SA in 2025, expanding beyond urban hubs to broader enterprise markets.

Bharti Airtel is trialing SA and core upgrades for enterprise/IoT; expected to extend to consumer markets.

Optus has rolled out “5G Ultra (SA)” in 15 cities across Australia, testing 5G-Advanced and spectrum-sharing expansion.

Other European Operators – Bouygues Telecom, SFR, Three Ireland, and Sunrise Switzerland are adopting SA for enterprise and fixed wireless access (FWA).

Deutsche Telekom & Telefonica – Investing heavily in SA infrastructure, preparing for large-scale commercial deployments.

Industry Outlook

With around 70 SA networks already in place and more launches expected, 2025 marks a turning point for 5G innovation. The combination of SA rollouts, RedCap adoption, and advanced 5G capabilities is set to unlock new levels of secure, scalable, and cost-effective connectivity — fueling the next wave of IoT growth.

Baburajan Kizhakedath