Asia–Pacific’s mobile telecommunications industry is undergoing a significant transformation, driven by investments in LTE, LTE-Advanced, and a strategic shift toward 5G and emerging technologies such as 5G Standalone and 5G-Advanced.

LTE

LTE remains a foundational technology across the region, particularly in rural and underserved areas, GSA said in its latest research report. As of June 2025, 174 operators in 52 countries are investing in LTE, and 150 of them have launched commercial LTE services. However, the pace of new LTE deployments is slowing, with only 11 operators currently deploying and 15 more planning launches, reflecting the growing prioritization of 5G infrastructure.

LTE-Advanced

LTE-Advanced has also seen strong adoption, with 82 operators across 29 countries investing in the technology, and 76 operators already having launched commercial networks. These deployments demonstrate the region’s earlier push for enhanced mobile broadband capabilities before the widespread availability of 5G. Despite its benefits in terms of data speeds and latency, the future for LTE-Advanced appears limited, with only a handful of operators planning new rollouts as the market transitions toward next-generation mobile services.

5G network

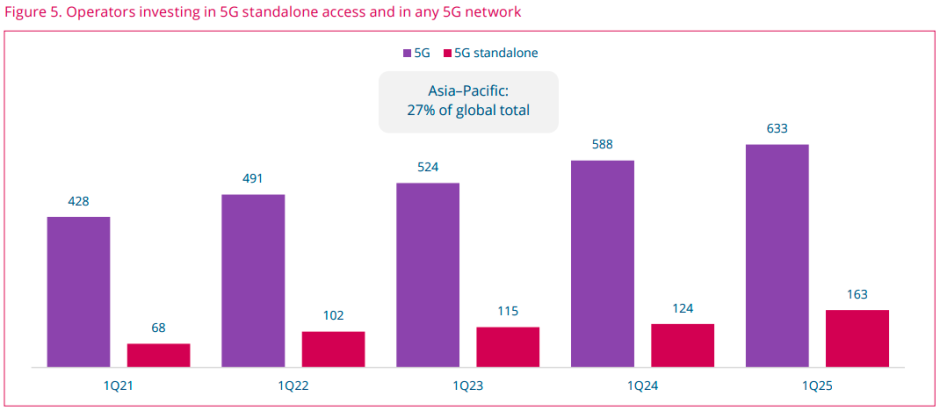

Investment in 5G rollout in Asia–Pacific is progressing. A total of 117 operators in 35 countries are investing in 5G mobile or fixed wireless access networks, and 69 operators in 26 countries have already launched commercial services. This represents 19 percent of global 5G launches. Thirteen operators are actively deploying 5G, and 17 more are planning network deployments, suggesting an expanding footprint in the near future. Countries such as India, China, South Korea, Japan, and Australia are leading the charge, with operators targeting urban centers and industrial hubs.

Standalone 5G

An important evolution within the 5G ecosystem is the shift toward standalone 5G networks, which enable the full benefits of the technology including ultra-low latency, improved network slicing capabilities, and enhanced security. In Asia–Pacific, 48 operators in 17 countries are investing in 5G standalone networks, accounting for 28 percent of the global total. Of these, 27 operators across 11 countries have launched services, and an additional 11 operators are currently evaluating or testing the technology. This progress points to a growing appetite for next-generation capabilities across consumer and enterprise segments.

Private mobile networks

Private mobile networks are also gaining traction in Asia–Pacific, underlining the region’s increasing interest in custom wireless solutions for industrial applications. There are 360 unique customer deployments of private LTE and 5G networks in the region, representing 20 percent of the global total. The majority of these are in Australia, China, Japan, South Korea, India, and Thailand. Manufacturing leads private network adoption, with strong activity also seen in mining, education, and smart city infrastructure. Although agriculture and maritime sectors are large in the region, they have seen limited uptake so far.

Spectrum policy

Since early 2022, spectrum allocation and auction activity in the Asia–Pacific region has been varied and strategically important. At least five auctions have concluded as of mid-2025, involving frequency bands ranging from 800 MHz to 3.5 GHz. Countries that conducted these auctions include Bangladesh, India, Malaysia, New Zealand, and South Korea. The pricing outcomes of these auctions have differed significantly. India’s recent C-band auction raised more than $10 billion, making it the highest in the region, while Malaysia’s 2.6 GHz auction brought in just over $8.5 million, reflecting the wide variance in spectrum valuation across markets.

There was limited activity in 2023 for spectrum allocation in the region, but this trend is expected to change. GSA is tracking several upcoming and restructured auctions planned for 2025 and beyond, particularly in key markets such as India and Malaysia. This renewed focus on spectrum availability and pricing reflects the increasing demand for high-capacity networks to support the expansion of 5G services and the shift away from older mobile technologies. As operators invest further in next-generation networks, spectrum availability and affordability will remain central to future telecom strategies in Asia–Pacific.

Telecom operators in Asia–Pacific are aligning their strategies around expanding 5G coverage, accelerating private network deployments, and reallocating legacy infrastructure resources. With rising demand for data, increasing device penetration, and growing enterprise digitalization, operators are focusing on high-capacity, low-latency networks. The region’s proactive stance on 2G and 3G switch-offs, along with targeted investments in emerging technologies like 5G-Advanced and network slicing, positions it as a global leader in next-generation mobile innovation.

Baburajan Kizhakedath