GSA’s FWA CPE market survey says FWA CPE shipments are expected to rise 23 percent to 37.5 million units in 2024. Reported total CPE shipments in 2023 amounted to 30.4 million from 30 respondents, a 2 percent increase from 2022.

5G-enabled FWA shipments reached 10.2 million in 2023. Growth of 5G FWA CPE shipments is expected to account for 42 percent of shipments in 2024 against 34 percent in 2023. 4G FWA CPE shipments dropped 5 percent between 2022 and 2023. Less than half of respondents will introduce a new 4G CPE product this year.

Various regions drove growth of 5G FWA shipments in 2023. In 2022, shipments were concentrated in North America. In India, 86 percent of FWA shipments are 5G-enabled, followed by North America (65 percent) and the rest of Asia–Pacific (39 percent).

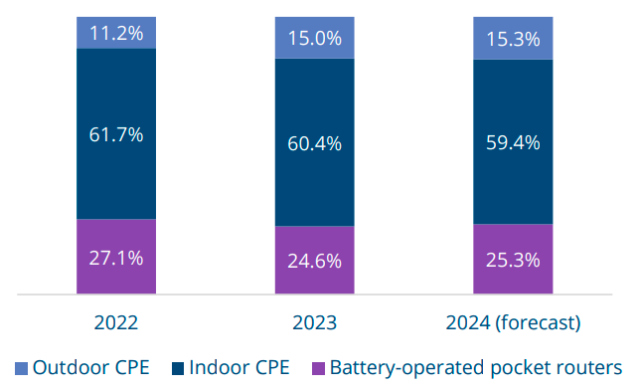

FWA shipments are dominated by indoor CPE (60 percent), followed by battery-operated hot spots (25 percent) and outdoor CPE (15 percent). Within outdoor CPE, flexible self-install devices are expected to grow from 1.6 million to 1.9 million. Their share of shipments in the category is expected to remain at about one-third.

Shipments of 5G devices with millimetre-wave (mmWave) capability rose 63 percent between 2022 and 2023 and are forecast to grow 22 percent by 2024 but remaining at under 10 percent of all 5G shipments.

The survey said 60 percent of shipments in 2023 supported the 5G standalone technology. These are expected to grow in 2024, reaching 8.9 million units from 6 million in 2023.

There is strong interest in RedCap, with 63 percent of respondents stating they will be introducing a 5G RedCap CPE device in 2024.

5G CPE will reach price parity with its 4G counterpart by 2026, according to 40 percent of respondents.

Most respondents claim that window-mounted CPE and self-installation apps are growing; flexible indoor and outdoor CPE are set to remain flat; and hybrid fibre/DSL CPE will decline.

More than half of respondents do not expect component shortages but do anticipate inflationary pressures in 2024.

Data for GSA’s annual FWA CPE market survey was collected from April to July 2024. 30 vendors of customer-premises equipment (CPE) from the GSA 4G–5G FWA Forum answered the survey.

Participants in the survey included: Airgain, Asiatelco Technologies Co, Askey, BEC Technologies, Chanhong, Compal, Da Ta Technologies, DZS (formerly Casa Systems), Elsys, Gemtek, Gongjin Mobile Communication/T&W, Green Packet, Huawei, Intelbras, Jaton Technology, MeiG Smart Technology, Nokia, Notion InfoTech, Shenzhen Jointelli, Smawave Technology, StartUSA, Tigercel, Tozed Kangwei, Vantiva, Wavetel, WNC, Xiamen Four-Faith, YaoJin Technology, ZTE and Zyxel.