Nokia has been recognized as the Leader in the Small Cells Competitive Landscape Assessment by GlobalData in its September 2024 report.

Nokia was particularly noted for excelling in both the residential and outdoor small-cell solutions, offering the market’s only ‘All-in-One’ 5G solution for both use cases globally, the report said.

Nokia’s small-cell portfolio, branded as Kolibri and Shikra, was praised for its lightweight, compact design, broad spectrum support, and offering sub-6 GHz spectrum 5G solutions not tied to CBRS products. These technologies enhance 5G coverage and capacity in both dense urban and indoor environments.

Nokia’s solutions are designed for minimal infrastructure requirements, supporting high-demand 5G applications such as virtual reality (VR), augmented reality (AR), and IoT in smart cities.

Nokia also provides plug-and-play small-cell solutions to enhance in-building 5G coverage, supporting mmWave bands for high bandwidth and data rates in venues like offices and malls.

Nokia’s small-cell solutions are powered by the latest ReefShark chipsets, offering premium coverage and capacity across various frequency ranges.

Mark Atkinson, Nokia’s Head of RAN, highlighted the recognition as validation of Nokia’s best-in-class small-cell portfolio tailored for both indoor and outdoor applications.

Highlights of Nokia’s Small-Cell Portfolio

Nokia’s portfolio includes the lightest and smallest 5G products available, supporting a broad spectrum range. Its Kolibri all-in-one 5G small cell, which supports sub-6 GHz spectrum, stands out as the only such product that is not part of the CBRS category. Shikra 5G radios offer a modular architecture, usable as either remote radios or integrated with compact outdoor BBUs. Nokia also provides CBRS products for the U.S. market, including strand-mount options for cable providers.

Nokia’s AirScale Indoor Radio (ASiR) solution integrates 4G and 5G technologies in the same hub, and its end units can be deployed in series. However, the solution does not support millimeter-wave bands or include hardened end units for outdoor use, differentiating it from some rivals. Nokia supports a large range of spectrum bands, but the weight and volume of its end units are typical within the market.

Each ASiR BBU can serve up to 18 hub units, and each hub can feed 12-24 end units depending on their configuration. The solution includes multi-operator and neutral-host capabilities as well as a CPRI Digital Donor module for DAS integration.

Nokia offers a 4G/5G femtocell that supports two LTE carriers and one 5G carrier, a notable addition in the residential space where most competitors have outdated or no products. This adds a new potential revenue stream for Nokia.

Strengths

Nokia is the only vendor offering all-in-one 5G small cells for both outdoor and residential use globally (non-CBRS). This positions Nokia to capture opportunities in residential, small business, and CBRS markets in the U.S.

Nokia’s outdoor 5G radios are among the smallest and lightest available, with a 4-liter volume and 4 kg weight. These compact designs make deployment easier and less costly while minimizing visual impact.

Nokia’s outdoor radios can be deployed remotely or integrated with compact outdoor baseband units. The flexible deployment options — from remote radios interfacing with traditional or virtual BBUs to direct BBU-to-end-unit indoor solutions — give operators more choice for various use cases.

Limitations

Nokia’s indoor portfolio does not support millimeter-wave spectrum, unlike competitors. Millimeter-wave can offer high capacity for enterprises, though it has limited ability to penetrate walls.

The AirScale Indoor Radio supports up to three bands, whereas competitors support at least four, potentially limiting network capacity and spectrum utilization in larger enterprise settings.

Nokia’s ASiR supports up to 144 4G end nodes per BBU, trailing competitors. Additionally, it requires Ethernet extension modules for end units beyond 100 meters, while rivals offer longer cabling spans, impacting scalability in large venues.

RECENT INNOVATIONS

Nokia introduced an all-in-one outdoor 5G small cell and announced plans to launch a new indoor small cell supporting Citizens Broadband Radio Service (CBRS) in early 2025.

Ericsson added three new indoor radio units to its distributed Radio Dot System and introduced a new Radio Dot end unit. The company also phased out some older products from its Radio Dot portfolio.

ZTE expanded its small-cell offerings by adding new outdoor radios and radio end units for its distributed indoor QCell solution.

Huawei promoted its Light Site iNCR and Light Site Max solutions, providing cost-effective 5G coverage for specialized spaces like elevator shafts and parking garages.

Small-Cell Market News:

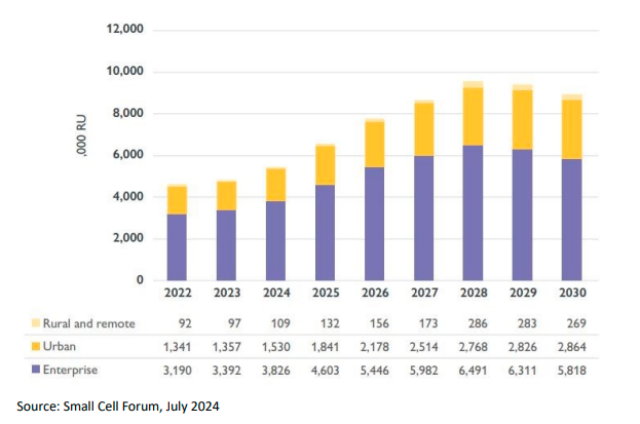

With macrocell 5G networks maturing, operators are shifting focus to network densification using small cells in both urban/rural areas and indoors, especially to target enterprise revenues.

Ericsson, Huawei, and ZTE are prioritizing enterprise opportunities with their distributed indoor solutions, emphasizing micro radio units as extensions of existing baseband units to support densification.

Nokia has focused on all-in-one outdoor 5G small cells, distinguishing itself by commercializing the global market’s first such product. While it lags behind in distributed indoor solutions, Nokia has succeeded in private enterprise networks and residential small cells.

Samsung has also emphasized all-in-one small cells but was later in entering the indoor enterprise market. Its support for virtual RAN (vRAN) was once a differentiator, but rivals have followed suit.

Airspan Networks transitioned from residential small cells to a broader focus on open RAN and private wireless opportunities, while Mavenir acquired ip.access to stimulate the open RAN market, with long-term plans to shift to software-only offerings.

Smaller players like BaiCells and Comba Telecom pursue niche opportunities, while the CBRS market in the U.S. and the open RAN movement have attracted new entrants, although the global market is still dominated by Ericsson, Huawei, ZTE, Nokia, and Samsung.

Baburajan Kizhakedath